Mortgage stats roundup - here’s your Q3 mortgage market report

We reveal our own data and trends to paint a picture of what happened in the mortgage market between July and September 2025.

What you need to know about the mortgage market right now

If you’re buying a property right now, you’ll probably be wondering what’s going to happen to rates in the coming months. It’s tricky to tell, though early indicators and market insights suggest rates will remain fairly stable for the rest of the year. Though the base rate has fallen three times so far in 2025, stubborn inflation and ongoing economic uncertainty has kept it stagnant since August.

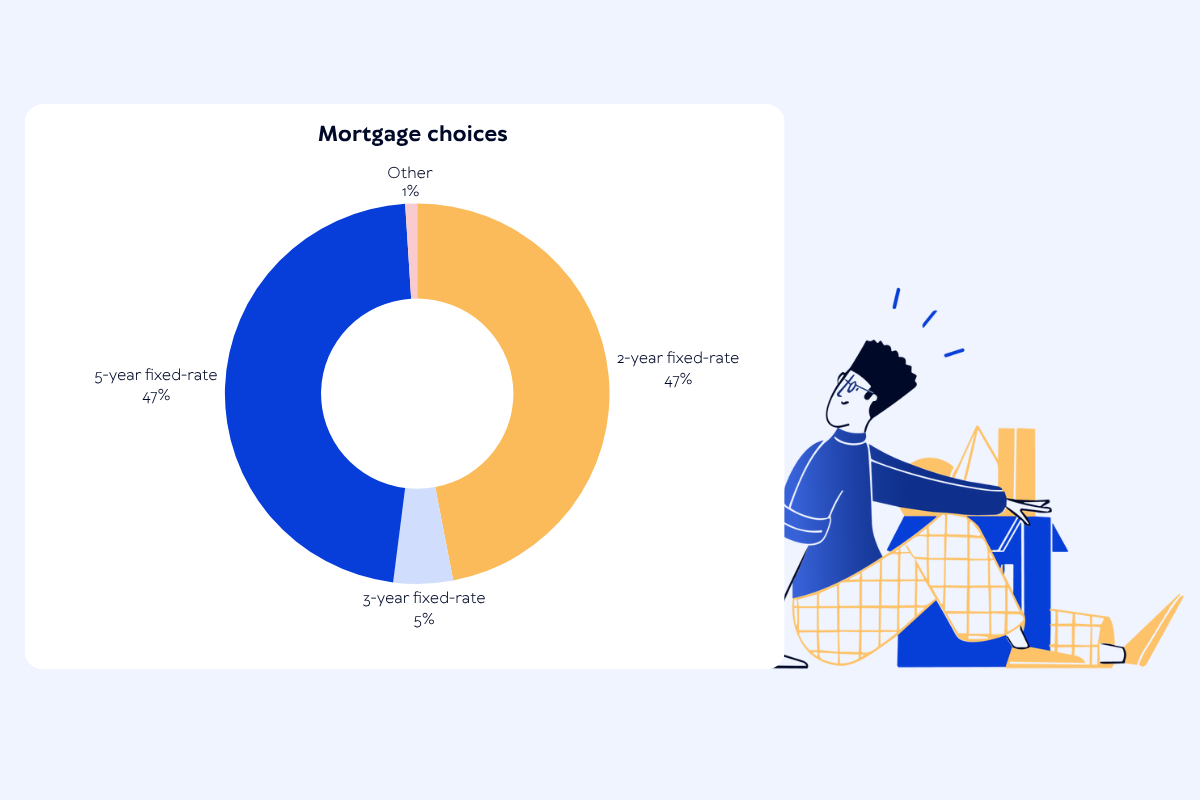

We’re now seeing the same percentage of customers (47%) opting for a 2-year fix as a 5-year fix, which just goes to show how important it is to weigh up your mortgage options and choose the deal that best suits your circumstances and risk appetite.

Fast facts

The average fixed mortgage rate was 4.3% in Q3 compared to 4.7% last year

The average mortgage size for home buyers this quarter was £257,253 - a 4.5% year-on-year (YOY) increase

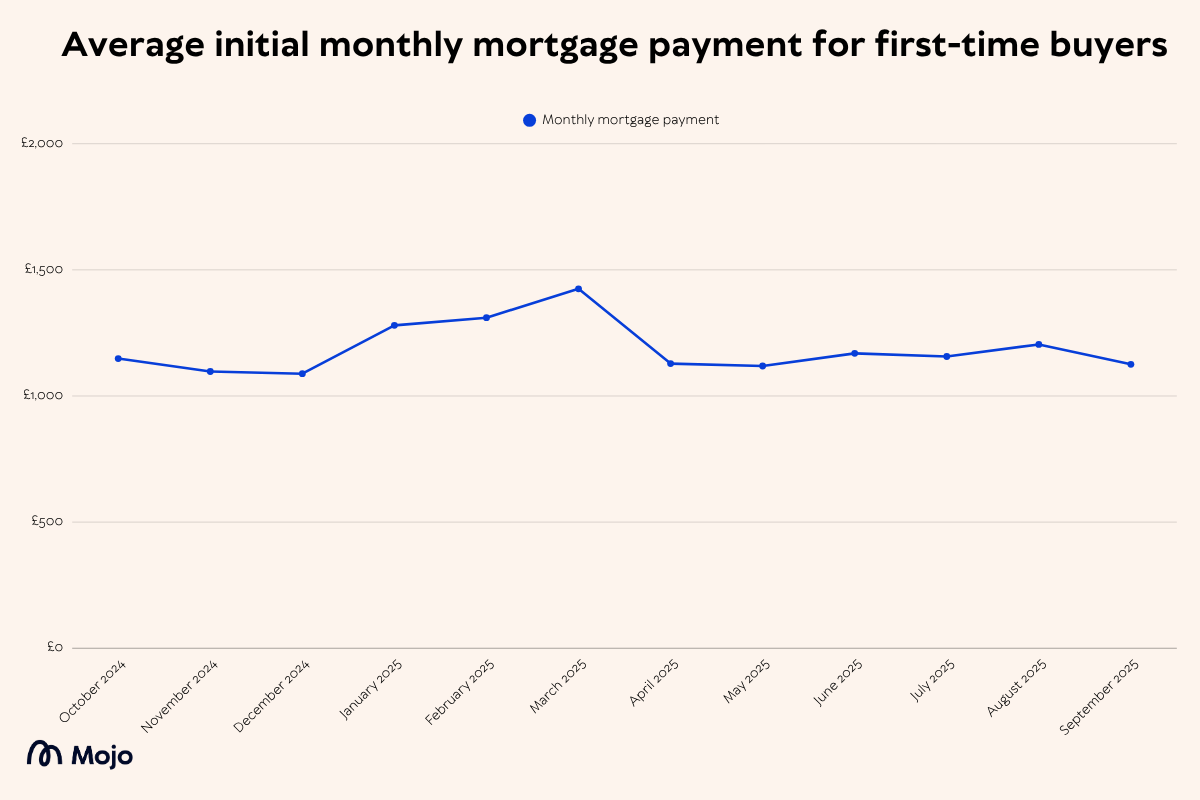

Average monthly mortgage payments for first-time buyers increased by just 1.8% compared to last quarter

Around half (47%) of customers opted for a 5-year fixed-rate mortgage - with the same percentage choosing a 2-year fixed-rate option

69% of home buyers received a mortgage offer within three weeks of submitting their application this quarter

Q3 mortgage stats at a glance

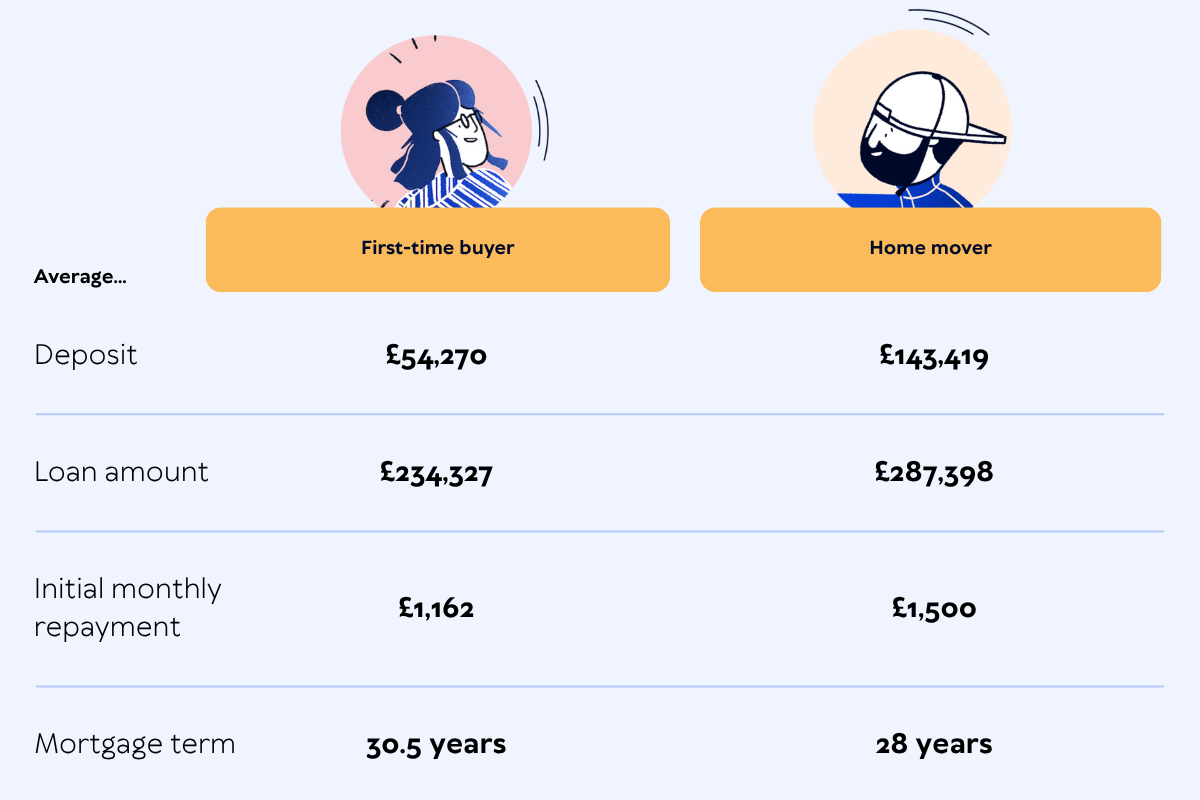

Average | First-time buyer | Home mover |

|---|---|---|

Deposit | £54,270 | £143,419 |

Loan amount | £234,327 | £287,398 |

Initial monthly mortgage repayment | £1,162 | £1,500 |

Mortgage term | 30.5 | 28 |

Average mortgage rates

Mortgage rates did fall slightly throughout the quarter before rising again in September, with the average fixed mortgage rate at the end of Q3 (30 September 2025) standing at 4.3%.

That said, even a small 0.1% or so difference in rate can make a difference to your mortgage repayments, so it’s well worth keeping up-to-date on any fluctuations.

Loan-to-value (LTV) | Two-year fixed-rate | Five-year fixed-rate |

|---|---|---|

60% | 4.1% | 4.1% |

70% | 4.0% | 4.1% |

75% | 4.2% | 4.2% |

80% | 4.3% | 4.3% |

85% | 4.3% | 4.3% |

90% | 4.7% | 4.5% |

95% | 5.0% | 4.9% |

This table highlights the average fixed rate for different deal lengths and different loan to value (LTV) ratios on 30 September 2025. This data is based on our analysis of the products available for new customers from five of the UK’s biggest mortgage lenders (Halifax, Santander, Nationwide, NatWest and HSBC).

Secure your new mortgage rate now

Lenders have been changing rates recently. Act now to secure your best deal!

Mojo Mortgage advisors can search across 60+ lenders to find the right mortgages for you.

Simply answer questions about your mortgage needs, and if you're eligible, we can book you in to speak to one of our experts.

How much is the average mortgage payment?

The average first-time buyer pays £1,162 each month for their mortgage - £337 less than those moving home. This is likely because those moving to a new property will have already built up significant equity, allowing them to access potentially more expensive properties.

Joint first-time buyers get a £56,000 bigger mortgage on average

Average loan amount for solo buyers | Average applicant income for solo buyers | Average loan amount for joint buyers | Average applicant income for joint buyers |

|---|---|---|---|

£201,706.83 | £51,203.21 | £257,921.35 | £76,085.37 |

Average mortgage size for home buyers

Based on our purchase customers’ applications, the average mortgage loan amount this quarter was £257,253. This is great news for prospective homeowners, as the amount people borrowed was much lower (-16%) than the previous quarter (£306,499). Though our customers are still borrowing 5% more compared to Q3 last year (£246,077).

The increase year-on-year is likely a reflection on rising house prices, which are now at 1.4% inflation compared to a year ago according to Zoopla’s House Price Index.

We break out the mortgage loan value by regions below.

Region | Average mortgage size for first-time buyers Q3 2025 | Average mortgage size for first-time buyers Q3 2024 | % change since last quarter |

|---|---|---|---|

East Midlands | £192,268 | £190,880 | -0.72% |

East of England | £236,509 | £287,301 | 21.48% |

London | £340,829 | £374,884 | 9.99% |

North East | £180,992 | £184,989 | 2.21% |

North West | £188,184 | £197,861 | 5.14% |

Northern Ireland | £191,650 | £157,656 | -17.74% |

Scotland | £164,688 | £172,740 | 4.89% |

South East | £255,329 | £316,191 | 23.84% |

South West | £222,799 | £249,747 | 12.10% |

Wales | £183,732 | £169,124 | -7.95% |

West Midlands | £191,844 | £195,127 | 1.71% |

UK average | £213,529 | £226,955 | 6.29% |

Most popular mortgage types for home buyers

In the third quarter of 2025, 98.5% of our first-time buyers and home movers applied for a fixed-rate mortgage. The remaining 1.5% of applications opted for a tracker mortgage (a type of variable deal).

This is a very slight shift compared to this time last year, when rates were typically higher and - as such - variable-rate mortgages ever-so-slightly more popular.

| % of home buyers applying for a fixed-rate mortgage | % of home buyers applying for a variable-rate mortgage |

|---|---|---|

Q3 2025 | 98.5% | 1.5% |

Q3 2024 | 97.6% | 2.4% |

How long do home buyers fix for?

47% of all home buying mortgage applicants opted for a 2-year fixed-rate mortgage, with the same percentage choosing a 5 year fix.

This is quite different to the same time period last year, where 44% of home buyers chose a 2-year fix versus 50% who chose a 5-year fix.

It’s likely that, with rates still turbulent, mortgage applicants are hoping that the next few years will bring lower interest rates - thus making remortgaging sooner a more attractive option.

Mortgage option | % of mortgage applicants in Q3 2025 | % of mortgage applicants in Q3 2024 |

|---|---|---|

2-year fixed-rate mortgage | 47% | 44% |

3-year fixed-rate mortgage | 5% | 6% |

5-year fixed-rate mortgage | 47% | 50% |

10-year fixed-rate mortgage | 0% | 0.2% |

Loan-to-value matters

90% was the most popular loan-to-value (LTV) mortgage amongst home buyers in the third quarter of 2025, with 36% of mortgage applicants choosing to put down a deposit of around 10%.

Loan-to-value | % of home buyers |

|---|---|

60% or less LTV | 23% |

70% LTV | 13% |

80% LTV | 28% |

90% or more LTV | 36% |

“The outlook is fairly positive for home buyers at the moment, with property prices falling slowly but surely and mortgage rates remaining stable. Home buyers might not have seen the significant rate drops they were hoping for at the start of the year, largely due to stubborn inflation causing the Bank of England to hold the base rate for longer. The next big event to keep your eye out for is, of course, the Autumn budget - though only time will tell how the Chancellor’s announcements may impact homeowners.”

John Fraser-Tucker, Head of Mortgages

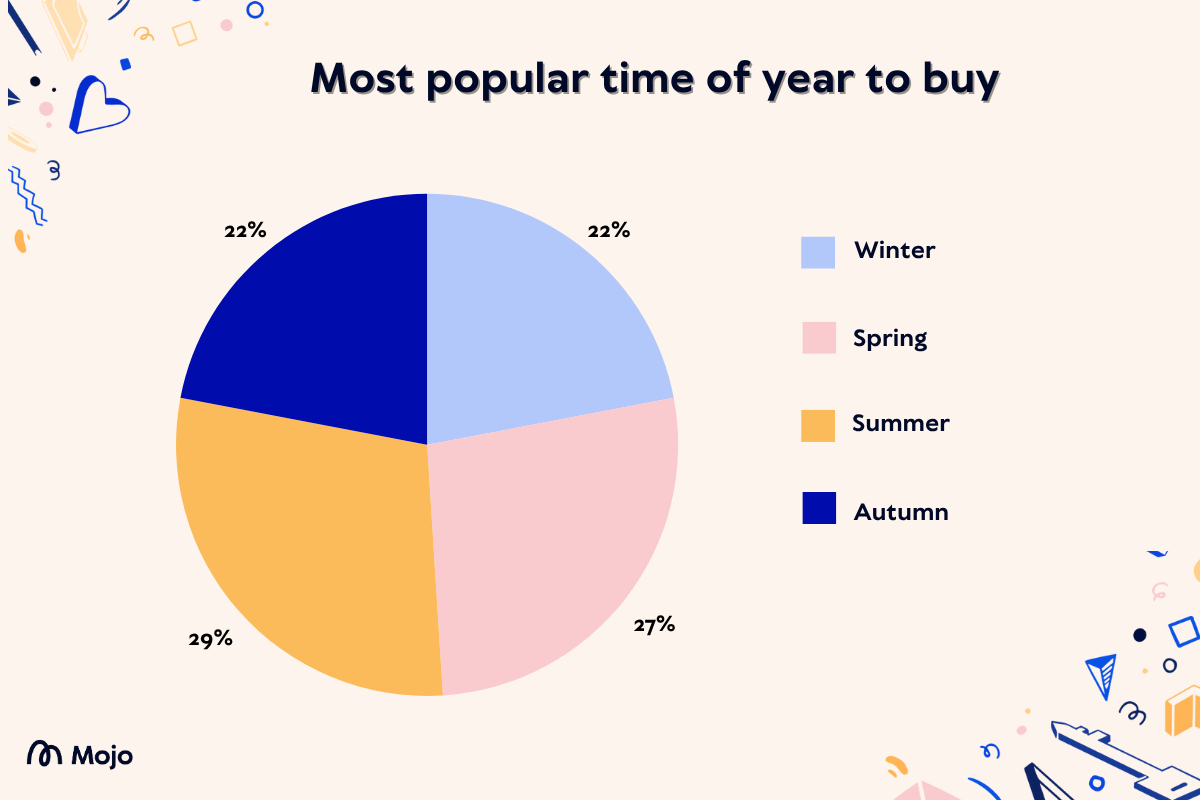

Most popular time of year to buy or move

So far over the last twelve months, we saw the highest peak in homebuying activity in Summer 2025, as the housing market heated up and customers looked to make the most of the longer days to move. However, Spring 2025 was also unseasonably busy as home buyers rushed to complete by the end of April to avoid paying additional stamp duty.

Season | % of completed mortgages |

|---|---|

December, January, February (24/25) | 22% |

March, April, May (2025) | 27% |

June, July, August (2025) | 29% |

September, October, November (2024) | 22% |

Where are people buying this quarter?

Outside of London, the most popular region for applying for a mortgage is the North West, with those in the North East holding off purchasing a home compared to this time last year.

Our most popular cities for mortgage applications are:

London

Birmingham

Nottingham

Newcastle

Manchester

… where are you based & where are you buying next?

Region | % of home buyer mortgage applicants in Q3 2025 | % of home buyer mortgage applicants in Q3 2024 |

|---|---|---|

East Midlands | 10% | 9% |

East of England | 8% | 7% |

London | 17% | 18% |

North East | 8% | 8% |

North West | 17% | 17% |

Northern Ireland | 0.6% | 0.7% |

Scotland | 6% | 7% |

South East | 12% | 10% |

South West | 7% | 7% |

Wales | 4% | 6% |

West Midlands | 11% | 10% |

Thinking of buying soon?

Buying a new property? Our Mojo mortgage brokers can help:

Free expert advice and help with all your mortgage questions

A free affordability assessment so you know how much you can borrow

A mortgage in principle to help you with your property search

All data shown is from Mojo Mortgages' own customer records, covering the period from July 1 2025 to September 31 2025.

All rate data is based on our analysis of the products available for new customers from five of the UK’s biggest mortgage lenders (Halifax, Santander, Nationwide, NatWest and HSBC).