Variable rate mortgages

Searching for the right variable rate mortgage can be tricky. At Mojo Mortgages, we're here to help.

Let us do the hard part. For free.

Last reviewed by John Fraser-Tucker on 1 January 2024

What is a variable rate mortgage?

With a variable rate mortgage your repayments can rise or fall from one month to the next. the amount they change depends on the type of variable rate mortgage you have.

There are three types of variable rate mortgage. Tracker and discount rate mortgages are similar to fixed-rate mortgages, as they have a set tie-in period with cheaper rates. SVRs (standard variable rates) however do not have an introductory term or rate and are usually the most expensive rate type.

How does a variable rate mortgage differ from a fixed-rate mortgage?

It’s changeable, that’s the main difference. When you take out a fixed mortgage product, you’re paying for the certainty that your mortgage rate won’t change for a set length of time.

While there are three types of variable rate mortgage, they could all potentially change at any time. That change isn’t always for the worst, but it depends on whether you want to take the risk for a cheaper rate.

What types of variable rate mortgages are there?

Tracker - probably what most people think of when they think of a variable rate mortgage deal. A tracker rate follows an external economic indicator for a set deal period - usually two to five years. This means it only changes when the indicator does during that time.

SVR - a standard variable rate (or SVR) mortgage is the base deal available from every lender. The lender sets the rate themselves, and it's a higher interest rate than other deals, but there is no tie-in period, meaning you’re free to remortgage at any time. This is also what you end up on when any other deal ends, whether it’s fixed or variable

Discount - A discount rate is the SVR with a reduction of a certain percentage, so it’s also controlled by the lender. The discounted rate is offered for an introductory period which lasts a set length of time. Sometimes you're tied to discount introductory periods, but not always.

How does the Bank of England base rate affect them?

Trackers tend to follow the base rate, or a similar indicator. This means that base rate changes directly impact them. For example, A lender might set their tracker at base rate +2% - If the base rate rises you’ll still pay the 2% extra, but on top of whatever the new base rate is.

SVRs, and by extension, discount rates are likely to be influenced by changes in the base rate. But as lenders factor in their future borrowing costs in advance, you won’t always see an immediate impact in these variable rates when the base rate changes.

All variable mortgage rates could go up or down, but SVR and discount rates are less likely to fall unless there is a major reduction to the base rate - whereas trackers would directly follow reductions.

Thinking of buying soon?

Buying a new property? Our Mojo mortgage brokers can help:

Free expert advice and help with all your mortgage questions

A free affordability assessment so you know how much you can borrow

A mortgage in principle to help you with your property search

How do you get the best variable rates available?

The same way that you get the best rate for any other type of deal:

Offer a large deposit - the bigger the deposit, the lower the LTV - which means lower rates

Prepare in advance - make sure your finances and credit score are in a good position

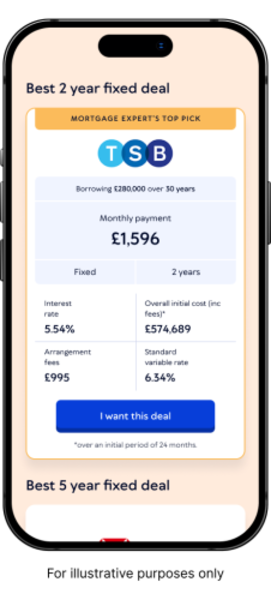

Speak to a mortgage broker - at Mojo mortgages we can search the market on your behalf to find the best variable rate deal available to you

Are there any advantages to choosing a variable rate mortgage over a fixed-rate mortgage?

Usually they’re cheaper to begin with, but that doesn’t necessarily mean they’ll stay cheaper. You could potentially take out a variable rate that’s cheaper than a fixed deal of the same length and it could rise the next day.

But it could also fall, meaning so do your payments. It really comes down to how confident you are about affordability of the repayments, no matter which direction they change in.

Variable-rate mortgages can have less restrictive terms, such as lower early repayment fees or higher overpayment thresholds. An SVR usually has no restrictions on either, so can allow you to repay your mortgage more quickly.

Can I switch from a variable rate mortgage to a fixed-rate mortgage later on?

In some cases, yes. If you take out an SVR for example, you can leave anytime you want to for any other rate. There are also certain tracker deals that allow you to switch before the end of the deal without heavy fees - but make sure you understand the full terms.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.