HSBC Mortgages

Find out about the range of mortgages offered by HSBC, plus how our Mojo mortgage advisors can help you to compare them with other lenders, and make a successful application

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 60+ lenders & broker exclusive products

We've helped 1000s of people find and get their mortgage

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

HSBC is a global bank, recognised around the world, as well as one of the ‘Big 6’ mortgage lenders in the UK. They provide a wide range of mortgage options, catering to various needs, from first-time buyers to buy-to-let investors.

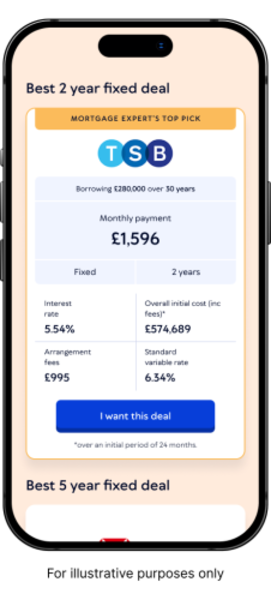

What are HSBC's best mortgage rates?

The definition of "best" mortgage rate varies depending on your specific requirements and circumstances. Not all borrowers seek the lowest interest rates, others prioritise overpayment flexibility. HSBC offers a range of mortgage deals depending on individual circumstances. Here are some examples of the lowest headline rates HSBC is currently offering:

What type of mortgages do HSBC offer?

HSBC offers both residential and commercial mortgages, on fixed or variable rates and as both capital repayment and interest-only options. They have a few specialist products, such as the ability to set up a Let-to-buy mortgage scenario, and are able to provide mortgages to foreign nationals based outside of the UK.

How can I make a HSBC mortgage application?

You can apply with HSBC through any of the usual mortgage application routes, online, by phone, or in person, however, remember to consider comparing their range against what other lenders are offering.

Why Use Mojo to Apply with HSBC?

At Mojo, we can provide you with free expert advice and compare HSBC mortgages against many other lenders on the market, to ensure you’re getting the most suitable deal available to you.

We can also assist with the application process, completing paperwork and chasing estate agents and solicitors on your behalf. This can make things a lot less stressful for you, giving you more time to focus on what matters, your new home.

How much can I borrow from HSBC for a mortgage?

HSBC typically offers loans of up to 4.49 times the gross annual income of applicants. The actual loan amount you're offered may be lower if you have lots of outgoings and/or debts.

Does HSBC offer remortgages?

Yes they do, as do the vast majority of mortgage lenders. However, generally this will be treated as a new application unless you opt for a product transfer - a new mortgage with the same lender.

Mojo’s mortgage checker can help you to decide whether a remortgage or product transfer is the right move for you. It will show you the other options available and we’ll look at other offers for you, to ensure you’re making the right choice for you.

Does HSBC offer buy-to-let mortgages?

Yes they provide buy-to-let mortgages at up to 75% LTV. We can help you with your investment purchases, as well as residential mortgages. To qualify for HSBC's BTL mortgages, you need:

Annual income of at least £25,000

To be a homeowner

Not have existing borrowing in excess of £2 million or four or more rental properties

Your buy-to-let property must be:

Located in the UK

Let under an Assured Shorthold Tenancy (AST) or company let agreement

Not an HMO (Houses in Multiple Occupation) property - such as a student let

Reach out to Mojo for advice about the best buy-to-let mortgage options available to you.

Like most other lenders, it takes up to 2 weeks to receive your mortgage offer from HSBC.

Most HSBC mortgages are portable, but always check your terms and conditions. Porting won’t always be the most cost effective option, but we can help you to find out whether you'd save more through remortgaging.

Early repayment charges typically depend on your specific mortgage deal, whether you’re in your introductory offer period, and the size of your overpayment. HSBC typically increases its annual overpayment allowance throughout your initial or discount rate period. If you exceed this allowance, you'll incur a charge of 1% of the overpaid amount.

Details about your early repayment charges can be found in your mortgage illustration, mortgage offer, or annual statement.

HSBC allows overpayments of 10% of the outstanding loan balance per annum. You can find your overpayment allowance and check your remaining mortgage balance through HSBC's online banking portal. Alternatively, we can help you calculate your early repayment charges in advance of a full remortgage.

HSBC mortgage offers last for 180 days (6 months).

HSBC may accept some minor defaults, CCJs, and satisfied DMPs (debt management plan) after a set amount of time has passed (this differs depending on the size and age of the issue).

However, those with more serious credit issues like current DMPs, IVAs or a history of bankruptcy are unlikely to secure a deal. If you’re worried about your credit history, we can look at bad credit lenders for you.

Like most lenders, HSBC accepts self-employed applicants that have been trading for at least 24 months and can back this up with accounts and tax documentation.