Will mortgage rates go down in 2026?

After years of rising mortgage rates, they're finally starting to ease following three Bank of England base rate drops in 2025. But what does 2026 look like?

And what could this mean for your mortgage? We break down the latest mortgage rate trends to help you make sense of what’s ahead.

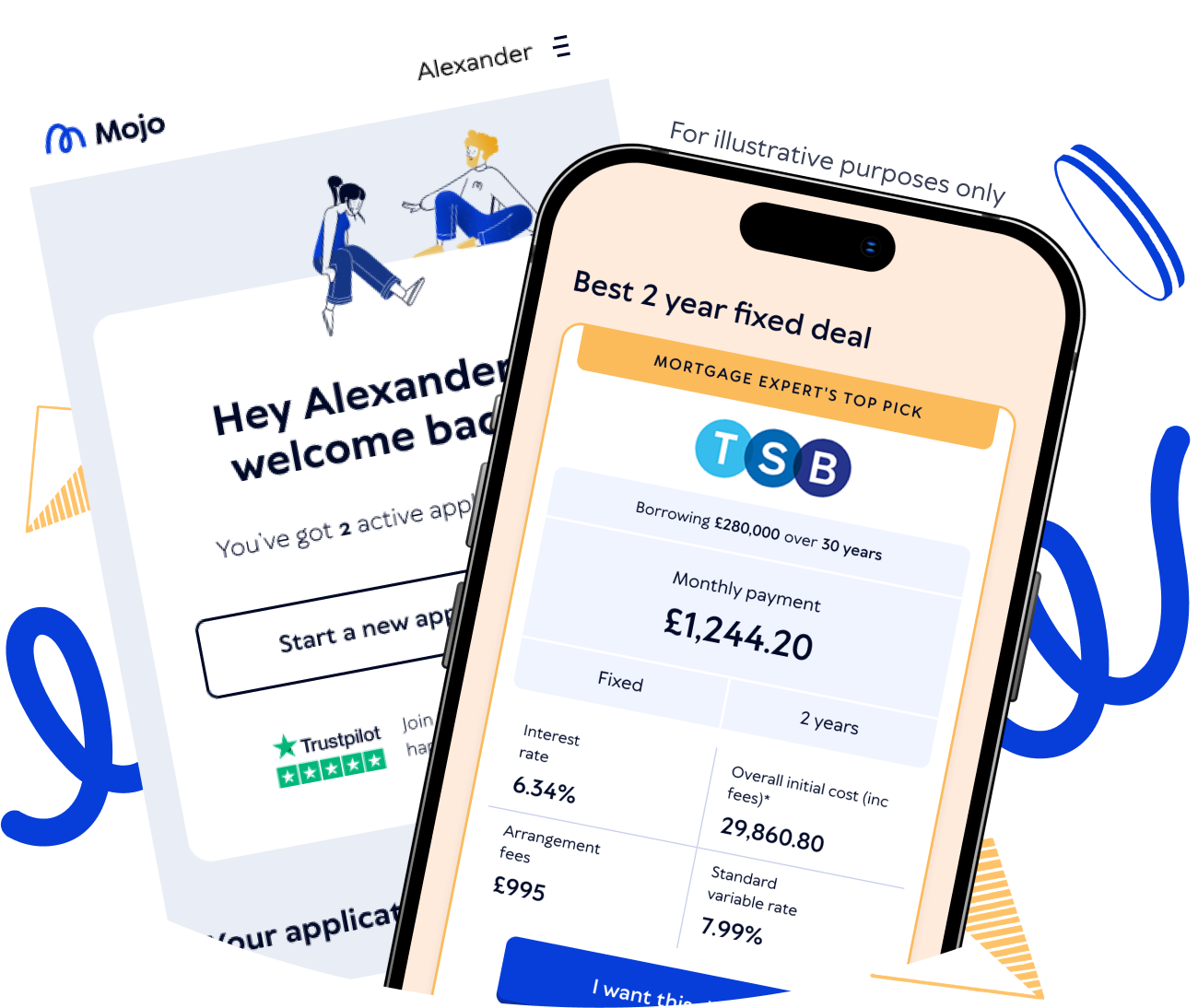

Looking to buy or remortgage this year?

Free expert advice about your needs and the current market

Discuss rates, mortgage types and deals available on the market

Find out whether fixing now could be a good option for you

Mortgage recommendations with access to 60+ lenders & mortgage broker exclusive products

Our Expert Says: "With swap rates climbing in March 2026 and the Bank of England now expected to hold the Base Rate on March 19th, mortgage deals are shifting fast. Secure a rate today for peace of mind. If rates do drop before you complete, our Mojo Rate Check Promise means we’ll notify you that we can switch you to the lower deal."

John Fraser-Tucker, Head of Mortgages

When will mortgage rates go down?

It's expected that mortgage rates will start to gradually fall in-line with any Bank of England base rate drops. That's because, while lenders consider many factors when setting their interest rates, rates for all kinds of mortgages are impacted by the base rate.

The UK base rate is currently 3.75%, having been held from the recent meeting of the Bank of England's Monetary Policy Committee on 5 February. Prior to this, the rate had been cut five times since August 2024, bringing it down from a high of 5.25%.

You'll understandably be wondering how this might impact you and your mortgage. Our mortgage brokers will be happy to compare mortgage rates from across a wide range of lenders, to provide tailored recommendations on the best mortgage deals for you.

The below table shows the average fixed mortgage rate for two-year and five-year fixed-rate mortgage deals for every month over the past year. These are based on our data of deals available from five of the biggest UK lenders (Santander, Nationwide, Natwest, Halifax and HSBC).

Average mortgage rates - 2 & 5 year fixed rate deals

Date | Average rate - 2 year fix | Average rate - 5 year fix |

|---|---|---|

31 January 2025 | 4.8% | 4.5% |

28 February 2025 | 4.6% | 4.4% |

31 March 2025 | 4.5% | 4.4% |

30 April 2025 | 4.4% | 4.3% |

31 May 2025 | 4.3% | 4.3% |

30 June 2025 | 4.3% | 4.3% |

31 July 2025 | 4.2% | 4.2% |

31 August 2025 | 4.2% | 4.2% |

30 September 2025 | 4.3% | 4.2% |

31 October 2025 | 4.2% | 4.2% |

31 November 2025 | 3.93% | 4.0% |

31 December 2025 | 4.0% | 4.1% |

31 January 2026 | 3.85% | 3.98% |

In 2025, the lowest average rate for a two-year fixed mortgage was 3.93%, while the highest was 4.8%. For a £200,000 mortgage with a 25-year term, the predicted monthly mortgage payment would be £1,050 at a 4.8% rate, or £1,150 at a 5.2% rate. Even a seemingly small rate increase would still increase your monthly repayments by £100, highlighting the importance of timing and thorough research when securing a mortgage.

The five-year fixed mortgage market also experienced changes last year, with average rates varying between 4.0% and 4.5%. Using the same mortgage example, this translates to a monthly payment range of £1,056 at the lower rate and £1,112 at the higher rate – a difference of £56 per month or £672 annually.

If you're wondering whether you should get a two-year or five-year fixed-rate mortgage, you may wish to speak to a mortgage advisor. They'll offer recommendations on the types of mortgages that could best suit you and your circumstances while also helping you to secure a competitive rate.

No rate FOMO with Mojo

With our Rate Check Promise, once you've had an offer accepted by a lender, we'll let you know if a lower rate for your deal becomes available. Giving you peace of mind you won't miss out by locking in a deal sooner.

Will the base rate fall again in 2026?

The base rate recently fell to 3.75% in December. It's important the Bank of England doesn't cut rates too much or too quickly, though, to make sure that inflation remains stable.

Even if the base rate does fall, while those on tracker rates will likely benefit from a fall in repayments, the impact on other variable deals and fixed-rate mortgages in the market is less certain.

Get the latest mortgage rates straight to your inbox every month - all we need is your email.

How do mortgage rates work?

Mortgage rates determine how much interest you'll pay. The rate you're offered is set by your lender, and will be based on several factors including economic conditions, the Bank of England base rate, your own personal and financial circumstances, your loan-to-value ratio and the type of mortgage you choose.

The higher the interest rate, the higher your monthly mortgage payments will be and the more expensive your mortgage will be in total. Lower rates will reduce your costs, both monthly and in total.

With fixed-rate mortgages, the interest rate stays the same for the full length of the deal which means your monthly payment will remain consistent. This can provide reassurance if rates rise, as you won't be impacted by increased rates unless your fixed-rate deal comes to an end. However, if rates fall, you won't be able to take advantage.

For those on variable-rate mortgages, including discount mortgages and tracker mortgages, the interest rate can change at any time so your monthly repayments will be largely at the mercy of Bank of England base rate changes.

Looking to compare mortgage rates and find the right deal for you? Work with an expert mortgage broker. They'll compare deals from a wide range of lenders and provide personalised recommendations to suit your circumstances.

Why are mortgage rates so high?

Towards the end of 2021, the Bank of England began to increase the base rate of interest. This was to try and combat rising inflation. It went from 0.1% to 5.25% in less than two years. It has since been cut significantly - the base rate is currently 3.75%.

The base rate is the Bank of England’s main lever to combat rising inflation, which they aim to keep at the government’s target of 2% (it is currently at 3.4%). The idea is that by increasing interest rates, people will tend to save more and spend less, helping to keep inflation down.

Mortgage rates are often heavily influenced by the base rate. So, as the base rate increased, so did mortgage rates. This was particularly true for those on variable mortgages, as the rates are often directly influenced by the base rate.

Fixed-rate mortgages have a set rate for a specified amount of time so those already on one weren’t affected by the increase in the base rate of interest straight away. But, when homeowners' fixed-rate deals came to an end, many found that the new fixed-rate mortgage deals available had higher rates.

Ready to compare mortgage rates?

Our expert brokers will compare deals from over 60 lenders to find the best rate available to you.

Should I wait for rates to fall before getting a mortgage?

Whether now is the right time for you to get a new mortgage, either for a new property or an existing one, depends on your personal and financial circumstances.

If you are due to remortgage soon, the average standard variable rate is still around 7.5% which is higher than most of the other fixed or variable deals on the market. So, waiting for rates to fall could end up costing you a lot in the short term.

And for those looking to buy, only you can decide whether it’s the right time to move or get on the property ladder. But if you do see a property you like, remember that it may not still be available when or if mortgage rates do fall.

Should I fix my mortgage for longer?

Once you find a mortgage deal that suits you, you may be tempted to lock it in for a longer term, (say, 5 or 10 years). With this, it’s always a good idea to talk to a mortgage broker who can give you closer insights on how the market may change in that time, and suggest a term that suits your needs.

How will changing mortgage rates impact me?

Whether your mortgage rate will change imminently or at the end of a fixed deal will depend on which kind of mortgage you have.

Variable-rate mortgages: Those on tracker deals should see the impact on their mortgage rate almost immediately if the base rate changes. That's because most residential tracker mortgage rates are set at a certain percentage above the Bank of England base rate, so the rate will rise and fall in response. Homeowners with a tracker mortgage will be hopeful for at least one or two base rate drops throughout 2026, as this will result in lower mortgage repayments.

Fixed-rate mortgages: If you're on a fixed-rate mortgage deal, your rate won't change for the duration of the deal. However, if your deal is coming to an end and you're looking to remortgage, you'll naturally want to know what kind of rates await you. Fixed-rate mortgage rates tend to be priced based on swap rates, although these are influenced by the base rate. Swap rates have decreased recently, which may lead to lenders reducing their rates.

How does inflation affect mortgage rates?

The Bank of England's base rate is used to help manage inflation (the rate of increase in the prices of goods and services over time).

When inflation is high, the BoE typically raises the base rate to slow down spending and help to bring inflation under control. This leads to higher mortgage rates.

When inflation is low, the BoE tries to cut the base rate to stimulate spending and boost demand in the economy. As a result, mortgage rates fall which makes borrowing cheaper - the theory being, that it encourages consumers to borrow more and therefore spend more.

We'll help to compare rates across 60+ lenders

"Really impressed - knowledgable advisors, good mortgage deals and very straightforward process. Took all the hassle out of finding and arranging a mortgage, with no fees."

Mr Wootton

14 May 2025

Related articles

Read some of our highlighted mortgage rates articles below.

FAQs

With mortgage rates remaining high, you may be wondering if 2026 will be a good time to remortgage or whether you should lock in a deal now.

However, it's difficult to know when, or even if, rates will fall next year. That said, the average standard variable rate is currently just below 8%, which is higher than many of fixed and variable deals available in the market. This means holding out for rates to fall before remortgaging could cost you quite a bit in the short term.

It could be worthwhile speaking to a mortgage broker to help you assess your options as they have a wider overview of the mortgage market.

So far, 2026 is shaping up to be a "stability year”, making it a favorable time to buy. With inflation cooling, the Bank of England has begun cutting the base rate (currently around 3.75%), leading to more competitive mortgage deals.

House prices are expected to rise modestly by 1% to 4%, which is significantly lower than the post-pandemic "booms," meaning you are less likely to overpay in a bidding war.

So, if you’re ready to get moving, this year may be a good time.

If you're worried about mortgage rates falling after you've secured a deal, you could consider:

Opting for a shorter term fixed-rate mortgage so you can switch to a new deal sooner, but be aware that rates tend to be a bit higher on shorter term mortgages in the current market

Looking at an ERC-free tracker mortgage that may allow you to remortgage at any point without facing fees. It is worth keeping in mind, however, that if interest rates increase, your mortgage rate will increase with it which would result in higher monthly repayments

It's important to discuss all your options with an expert broker who can help you find the right one for you and your circumstances.

Also, remember if you've secured a new remortgage deal a few months in advance of your current one ending, you can normally switch before it officially starts. So, if rates fall before your new mortgage begins, you may be able to move to a better one without facing any penalties.

Though mortgage rates are not expected to rise significantly in 2025, you may still be worried about what to do if your mortgage rates increase.

Consider taking out a fixed-rate mortgage deal, which will keep your rate the same for a set period (typically two or five years). Knowing your rates won't change could give you some peace of mind and help you to budget more effectively

Lock in a new rate when interest rates are low. If your current mortgage deal is coming to an end within six months, you could switch deals and avoid an early repayment charge, so it's worth shopping around early to get a good understanding of the mortgage market and how current rates could impact your monthly budget

Swap rates refer to the interest rates used in interest rate swap agreements, where financial institutions exchange a fixed rate (such as the interest they receive from fixed-rate mortgage customers) for a variable one. This helps mortgage providers to manage the risk associated with offering fixed-rate, long-term lending.

Many factors influence swap rates, including inflation, economic stability, and market expectations of whether the Bank of England might raise or lower the base rate. Swap rates reflect what markets anticipate interest rates will be in the future.

Lenders take swap rates into account when pricing fixed-rate mortgages. If swap rates rise, the price of fixed-rate mortgages normally goes up. Similarly, if swap rates fall, the price of fixed-rate mortgages normally lowers too.

Lenders usually price fixed-rate mortgages above swap rates to to protect themselves against risk. So, if you're considering a fixed-rate mortgage, keeping an eye on swap rate trends might help you to get a feel for whether rates are most likely to rise or fall in the near future.

We saw some lenders begin offering sub-4% mortgage rates at the start of 2025, and some forecasts suggest we could see more 3% to 3.5% offers at the end of 2026, heading into 2027. It’s hard to precinct, but it may be some time before mortgage rates are consistently being offered at 3% or lower.

It's likely that many homeowners able to secure a 3% mortgage in the early 2020s will be coming up to the end of their fixed-term deal before rates fall back to the 3% mark.

It’s hard to say. Some mortgage outlooks suggest a gradual descent followed by a “lower-for-longer” plateau. It’s hard to make an exact prediction, but we’ll be here to update you along the way.

Author - John Fraser-Tucker

Last reviewed on 5th March 2026

Bank of England information on the base rate

Office for National Statistics information on inflation (Consumer Prices Index)

Mortgage rates provided by Mojo Mortgages and based on deals available at the time from selected lenders

Our editorial policy: we write content for our customers that makes mortgages make sense. We create helpful, human, reliable, and unbiased content about mortgages, written by subject matter experts, reviewed by editorial teams and published without receiving benefit from lenders or affiliates. We ensure all of our content complies with up-to-date Financial Conduct Authority (FCA) regulations.