How to avoid gazumping

Buying a property is often one of life's most exciting achievements, but there are a few potential pitfalls that not everyone is aware of. One of which is the notorious ‘gazumping’. We'll explore what gazumping is, and how best to avoid it when buying a home in the UK.

Speak to an expert today about your needs and the current market

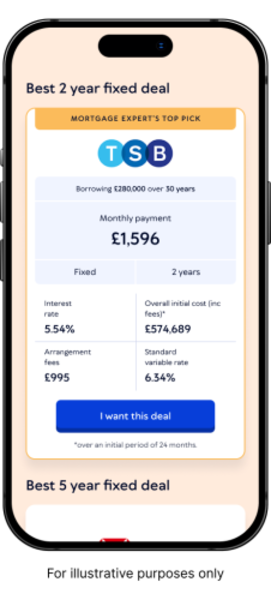

Clear mortgage recommendations with access to 70+ lenders & broker exclusive products

We've helped 1000s of people find and get their best deal

Going above & beyond to save you time ⏳ & money 💰 on your mortgage

Paperwork help ✅ Mortgage broker exclusives ✅ Works alongside over 70 lenders ✅

1. Add your details online

No 2-hr phone calls or branch visits. It takes a few minutes to tell us what you need from your next mortgage online.

2. Speak to your broker

Choose the perfect time, whether that is ASAP or a time better suited to you, we are available 6 days a week, including evenings.

3. Get your mortgage with Mojo

We’ll check and chase to help avoid delays. Get regular updates from your mortgage advisor and case manager.

What is gazumping?

Gazumping is when a seller accepts a higher offer from a different buyer after they have already agreed upon a sale. This can be both frustrating and disappointing for the original buyer, as it often leads to them losing the property their heart was set on.

Is it legal?

Sadly, while controversial, gazumping is not illegal in the UK. Property transactions are not legally binding until contracts have been exchanged - meaning either the buyer or seller can change their minds up until that point of the purchase process.

The practice is frowned upon and discouraged by most estate agents, but it does happen.

How to Protect Yourself from Gazumping

One way to protect yourself is to act quickly. In a competitive market, the faster you move, the less likely you are to be gazumped. Ensure you have your mortgage agreement in principle ready before you make an offer. This will show sellers that you're serious and ready to proceed swiftly.

It can also be beneficial to make an offer above the asking price if you feel there is a lot of competition for your chosen property. The estate agent should be able to let you know how in demand property is. It can also be beneficial to keep an eye on local property prices yourself - this way you can better preempt being outbid.

In some cases, you may also be able to negotiate a ‘lockout agreement’ with the seller. This legally binding contract prevents them from accepting other offers for a specified period, giving you time to complete the purchase. This can be easier if you build up a rapport with the seller, and they feel confident you’ll look after their old home.

Once a buyer accepts your offer, work to exchange contracts as soon as possible. At Mojo we can do this on your behalf, meaning that those with busy jobs won’t need to worry about availability.

Gazumping is not a common practice in the UK, although it does tend to be more prevalent in higher priced areas of the country, such as London and the South East. At Mojo, we’ll do everything we can to ensure your application is processed as quickly and smoothly as possible, to minimise the potential for this unethical behaviour spoiling your home buying journey.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.