What is loan to value?

LTV calculator, and how to work it out

Loan to value (LTV) is the percentage of a property’s total value that you borrow from your mortgage lender. It's important because it impacts the interest rate you’ll be offered. We explain the key info you need to know.

Quick summary

Your loan-to-value ratio shows how much you're borrowing from your lender compared to the property's value

Lower LTVs usually come with more competitive mortgage rates, meaning lower monthly repayments and lower overall borrowing costs

LTVs change over time depending on how quickly you build up equity and how swiftly property prices change

You may be able to increase your deposit size or equity to move into a lower LTV threshold (these usually come down in ‘steps’ of 5%)

Why does LTV matter?

Your loan to value matters because it directly impacts a lender’s risk, and therefore how much interest they charge to balance out that risk.

Investing more towards your own property (either by putting down a bigger deposit or building up equity in your home) reduces lender risk, leading to more competitive rates and potentially lower monthly repayments.

Conversely, a higher LTV increases risk for the lender. They have less financial buffer if property values fall or you default on your payments and the lender - as a very last resort - initiates court proceedings for possession of the property to recoup the money they originally lent to you. For this reason, lenders often charge higher interest rates and may have tighter lending conditions to compensate for taking on this greater risk.

How to work out loan to value

Find out how much you’re borrowing (or your current mortgage balance), divide it by the current property value and multiply that figure by 100 to calculate your LTV.

So, for example, if you want to buy a £250,000 property with a £25,000 deposit your LTV would be 90% as you’ll be borrowing 90% of the property’s value from the lender.

Want an even more straightforward way to work out your loan to value? Use our LTV calculator below!

Loan To Value (LTV) Mortgage Calculator

Use our LTV calculator to work out your loan to value ratio for your mortgage.

Your LTV is:

0.00%

Did you know? You may be able to access better rates by lowering your loan to value

Your property may be repossessed if you do not keep up repayments on your mortgage.

LTV bands explained

Lenders typically offer different interest rates depending on which loan to value bracket you fall into. These go up in 5% increments (usually between 60% to 95%). That said, not all lenders offer loans at every LTV level and some may have wider thresholds than others. You’ll likely be offered a better deal if you can go down a band or two.

What’s the maximum LTV mortgage you can get?

Many lenders offer up to 95% LTV mortgages, meaning you’d need at least 5% deposit.

It is possible to get 100% LTV mortgages in certain circumstances, too. A very small number of lenders such as Skipton Building Society offer a 100% mortgage product, while other lenders offer guarantor and family assisted mortgage products that enable you to borrow up to 100% of the mortgage loan.

It’s worth noting that you’re not guaranteed to be accepted for a high LTV mortgage (and, even if you are, you may be offered comparatively higher interest rates and subject to potentially stricter lending conditions). Lenders take all sorts into account when deciding how much you can borrow, including your income and outgoings, credit history and personal circumstances. If a high LTV mortgage is deemed too risky or unaffordable, your lender might offer you a smaller mortgage amount, which could result in you adjusting your approach (for example, saving for a larger deposit or looking for a cheaper property).

Did you know? Around 42% of our first-time buyer customers choose a 90% or higher LTV product*. That means over half of our customers opt for a lower LTV, which typically gives access to lower rates and therefore reduced monthly payments.

What’s the lowest LTV mortgage available?

Most lenders will set their own minimum loan size. If your LTV is so low that you need to borrow less than that, you may need to look at an alternative borrowing solution. If you’re wanting to remortgage with a very low LTV, you may find it more suitable to stick with your lender’s standard variable rate.

Generally speaking, the lower your LTV, the better the interest rate you’ll be offered. The best rates on the market tend to kick in at 60% LTV, meaning you’d need a 40% deposit to access them.

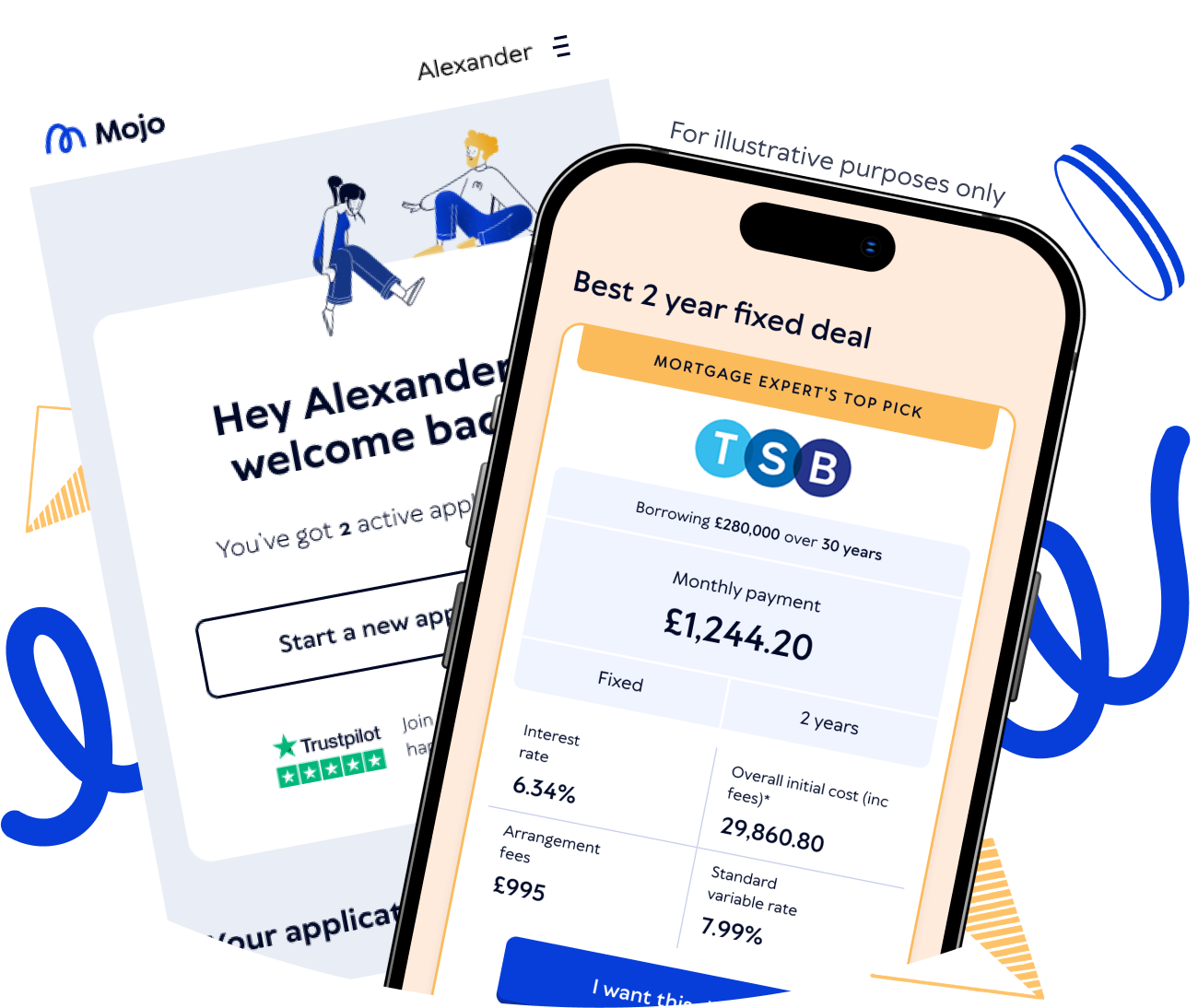

Ready to discover your mortgage options?

Tell us a few details about your circumstances, deposit size and the kind of property you want to buy to see what rates could be available to you.

What’s a good loan to value for a mortgage?

Lenders each have their own ideas and appetites towards risk but, generally:

-

80-100% LTV is considered high

-

70-75% LTV is mid-range

-

65% or lower is considered low LTV borrowing

You typically get access to more competitive rates at around 75% LTV (when you have a 25% deposit) and rates tend to level out once you’re on a 60% LTV mortgage or less. So the ‘sweet spot’ for getting access to the most competitive rates is around 60% to 75%.

A lower LTV mortgage could make your mortgage more affordable too, as you’re borrowing less. Your payments may therefore be lower - or you could opt for a shorter mortgage term to further reduce the amount of interest you pay in total.

“It is possible to get a mortgage with a lower LTV than 60%, but rates don’t tend to improve further once you’ve hit the 60% LTV threshold. You’ll likely be offered the same range of rates even if you put down an even bigger deposit or hold even more equity than 40%.”

April Aldridge, Director of Customer

How LTV could impact your mortgage payments

Your LTV represents how much you need to borrow and impacts the interest rate you’re offered - both make a difference to your monthly mortgage payments.

Deposit | Property value | Mortgage amount | LTV | Interest rate* | Monthly mortgage payment |

|---|---|---|---|---|---|

£100,000 | £250,000 | £150,000 | 60% | 4.0% | £792 |

£75,000 | £250,000 | £175,000 | 70% | 4.0% | £924 |

£50,000 | £250,000 | £200,000 | 80% | 4.3% | £1,089 |

£25,000 | £250,000 | £225,000 | 90% | 4.7% | £1,276 |

£12,500 | £250,000 | £237,500 | 95% | 5.0% | £1,388 |

*Rate data is a median rate based on our analysis of all two-year fixed-rate products available to new customers from five UK mortgage lenders (Halifax, Santander, Nationwide, NatWest and HSBC), accurate as of 2nd September 2025.

The actual rate you are offered and your monthly payments will depend on your personal circumstances. The figures in this table are based on a 2-year fixed-rate mortgage with a 25-year mortgage term.

How to reduce your loan to value ratio

The LTV of your borrowing is determined by your deposit size or your equity, so to reduce your LTV you'd have to reduce the amount you're borrowing overall.

There are a few ways you could potentially do this:

-

Save a larger deposit or wait until you’ve got more equity (you can speed this up by making overpayments, though check your lender’s terms for any potential overpayment charges)

-

When buying property, aim for a lower offer by researching local market prices, thoroughly reviewing the home survey if commissioned, and negotiating effectively to make sure you're getting a fair deal

-

If you're looking to remortgage, you'll want your home to be in the best possible shape. It's a good idea to continually maintain your current home and, if possible, try to make some value-enhancing improvements in advance of speaking with a mortgage broker or lender

-

Look for a cheaper property if you’ve not yet bought, although this might not be the most appealing option for many people

Top tip: Don’t forget that LTV is grouped by bands which usually goes up in 5% steps. So if you’re in the middle of a band (say, 78%) you’ll probably be offered rates at the higher loan to value. It could be worth saving that extra 3% deposit to push you into a lower LTV band with access to potentially better rates.

Find out how much you could borrow

With a Mojo mortgage in principle (MIP), we’ll tell you the maximum amount you can borrow across a wide range of lenders based on your circumstances. Though a MIP isn’t a guarantee, it does give you a better idea of your buying budget so you can set your savings goals or start your house hunt.

Loan to value FAQs

Yes - your loan to value will still impact the rates you’re offered when you remortgage. However, your equity is used in place of a deposit. This usually builds up over time as you gradually pay off more of your mortgage and your property value (hopefully) increases.

If you’re wanting to improve your LTV ready for remortgaging, you’ll need to find a way to increase your home’s value or boost your equity with a cash injection when you remortgage.

You may find your LTV impacts the rate you’re offered on a buy-to-let mortgage too. Most lenders will typically lend a maximum of 75% LTV so you’ll likely need to find at least 25% deposit.

Some lenders will offer higher LTV buy-to-let mortgages, so it’s worth speaking to a broker to find out your options.

Equity is basically how much of your property you own. It’s calculated by subtracting how much you owe on your mortgage from the current value of your property. Your property’s value can change over time, meaning your equity might go up and down too.

If the value of your home is worth less than the amount you owe your lender, you’ll be in negative equity. This could make it harder to move home or remortgage (as you’ll be asking to borrow more than the house is worth).

Deciding whether to wait to lower your LTV can be a balancing act. If property prices go up faster than you can save for a larger deposit, your LTV could actually end up rising. So it really is up to you whether you’d prefer to get on the property ladder sooner with a higher LTV and potentially higher rates, and build up your equity from there, or hold out for a lower LTV and potentially better rates.

*All data is taken from Mojo Mortgages’ own customer records, covering the period from 1 January 2025 to 31 August 2025.