Tracker mortgages

Tracker-rate mortgages are a type of variable-rate mortgage deal, which means that the interest rate is not fixed, so can potentially rise or fall during the deal term.

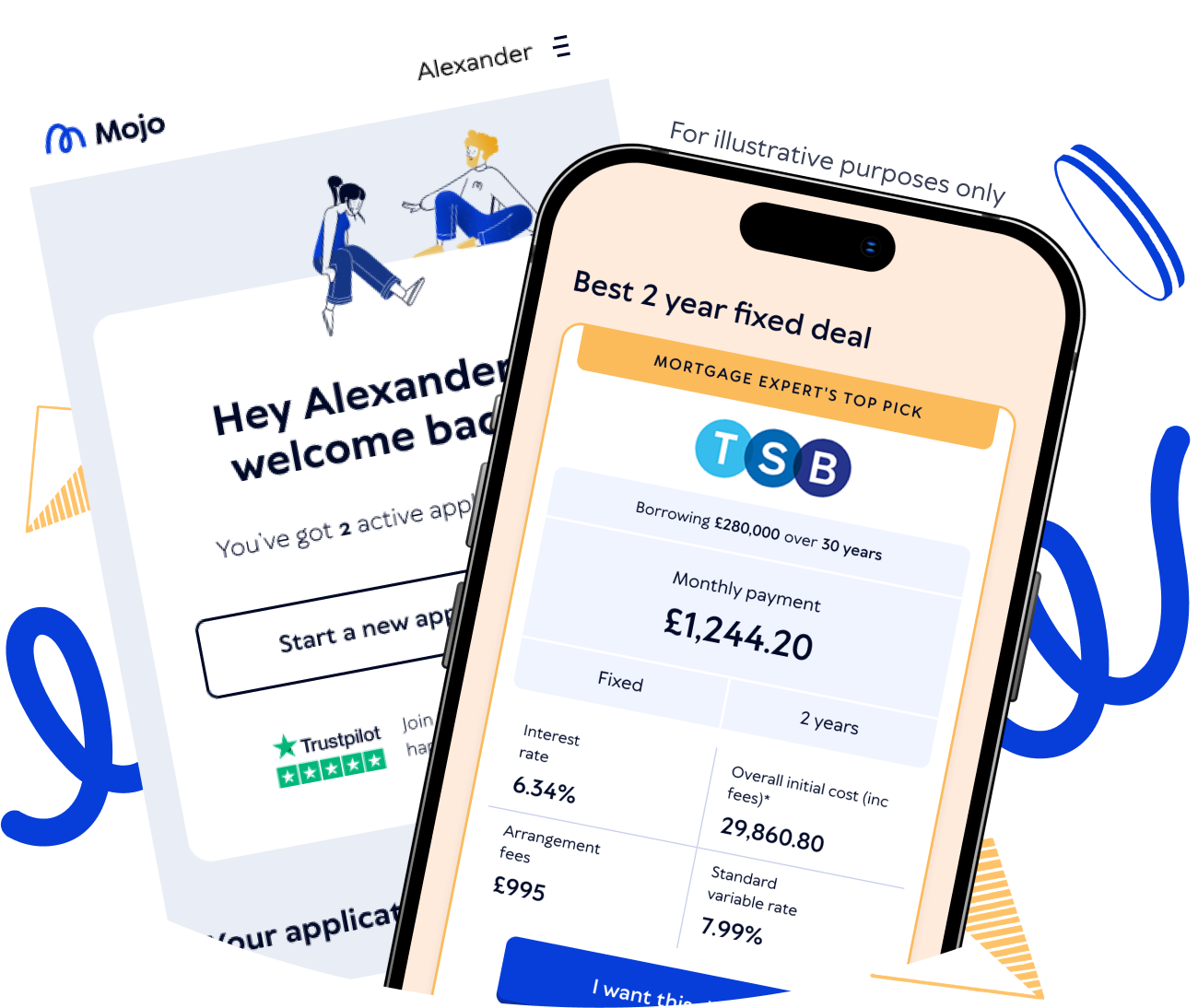

We explain how to weigh up the advantages and disadvantages of a tracker mortgage, and how to secure the best tracker rate mortgage available to you with Mojo.

What is a tracker mortgage?

A tracker mortgage is type of variable rate mortgage which does exactly what it suggests, it tracks. Usually it tracks an external economic indicator unrelated to the lender offering the rate, such as the Bank of England (BoE) base rate.

However, for commercial mortgage products, sometimes including buy-to-let trackers, a tracker mortgage follows Sterling Overnight Index Average (SONIA).

How are tracker mortgage rates set?

Mortgage lenders set their tracker rates at a certain percentage above whichever economic indicator they follow, which is the BoE base rate for most residential deals. This means that your repayments rise and fall in line with changes to the base rate.

For example, if the base rate is 5%* and the lender sets their rate 1.5 percentage points above this rate:

-

You will be charged 6.5% interest on your monthly repayments

-

If the base rate is reduced to 4%, your interest rate is immediately reduced to 5.5%

-

If the base rate is increased to 6%, your interest rate is immediately increased to 7.5%

While external economic indicators can change at any time, the percentage that your lender sets your rate at above it won’t until your deal term ends. So if you have a two year tracker at 1% above the base rate, your lender can’t charge you more than an additional 1% for two years.

*For example purposes only - find out the current Bank of England base rate.

"If the base rate falls during your deal term, you may have an option, subject to lender overpayment criteria, to continue paying the same amount, meaning you can slightly overpay your mortgage without having to source additional funds. This will reduce how much interest you pay overall and can slightly reduce your overall repayment term"

John Fraser-Tucker Head of Revenue Operations at Mojo

When could my tracker mortgage rate change?

It depends on the indicator it’s following. So, for example, if it follows the BoE base rate, the Monetary Policy Committee (MPC) has eight set dates per year where they may choose to alter the base rate. They can also opt for an occasional emergency meeting, such as during a scenario like Covid, if they feel this is necessary.

However, keep in mind that this won’t necessarily mean that it will change. For example, between August 2023 and 2024, no changes were made to the base rate at any of the MPC meetings, until they finally reduced it from 5.25% to 5% on 2 August 2024.

If you’re planning to take out a tracker mortgage, it’s a good idea to stay aware of the economic indicator it follows and the general economic climate in the UK. Typically, you’ll see the base rate rise and fall broadly in line with inflation, but this is not always the case.

What happens when a tracker deal ends?

The tracker deal term, often referred to as the “introductory period” is set for a certain number of years, which you can choose, much like with any other mortgage deal. Trackers are generally available for between two and 10 years, but some lenders also offer lifetime trackers. These deals last for the full length of your mortgage, unless you choose to remortgage at any point.

When any mortgage deal ends, you are automatically put onto the lender's standard variable rate (SVR), unless you opt to remortgage.

The SVR is the standard rate, which means the lender is not offering a deal of any kind. While this has some benefits, since there is no tie-in period, it is also usually the highest rate a lender offers. It can be a few percent higher than their range of deals.

What are lifetime tracker mortgages?

A lifetime tracker lasts for the full length of your mortgage term - usually somewhere between 25-35 years.

There can be benefits to this, such as no fees for overpaying by more than a certain amount or by remortgaging to another deal. But keep in mind that having your mortgage rate vulnerable to change for such a long period could mean paying more than you need to in interest.

That said, as you usually have the option to change a lifetime tracker if it becomes unsuitable, it may be worth looking into the potential benefits for your circumstances.

How many people have tracker mortgages?

Tracker mortgages are less popular than fixed-rate mortgages, likely due to the fact that most buyers see them as a riskier option. It’s often difficult to establish the exact number of borrowers opting for a tracker mortgage, as data tends to be collected for all variable rate types combined.

However, our latest internal mortgage data shows that in August 2024, just 3% of our total applications were for tracker mortgages. This is in contrast to August 2023, when 14% of our total mortgage applicants opted for tracker mortgages.

This is likely because the average fixed-rate mortgage deal was higher in August 2023 than August 2024, resulting in customers being more open to the reduced stability of a variable rate. Either because tracker deals offered better short-term value than fixed rates, or in the hope that a base rate fall would eventually lead to them paying less.

How can I secure the best tracker mortgage rates?

The best tracker mortgage rates are generally set at the smallest percentage above the base rate. However, in order to be eligible for the most competitive tracker deals you'll usually need to be borrowing at a fairly low loan-to-value (LTV). However, it will also depend on your broader individual circumstances, so it’s a good idea to speak to one of our mortgage advisers.

What are collars and caps?

Collars, also referred to as floors are an additional caveat on top of a tracker rate. If your tracker mortgage has a collar, it can’t fall below whatever that collar rate is, no matter how far the economic indicator falls.

For example, if the base rate is 5%*, your lender sets your rate at one percentage point above the base rate, and there's a collar rate of 3%:

-

You will be charged 6% interest on your monthly repayments

-

If the base rate is reduced to 3%, your interest is immediately reduced to 4%

-

If the base rate is reduced to 2%, you still pay 4%

That's because the collar is 3%, so you’ll still pay this plus the additional 1% set by the lender

A cap, also known as a ceiling, is fairly rare to find, but certainly a great addition to a tracker mortgage deal. A cap is the opposite of a collar, so it’s an additional rate that your mortgage interest can not rise above, even if the base rate does.

For example, if the base rate is 5%*, the lenders set their rate at one percentage point above the base rate, and there's a cap rate of 6%

-

You will be charged 6% interest on your monthly repayments

-

If the base rate rises to 6%, your interest is immediately increased to 7%

-

If the base rate rises to 7%, you still pay 7%, not 8%

This is because the cap is 6%, so this is the most you can pay, plus the additional 1% set by the lender.

While tracker mortgages with a cap are hard to find and likely not as competitive as those without caps, or those with collars, they may be the best option for those looking for a tracker deal, but with a set budget.

Advantages and disadvantages of tracker mortgages

The below table demonstrates the broad benefits and risks of a tracker mortgage, but keep in mind that whether or not and how much these apply to you will depend on your own circumstances:

Benefits of a tracker mortgage | Risks of a tracker mortgage |

Interest goes down when the base rate (or whatever rate it’s tracking) does | Interest rises when the base rate (or whatever rate it’s tracking) does |

Rates can be lower than fixed-rate deals | Rates are vulnerable to change at any time |

Not all trackers have early repayment charges (ERC) to leave the deal | Some tracker deals have ERCs if you leave during the introductory period - remember to check all terms |

Can allow you to overpay your mortgage without additional funds | Some tracker deals have collars (or floors), which can prevent you from getting the full advantage of base rate reductions |

Some tracker deals offer a cap (or ceiling) which can give you certainty that although your rate can rise, it can never go higher than a set percentage |

Is a tracker mortgage right for me?

Choosing the right mortgage can be difficult, because what’s ideal for one borrower won’t necessarily work for another with different circumstances or preferences. Tracker deals, like any other type of mortgage, can vary drastically in both their terms and conditions, and their criteria - so, therefore the rates available to you. This is why many people opt to seek the guidance of a broker, like ourselves.

Generally, tracker mortgages are more suited to applicants that are not bound by a fixed budget. This usually means that they are fairly popular with commercial mortgage borrowers, such as buy-to-let landlords. Residential buyers with a good level of equity in their home may also feel more confident to test a tracker deal, once their overall balance has come down.

Tracker mortgage FAQs

Which lenders offer tracker mortgages?

The majority of lenders offer some tracker deals, but not all of them will be suitable for your needs. Speaking to a broker about your needs and priorities is a good way to ensure you secure the right type of tracker mortgage from a lender whose criteria you most closely match.

Can I switch from my fixed-rate mortgage to a tracker mortgage?

If you’re considering switching from a fixed-rate mortgage to a tracker because tracker rates are lower, bear in mind that your rate could go up so you could end up paying more overall than if you had stuck with the fixed rate. If you need advice on which option is the best for you, speak to a mortgage broker.

Are there exit fees on a tracker mortgage?

It depends on the type of tracker mortgage and on the lender’s individual terms and conditions. Lifetime trackers are less likely to charge exit fees, whereas the shorter two-five year deals, which tend to have more competitive introductory rates, often do.

Can you move a tracker mortgage?

Most mortgages in the UK are now portable, meaning you can move them from one property to another, assuming your lender is happy with the new one. This includes tracker mortgages, although it’s always best to check the terms of your individual mortgage.

What’s the difference between a variable mortgage and a tracker mortgage?

A variable mortgage is any mortgage that has a changeable interest rate, which includes tracker mortgages. However, the difference between trackers and other types of variable rate mortgage is that a tracker deal can only change when the external economic indicator, such as the base rate, changes. Other types of variable rate mortgage fluctuate based on lender decisions.

This is why tracker mortgages may be slightly more predictable than other variable rates. The alternative to a variable-rate mortgage would be a fixed-rate mortgage, which has interest rates that cannot change until the deal ends.

Can I get a tracker mortgage on a buy-to-let purchase?

You can usually select a tracker rate no matter whether you're buying a residential or buy-to-let property.

Am I always tied into a tracker mortgage?

No. Not all tracker mortgages have a tie-in period in the same way that a fixed-rate mortgage does. So, for example, there won’t always be fees payable to switch to another mortgage deal - but you should always ensure that you understand the terms on your exact deal as they do differ from lender to lender and between products.