Mortgage news

Below we look at the latest news in the mortgage market, from what's happening with the interest rates to new schemes and lots more.

In each article, we feature our own data and expert insights. To help you make sense of what's going on in the complex world of mortgages.

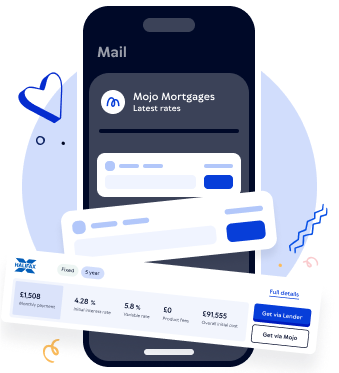

Looking for a mortgage?

Free expert advice about your needs and the current market

Clear mortgage recommendations with access to 60+ lenders & mortgage broker exclusive products

Latest mortgage news articles

What's been happening in the mortgage market recently?

The main chatter in the mortgage market remains on mortgage rates dropping. Here are the key things to know:

The Bank of England last reduced the base rate to 3.75% in December

The UK inflation rate is currently 3.2%

Want to stay up to date with the latest mortgage rates?

We’ll send the latest mortgage rates straight to your inbox every month - all we need is your email.