Fixed-rate mortgages

With a fixed-rate mortgage, your payments are predictable because your interest rate won’t change, no matter what happens in the market.

So far this year, we’ve helped over 7,000 customers find a fixed-rate mortgage*. Let our expert brokers compare hundreds of products to find the best fixed-rate mortgage deal available for you.

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 70+ lenders & broker exclusive products

We've helped 1000s of people find and get their mortgage

Last reviewed by John Fraser Tucker on 15th April 2025

What is a fixed-rate mortgage?

A fixed rate mortgage is exactly that: fixed. The interest rate will stay the same for an agreed period of time, so you know from the start what you’re going to pay each month.

When the fixed-rate ends, you’ll continue paying your mortgage, but on your lender’s standard variable rate (SVR) - which is usually much higher. Many people choose to remortgage onto a new fixed-rate deal to avoid this.

You can, theoretically, leave a fixed-rate deal any time you like - but it may cost you to do so. Most lenders expect you to pay early repayment charges (ERCs) if you leave a fixed deal before the end date. This is why most people consider themselves tied to the deal. If you’re looking for a more flexible option, you might wish to take a look at variable-rate mortgage deals instead.

How does it differ from a variable-rate mortgage?

The difference between a fixed and variable rate mortgage is very simple - a fixed rate can’t change during the deal period, a variable rate can.

Both work and are repaid in exactly the same way, regardless of the interest rate type.

Fixed-rate mortgages are the most popular type of mortgage by far. In fact, 96% of our customers apply for a fixed-rate deal.

How to get a fixed-rate mortgage…

- 1.

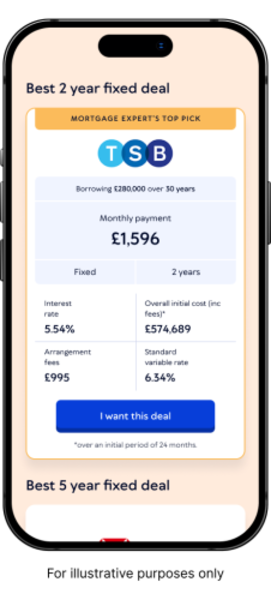

Decide on your deal length. Your fixed or tie-in period, sometimes referred to as an introductory period, is how long your lender promises not to change your interest rate for. Various fixed-rate deal lengths are available, the most common being two and five years.

- 2.

Compare fixed-rate mortgages & apply. When you work with a broker like Mojo, we’ll do the hard work for you. Our advisors can compare deals from across 70+ lenders to find the most suitable fixed-rate mortgage deal for you.

- 3.

Make your monthly repayments. You’ll make the same payment amount every month for the duration of your deal - no changes, no surprises.

- 4.

Choose a new deal when your current one ends. To avoid being automatically shifted to your lender’s SVR, which is usually a much higher rate, lock in another fixed-rate deal. You can either stick with your current lender or switch to a new one - speaking with an experienced broker can help you to compare your options.

Advantages and disadvantages of fixed-rate mortgages

All mortgages have their pros and cons, and how they impact you depends on your circumstances and what you want to get out of your mortgage.

Some of the benefits of a fixed-rate mortgage are:

-

Your mortgage payments won’t change. This makes it much easier to manage your finances month on month, making fixed-rate deals most suitable for those on a strict budget or who value stability

-

You can choose your deal term length. Whether you want to fix for 2 years, 5 years or even longer, you’ll be able to choose an option to suit you

-

Rising rates? Not your problem. You won’t need to worry about what’s happening with mortgage rates until you’re nearing the end of your deal term

Some disadvantages of a fixed-rate mortgage are:

-

Fixed-rate deals can be more expensive. The equivalent length variable rate deal is usually a bit cheaper, at least to begin with - although it’s not guaranteed to stay that way

-

You could miss out on a cheaper rate. As your rate is fixed, if interest rates fall across the board, you won’t feel the benefit

-

Fees and charges can be larger. You may need to pay heftier arrangement fees or overpayment penalty charges compared to other mortgage types, and you’ll probably have to pay ERCs if you want to leave your fixed-rate deal early

How do I get the best fixed-rate mortgage deal?

Getting the cheapest fixed rate mortgage might not necessarily equate to getting the best fixed-rate mortgage, as you’ll also need to consider whether the terms and conditions suit you.

In terms of getting the most competitive rates available to you, however, there are a few things you can do to tip the scales in your favour:

Lower your loan-to-value ratio to access more competitive rates. If you’re a first-time buyer, this means saving up a larger deposit. If you’re remortgaging, you may wish to wait until you have a decent amount of equity or top up using some of your savings.

Consider a shorter fix. Most of the best priced fixed-rate mortgages are usually (but not always) the shorter term deals though it is possible to opt for fixed-rate mortgages that last 5, 7 or 10 years (or in some cases, even longer).

Watch out for fees. Lower interest rates can sometimes come with high arrangement fees, so you’ll need to weigh up whether avoiding an arrangement fee is worth paying a slightly higher interest rate in the long-term.

Speak to a mortgage broker like ourselves. We’ll help you compare deals from a wide range of lenders, and may also be able to recommend deals that you’re unable to access without a broker.

Which fixed-rate mortgage should I choose?

The most popular deal lengths are two and five years. However, it is possible to get 10 year fixed-rate mortgages - and some lenders offer even longer.

So far this year, 50% of all mortgage applicants opted for a 2-year fixed-rate mortgage, with 40% choosing a 5-year fix. While we did see a small number of applicants choose a 10-year introductory period, these made up less than 1%.

Interestingly, our data shows that 54% of home movers chose a 5-year fix, suggesting those moving home or buying their first property value the security of fixed payments during the current economic climate.

How long should I fix for?

If you’re comparing fixed-rate mortgage deals, you’ll need to ask yourself these key questions to help you decide on the best deal length for you.

Am I moving home any time soon?

If you’re planning to move in the near future, a shorter fix may be better for you. Longer fixes tend to have higher ERCs so it will be more expensive to leave them if you suddenly decide you want to move house, and end up needing to remortgage.

Are rates likely to go up or down?

If mortgage rates look like they’re going to fall, you may miss out on lower rates in the future if you’re tied into a longer fixed-rate deal. Similarly, if rates are expected to rise, you may wish to lock in a competitive rate for longer.

Would I prefer my payments to stay the same?

Fixed rates are ideal if you value predictability. If the possibility of your payments changing feels stressful to you, opting for a longer fixed-rate deal might be a good option.

“Keep in mind that there are usually at least some fees to pay each time you remortgage to a new deal. So switching to a new fixed-rate deal every two years over the duration of a 30-year mortgage could end up more expensive than simply taking a longer-term fixed-rate deal. A broker can help you figure out your options and what deal length might be best for you.”

Stuart Bowman, Mortgage Expert

What happens when my fixed-rate mortgage ends?

You’ll automatically be transferred onto the lender’s standard variable rate (SVR), unless you choose to remortgage at the end of your fixed-rate deal period.

SVRs are notorious for being the highest rate a lender offers, but they do have some benefits. For example, you don’t need to pay to leave them, and usually there is no limit on the overpayments you can make.

That said, most people still choose to remortgage to a new deal to avoid the higher interest rate.

Are you coming to the end of a fixed-rate deal?

It’s best to try and lock in your new rate around three to six months before your current one ends.

Remember - you’re not tied to the new deal until your old one ends. So, if you see a better deal in the meantime, you can switch again. This gives you the flexibility to lock in a low rate before rates rise, but not to miss out if they fall.

If you compare fixed-rate deals with us, our brokers will continue to check your chosen lender’s best rates, giving you additional peace of mind.

Fixed-rate mortgage FAQs

Yes, it is possible to get a 10-year fixed-rate deal, and potentially even longer. However, keep in mind that the longer the fix, the higher the rate is likely to be. This is because you’re paying for a longer period of certainty that your repayments won’t rise.

It depends on your circumstances. If you are moving home, remortgaging or looking for a new mortgage deal it may be a good time to lock in a fixed interest rate if…

You’re coming to the end of an existing introductory period and want to avoid moving to your lender’s SVR

You’re currently on a variable rate that’s rising or expected to rise further

You see a much cheaper rate available than the one you’re currently on (remember to take any early repayment charges into account!)

Your equity has increased a lot since you bought your home - a lower loan-to-value mortgage could give you access to better rates

You are planning to stay in your home for a while and want payment stability

Yes you can - but you’ll usually need to remortgage or do a product transfer with your existing lender.

It’s rare to get a deal length longer than 10 years. However, though not commonly available, some lenders do offer fixed-rate deals for the entire length of your mortgage - which can be as long as 40 years.

Keep in mind, though, the longer the fix, the higher the interest rate is likely to be. Even top economists sometimes struggle to accurately predict interest rates over the next few years, let alone what they’ll be in 20 or 40 years’ time. That makes longer fixed-rate mortgages more of a risk for lenders and they often charge higher rates to protect themselves from that risk.

Yes, you can move house during your fixed-rate mortgage period. You have two main options:

Port your mortgage. This essentially allows you to transfer your existing mortgage to your new home, so you’ll avoid those pesky early repayment charges.

Choose a new mortgage. Like remortgaging, this involves paying off your current mortgage and taking out a new one. You’ll likely have ERCs to pay but you have greater flexibility when it comes to choosing your lender, mortgage deal and terms.

Check out our guide to moving home mortgages for more information.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

*Data taken from Mojo Mortgages’ own customer records, covering the period from 1 January 2025 to 31 March 2025.