Remortgage advice

On the lookout for your next mortgage deal? Trust us to compare hundreds of remortgage options to find the right product for you. For free.

Remortgaging summary:

What is it? Remortgaging means switching your current mortgage to a new deal, either with a new lender or your existing one. All while staying in the home you love.

Why do it? The two main reasons for remortgaging are to save money by securing a lower interest rate (normally to avoid your lender’s standard variable rate when your current deal comes to an end), or to borrow more for big plans like home improvements.

It’s been a wild ride for homeowners lately thanks to market fluctuations and rate uncertainty. Those who bought a home or remortgaged around five years ago will likely find rates have gone up a lot since then, while those coming to the end of two-year deals might now find themselves able to access much cheaper deals.

Even a small fluctuation in rates can make a big difference to your monthly mortgage payments so it’s crucial to compare mortgage products from across the market to find the right deal for you. The good news is you don’t have to figure things out alone.

Remortgage Calculator

Use our remortgaging calculator to discover how your mortgage repayments could change when you switch deals.

Your monthly payments are currently

£0

Your new monthly payments could be

£0

Figures are illustrative based on the information inputted into the calculator and are not based on a particular product or deal. For personalised advice, please speak to a mortgage broker.

Your property may be repossessed if you do not keep up repayments on your mortgage.

Ready to remortgage?

A remortgage is when you switch to a new mortgage but keep the same home. You can change lenders or stick with the same one (known as a product transfer).

Whatever your reasons for remortgaging, we’re here to help.

-

Your current deal is ending. Avoid moving to your lender’s (often higher) standard variable rate by securing a new deal

-

Find better remortgage rates. If rates have fallen or your home’s value has increased, you might be able to find a more competitive deal. Always factor in any early repayment charges that could outweigh any savings you’ll make by changing deals

-

Change mortgage type or terms. Perhaps you want to switch from a variable to a fixed rate, adjust your mortgage term or gain more flexibility for overpayments. Your mortgage should always be the right fit for your current needs

-

Release equity to borrow more. If you have enough equity in your home, you might be able to borrow more against your property when you remortgage for things like home improvements, debt consolidation or big one-off purchases - but it’s not always the cheapest way to borrow and could put your property at risk if you miss your payments

While it’s more common to remortgage to get a new rate, 9% of our customers look to release equity or borrow more when they remortgage*.

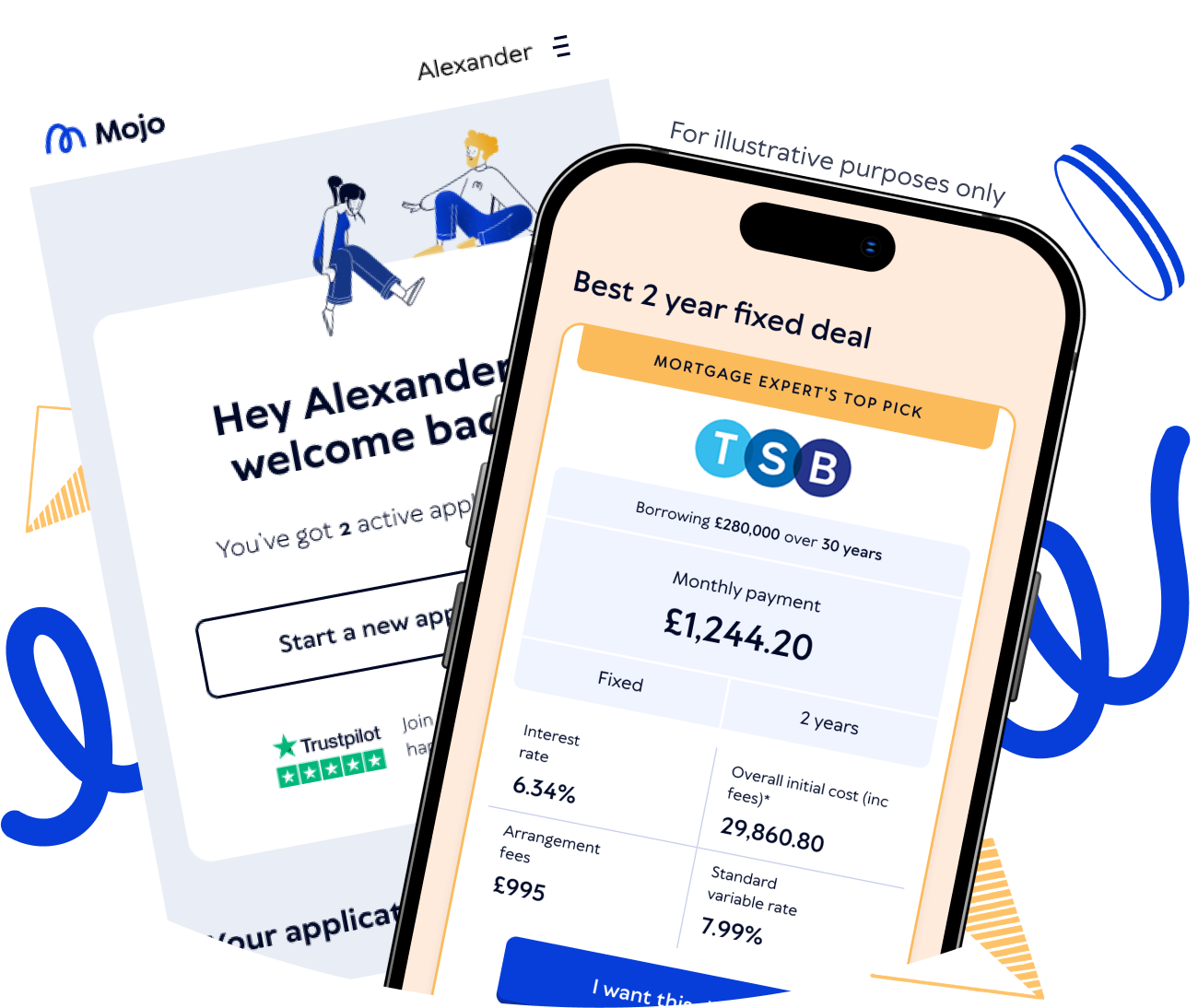

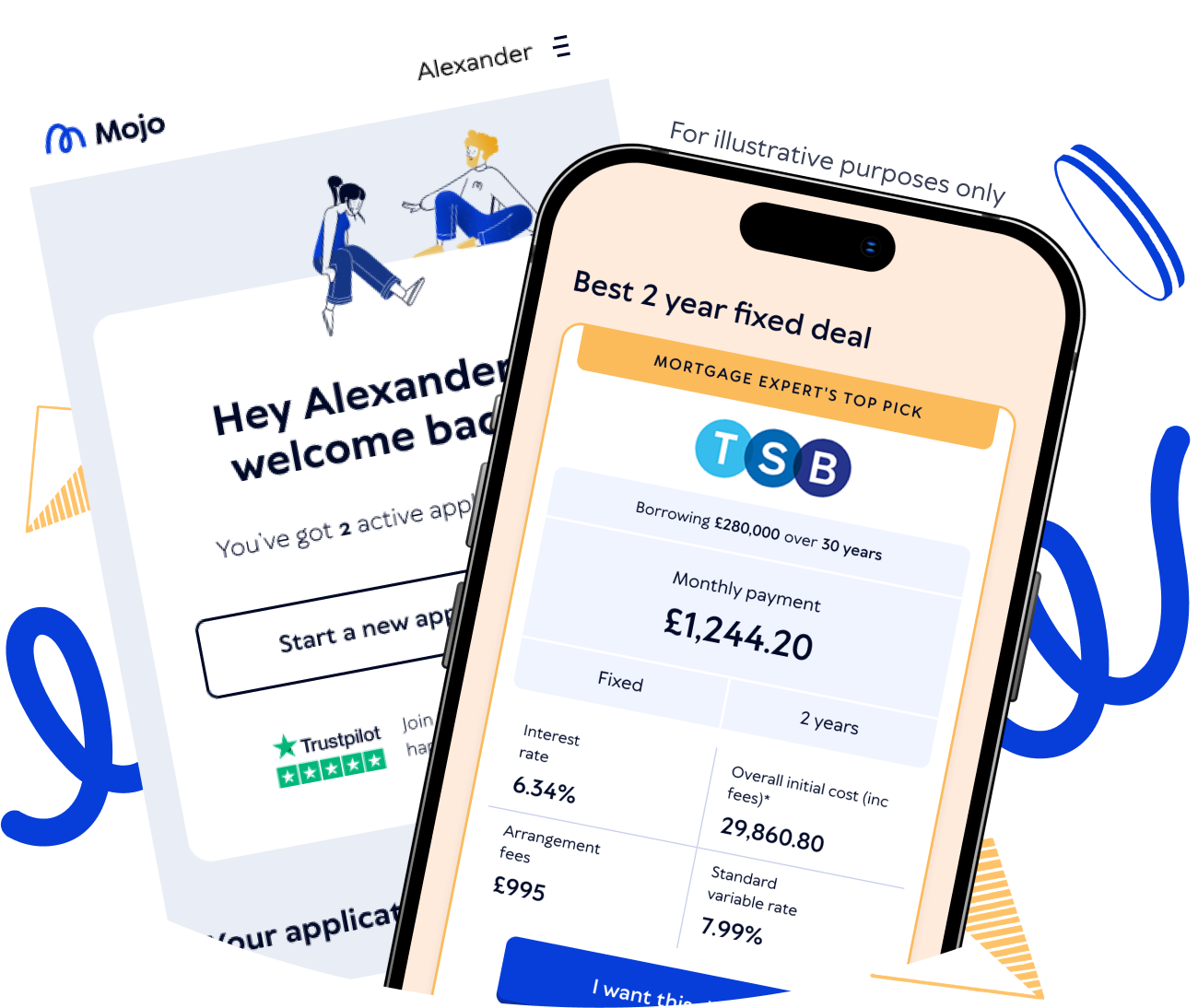

Speak to a Mojo mortgage expert for your next remortgage

Fee-free. It won’t cost you a penny to compare remortgages with us

Find your deal. We’ll compare thousands of deals from over 60 lenders and recommend the best deal you’re eligible for

Real expertise and experience. Book in a call with one of our qualified experts to chat things through

Ongoing support from start to finish. We can prepare and submit your application for you, and will be on hand until completion (and beyond) to ensure the process runs smoothly

Peace of mind. Check your rates right up until a few weeks before completion so, if a better rate for your deal become available, we’ll let you know about it

When should I remortgage?

Start looking for a new mortgage around three to six months before your current one expires to lock in a deal. Even if current rates are higher than your previous deal, in most cases it’s still worth remortgaging as your lender’s standard variable rate (SVR) will likely be much higher than other options.

With expert advice, we can help you lock in the right deal for you while it’s available. Pre-arranging a new rate to start as soon as your current deal ends can be a good idea, whether or not rates are predicted to rise. As you’re not tied into your new rate until your existing deal ends, you’ll be able to switch if you see a better rate in the meantime. Do be mindful that there’ll likely be a cut-off date for changing or cancelling your deal, so always double check your existing lender’s terms.

While it’s possible to remortgage at any time, you may incur early repayment charges (ERCs) for leaving your deal too soon.

Secure your new mortgage rate now

Lenders have been changing rates recently so you may be able to secure a more competitive rate.

Simply answer questions about your mortgage needs, and if you're eligible, we can book you in to speak to one of our remortgage experts.

Are there times when I shouldn’t remortgage?

Timing is a really important factor in remortgaging, because your personal circumstances will play a big part in the products available to you.

-

High ERCs - If the cost of your lender’s ERCs outweighs the savings you’d make from a new rate, it’s probably not worth switching until your deal ends (or you’re at least closer to the end of it)

-

Difficult qualifying - Some people may find it difficult to qualify to borrow the same amount of money, especially if interest rates are higher than they were before or their property value, affordability or credit score have deteriorated. A product transfer might still be an option through

-

Your mortgage balance is small - Remortgaging may not be beneficial if your mortgage balance is small, typically below £50,000. This is because the remortgage fees are likely to outweigh any savings you could make from a lower rate

-

You’re planning to move soon. If you’re thinking about selling up in the near future, the costs of remortgaging and potential new early repayment charges might not make it worthwhile

Takes the stress out of remortgaging

"Used and recommended a few times now. They make remortgaging so easy. Not only do they search for the best offers to suit you but will inform you if lower rates become available before completion. All the team are really friendly and knowledgeable including the insurance team. My remortgage is usually very stressful but Mojo have really helped it become a smooth process."

Laura

2 June 2025

How your loan-to-value impacts your remortgage rates

Your loan-to-value (LTV) ratio is the percentage of your property’s value that you’re borrowing. When you remortgage, equity is typically used as your deposit - so the more you have, the better the remortgage rates available to you.

The good news is that your LTV is likely to improve over time as you gain equity in your property (this usually happens as you repay some of what you originally borrowed and your property value hopefully increases).

Don’t worry too much if your loan-to-value is still on the higher side, though. 19% of our remortgage customers have a LTV of 70% or more*.

Luke Butcher says: “Lenders tend to offer their interest rates based on LTV bands, which are spaced at intervals of 5%. If you don’t quite have enough equity in your property to move into a lower band, you may be able to further improve your LTV by making an additional cash contribution when you remortgage.”

Luke Butcher, Chief Revenue Officer

Read more about remortgaging

Remortgage FAQs

A lender’s most competitive remortgage rates are generally offered to those with high equity (low LTV), a strong credit score and good affordability. That said, each lender’s criteria is different, so it’s essential to shop around.

Here are a few tips to help you improve your chances of securing a more favourable rate:

Compare deals from different lenders. Don’t just compare interest rates - compare the full cost of remortgaging, including all fees and charges

Improve your credit score. Check your credit report for any errors and make sure you make any repayments on time

Reduce your borrowing. You could choose to make overpayments (be mindful of ERCs) or add a lump sum cash deposit to decrease your loan-to-value.

Increase the value of your home. A more valuable property reduces the LTV of your borrowing.

Get expert advice. Engage expert advice from the likes of Mojo Mortgages, who’ll help you find the best fit for your circumstances.

Your existing mortgage is paid off with the new loan. You then simply start repaying the monthly payments on the new mortgage and cease paying the previous one.

You can remortgage before the end of your current deal, but most lenders will charge an early repayment charge (ERC) if you remortgage before the end of the introductory period.

If you’re near the end of your deal period, this might not be too much of a problem, but it tends to get costlier the longer you have left on your existing deal.

You’ll generally need a solicitor or conveyancer when remortgaging if you are switching to a new lender, as they handle the legal transfer of the mortgage and property checks. However, if you're simply changing deals with your current lender and no other changes are being made (such as changes to property ownership), a solicitor usually isn't required.

While you might incur extra costs if you choose your own solicitor when remortgaging, many lenders offer free legal packages as an incentive for switching to them.

Yes you can remortgage if you're self-employed. It can be more difficult if you’ve recently become self-employed, but if you’ve got proof of income for a long enough duration, you shouldn’t be affected. Most lenders want 12-36 months worth of tax returns and accounts, but unless your income has fallen since you bought the property, how you earn your income won’t prevent you getting a remortgage.

How long remortgaging takes will depend on your circumstances, however, it's usually around four to six weeks.

Product transfers can be much quicker, in some cases as short as a day, but usually won’t take more than two weeks.

There are different costs of remortgaging which your mortgage broker will be able to talk you through.

If you leave your current mortgage lender:

Early repayment charge (ERC) - If you remortgage before your existing mortgage term ends, you may have to pay a fee. It can be expensive (usually between 1 and 5% of your remaining principle, so weigh up the costs of any savings from the new mortgage.

Deed of release fees - The cost of your current lender to send the title deeds to your conveyancer. Not all lenders will charge this, but it can be a couple of hundred pounds.

For a new mortgage deal from a different lender:

Arrangement fee - Covers the lender’s admin fees, and usually ranges from £999 to £2,000. You can choose to pay it upfront or add it onto the mortgage (where you’ll pay interest on the fee).

Booking fee - Also called the application or reservation fee, which secures your mortgage deal.

Conveyancing fee - If your conveyancer charges you for transferring your mortgage.

Mortgage broker fee - Some brokers charge a flat fee for advice. Here at Mojo Mortgages, it’s free.

Typically, you should prepare the following documents:

Bank statements and payslips from the previous three to six months

Tax returns for the last 12-36 months, if you’re self-employed

SA302 tax return if you’re self-employed or have more than one source of income

P60 from employer

A form of ID

Proof of address

Numbers of other debts and regular expenses

Last reviewed by John Fraser-Tucker on 31 July 2025

*All data taken from Mojo Mortgages’ own customer records, covering the period from 1 January 2025 to 10 June 2025