Mortgage in principle - what can go wrong?

A mortgage in principle gives you an idea of how much you might be able to borrow, but it doesn’t guarantee you’ll be offered that exact amount when you apply for a mortgage.

In this guide, we explain just how reliable a mortgage in principle can be… and what might impact your borrowing potential later down the line.

A quick summary

A mortgage in principle gives you a good idea of how much you might be able to borrow, but it’s not a guaranteed mortgage offer

Qualifying for a MIP is a positive sign, though - 93% of our home buying customers successfully received an offer after getting a MIP and submitting their mortgage application

A mortgage application is most commonly declined after getting a mortgage in principle because your circumstances change in the meantime, incorrect information is provided or the lender has an issue with your chosen property

How reliable is a mortgage in principle?

A mortgage in principle (MIP) is a guide to how much lenders might be willing to offer you but it doesn’t guarantee you’ll be given that exact loan amount once you submit a full application.

That said, getting a mortgage in principle is still a milestone moment for any home buyer. It suggests a lender is, in principle, willing to offer you the funds you need to get a mortgage - a positive sign, we’d say!

In fact, 92% of first-time buyers go on to successfully receive a mortgage offer and complete on their dream home after getting a MIP!

A MIP is usually based on some basic information about your personal and financial circumstances, plus a soft credit check (which has no impact on your credit report). You’ll need to fill out a full mortgage application and the lender will conduct a hard credit check before making a formal mortgage offer. The amount they can offer you may differ to the amount suggested on your MIP depending on the findings of the lender’s checks during the application process.

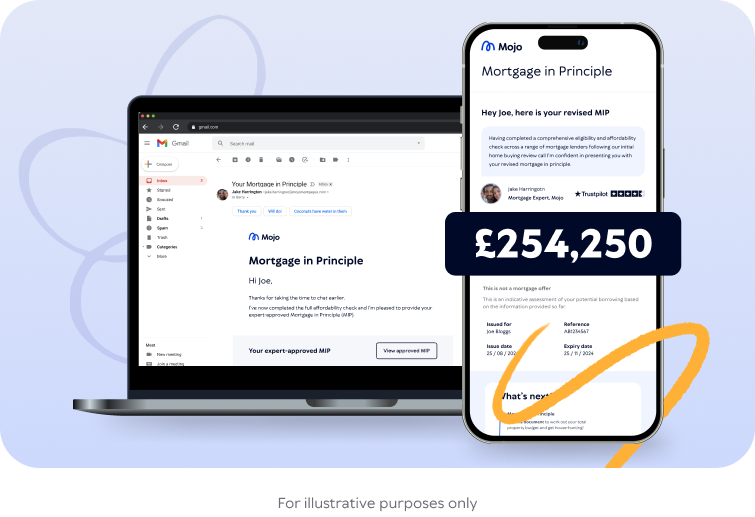

Working with a broker like Mojo could help to boost your chances of securing a MIP

81% of first-time buyers looking for a new home successfully secured a broker-verified MIP for the amount they were looking for after speaking to one of our experts.

We compare your eligibility against a wide range of lenders to create a tailored MIP that details your maximum borrowing potential. This saves you time and hassle individually applying for multiple MIPs from different lenders, some of whom might not be a suitable choice for you.

Can a mortgage in principle be declined?

Yes, it’s possible you might not get a mortgage in principle. This could happen if you don’t meet a lender’s eligibility criteria, for example:

-

Your income is too low or unstable

-

You haven’t got a large enough deposit

-

You have too much existing debt

-

You have had credit issues in the past

-

You can’t prove your address history

-

The lender can’t confirm your identity

Why could a mortgage application be declined after getting an agreement in principle?

This usually only happens if there is a discrepancy in information between your MIP and mortgage application, there’s been a change of circumstances or there is an issue with the property you’ve chosen.

A mortgage in principle is usually offered based on basic information provided and fairly rudimentary checks. Once you get to the application stage, more in-depth checks will be carried out by your lender that may uncover issues that affect your application.

Fortunately it’s quite rare for an application to be declined after getting a MIP.

Our data suggests that just 8% of first-time buyers and 5% of home movers have their mortgage application rejected after getting a Mojo MIP.

9 common reasons a lender might decline your application after getting a MIP

1. Your circumstances have changed

A lender will reassess your affordability when you submit a full mortgage application. So, if your income has reduced or there’s been a change in your circumstances (such as welcoming a child, getting divorced or changing jobs) you may find this impacts your application. While a lender might not decline your application due to a change in circumstance, they may decide to offer you a lower borrowing amount compared to your MIP.

2. You’ve had a few credit issues

If you’ve experienced credit issues since applying for an agreement in principle, you may find it harder to get a mortgage. That’s because the lender might see you as more of a risk.

Significant credit issues such as bankruptcy or County Court Judgements are likely to have the biggest impact on your application, but even things like missed or late payments could make a difference.

It may still be possible to get a mortgage with bad credit - speaking with a specialist broker could help you work out your options.

3. You’ve taken out additional credit

In our experience, one of the most common reasons for getting declined after securing a MIP is applying for new lines of credit. Maybe you decide to get a new car on finance, or buy some swanky new furniture on interest-free credit. While you might think your mortgage is already secured - think again.

Any new lines of credit will impact your credit score and debt-to-income ratio (the percentage of your income that goes towards paying off debt). So, when your lender assesses your full application, you may find that they won’t be prepared to offer you the same amount - or they might decide to decline your application altogether.

4. Your dream home costs more than your MIP and deposit

A mortgage in principle should give you an idea of how much a lender might allow you to borrow… but what if the house you want to buy is more expensive? The amount you can borrow plus your saved deposit might not cover it. While not impossible, you’re unlikely to be accepted for a higher amount than your MIP unless your financial circumstances have improved since.

This is where a broker-verified MIP can really come in handy. Unlike lender AIPs, which tells you the maximum amount you might be able to borrow from that one specific lender, a broker MIP gives you an idea of your maximum borrowing potential across a wider range of lenders. So, while one mortgage provider might not be comfortable lending you the funds you need, another may feel differently.

5. There are problems with the property you’ve chosen

While a MIP gives you an estimate of how much you could borrow, it doesn’t factor in all aspects of a lender’s criteria. For example, some lenders might exclude non-standard construction properties, certain new-build homes or properties smaller than a minimum size (usually 30sq metres).

Your mortgage offer will also be dependent on the findings of your lender’s property valuation. If they don’t feel your property is worth what you’re buying it for, or they find problems with the property, they may reduce the amount they’re willing to lend you or decline your application altogether.

6. There was a mistake in your application

The information provided to secure your MIP should match the information on your formal mortgage application. If a lender uncovers something you didn’t disclose, or discovers you’ve provided false or incorrect information, they may reject your application - even if it was just an honest mistake.

A mortgage broker can help to prepare and submit your application on your behalf, ensuring the information is filled out thoroughly and correctly to avoid any issues cropping up.

7. The market has changed

Although rare, a lender may decline your application if their own criteria or interest rates have changed since you got a MIP. For example, if the Bank of England base rate increases and the lender then decides to increase their mortgage rates, this increased interest amount could mean the mortgage you’ve applied for is now unaffordable for you.

8. You’re unable to provide adequate proof of your deposit or income

Lenders will run more in-depth checks during the full application process and, as part of this, will likely ask you to provide proof of your deposit and income.

Those with complex or irregular income, such as self-employed applicants, may find it harder to evidence a regular, reliable income.

Similarly, some lenders might be wary of applicants using non-standard deposit sources such as gambling winnings, cash deposits, gifted deposits from friends and distant family members, or personal loans. Your lender may require further evidence to prove the source of your mortgage deposit and, ultimately, they may reject your application if they’re not satisfied with the documentation you provide.

9. Your MIP has expired

Most MIPs last for 90 days, giving you three months to find your dream home and put your offer in. However, if your MIP has expired, it’s no longer an accurate estimate of how much you could borrow. Your lender could change their policies in the meantime so, when it comes to putting in a mortgage application, you may find you no longer meet their eligibility criteria.

If your MIP is close to expiring, it’s a good idea to extend your MIP or apply for a new one before continuing your house hunt.

“Working with a mortgage broker who knows each lender’s requirements inside out can help to avoid declined applications. They’ll work closely with you to make sure your mortgage application is accurate and up to date, before matching you with a lender who’s most likely to accept your application for the funds you need.”

Luke Butcher, Chief Revenue Officer

What to do if your mortgage in principle is declined

Don’t be too discouraged if your mortgage in principle is declined. There are plenty of steps you can take to improve your chances of getting one. Remember, it’s free to get a MIP and as long as the broker or lender you choose uses a soft credit check there’ll be no impact on your credit score if you choose to reapply.

-

Work with your broker to improve your application. Your broker may be able to tell you why you didn’t qualify for a MIP and recommend the steps you need to take to improve your application.

-

Try to boost your deposit. This will lower the amount you’ll need to borrow from a lender.

-

Check your credit report. If you spot any errors or inaccuracies, raise them with the relevant credit reference agency as soon as you can. There are some simple steps you can take to boost your credit score, too, such as getting on the electoral roll.

-

Keep an eye on your finances. Make sure you pay existing debt on time consistently, try to keep your credit card utilisation below 30% and avoid taking out any new credit in the run-up to applying for a mortgage.

-

Apply with a specialist lender. Certain lenders specialise in complex situations, such as mortgages for those with bad credit or applying for a non-standard construction property. A broker will be able to help point you in the right direction.

-

Wait for your circumstances to change. While this isn’t ideal, you may need to wait for your situation to improve. For example, your credit score may need a boost or you might need to earn a higher income before you can successfully get a MIP.

Going above & beyond to help you figure out the perfect mortgage and house-buying budget

Paperwork help ✅ Mortgage broker exclusives ✅ Borrowing limits from over 60 lenders ✅

1. Add your details online

No 2-hr phone calls or branch visits. It takes a few minutes to tell us what you need from your next mortgage online.

2. Speak to your broker & get a MIP

Choose the perfect time, whether that is ASAP or a time better suited to you, we are available 6 days a week, including evenings.

3. Get your mortgage with Mojo

We’ll check and chase to help avoid delays. Get regular updates from your mortgage advisor and case manager.

FAQs

No, a mortgage in principle is not a guaranteed mortgage offer nor legally binding. It’s a conditional offer stating how much a mortgage provider might be willing to lend you based on basic financial checks.

In order for a lender to make you a formal mortgage offer, more detailed checks are required including a full credit check, affordability assessment and property valuation.

If you have secured a mortgage in principle from your broker or an agreement in principle from a lender, it’s likely your mortgage application will be successful (as long as you are able to verify disclosed information and your circumstances haven’t changed since getting your MIP) but a mortgage offer is not guaranteed.

You're most likely to get a mortgage offer if your financial situation remains stable and nothing significant has changed since getting a MIP. However, if your mortgage application uncovers affordability or credit issues, your lender may offer you a different amount or they may decline your application completely.

While it is technically possible to appeal against the decision, it’s likely you’ll have to apply for a mortgage with a different lender.

This does mean another hard credit check will be recorded on your credit file - and too many of these in quick succession could damage your credit score. So it’s important to make sure you only apply with a lender if you meet their specific criteria.

Working with a broker like Mojo could help to give you the best chance of securing a mortgage. Our brokers compare thousands of deals across over 70 lenders for free, so they’ll be able to recommend applying to lenders where you have the best chance of success.

Provided only a soft search is carried out at the MIP application stage (which is the case for most brokers and lenders), a rejected MIP will have no impact on your credit score.

However, a hard credit check will be carried out at the mortgage application stage. So, if you’re struggling to be accepted at the early mortgage in principle stage, you may wish to look at ways to boost your credit score and improve your application before diving in.

Yes! While getting a MIP won’t guarantee you’ll get a mortgage offer, it’s still a useful indication of how much you could afford. This not only helps you refine your property search, but it can show sellers you’re a serious buyer too.

The process of getting a MIP still requires eligibility and affordability checks so, if you do get a MIP successfully, it’s a good indication that you’ll be eligible for a mortgage too. If, for whatever reason, your MIP application is unsuccessful, it’s much better to find out the reasons why at the very start of your mortgage journey than after you’ve already picked out your dream home.

All data shown is taken from Mojo Mortgages’ own 2024 customer records