Self employed mortgages

Getting a mortgage if you’re self employed isn’t as tricky as some people think. At Mojo Mortgages, we’re here to help.

Last reviewed by John Fraser Tucker on 25 September 2025

A summary for self-employed mortgage applicants:

You’ll usually be classed as self-employed if you own 20% or more shares in a business that provides most of your income

Whether you’re a sole trader, contractor, freelancer or limited company director - it’s perfectly possible to get a mortgage when self-employed

Proving your affordability is the most important step, so you’ll need to make sure you have the right documents ready for lenders to review

Lender criteria varies significantly. It can be much more straightforward to work with a mortgage broker to match you with the right lender for your circumstances

Getting a self employed mortgage

It’s a common myth that it’s tough to get a mortgage when you’re self-employed. But it doesn’t have to be.

82% of our self-employed customers who submitted a mortgage application in the last 12 months received a mortgage offer*.

Largely, self-employed applicants have the exact same access to mortgage deals as everyone else including fixed-rate, variable-rate or interest-only mortgages. There’s just a slight difference in the application process, mainly how lenders assess your income.

This will typically involve:

More documentation. You'll need to provide more detailed financial records than an employed applicant in order to paint a clearer picture of your earnings. For example, you’ll need to show how much income you’ve earned and how much tax you’ve paid.

Proving your trading history. Lenders will want to see how long you’ve been self-employed for. Most prefer to see at least two to three years of accounts, though some will consider one year in certain circumstances.

A detailed income assessment. Lenders will look at your net profit or a combination of salary and dividends, often averaging your income across a set number of years.

Ultimately, lenders need to be confident that you can consistently meet your monthly mortgage repayments, so they’re looking for signs of stability. This means understanding how long you’ve been self-employed for, how much money you earn on a consistent basis and how reliable your income is.

“Lender criteria can be a bit stricter for self-employed applicants, but some lenders are much more flexible than others. That’s why it’s so important to work with an experienced mortgage broker who can recommend the best route forward.”

April Aldridge, Director of Customer

Key document requirements for a self-employed mortgage application

Usually, the type of self-employed income you earn will determine what documentation you’ll need to provide. This is in addition to all the usual paperwork required for any mortgage application.

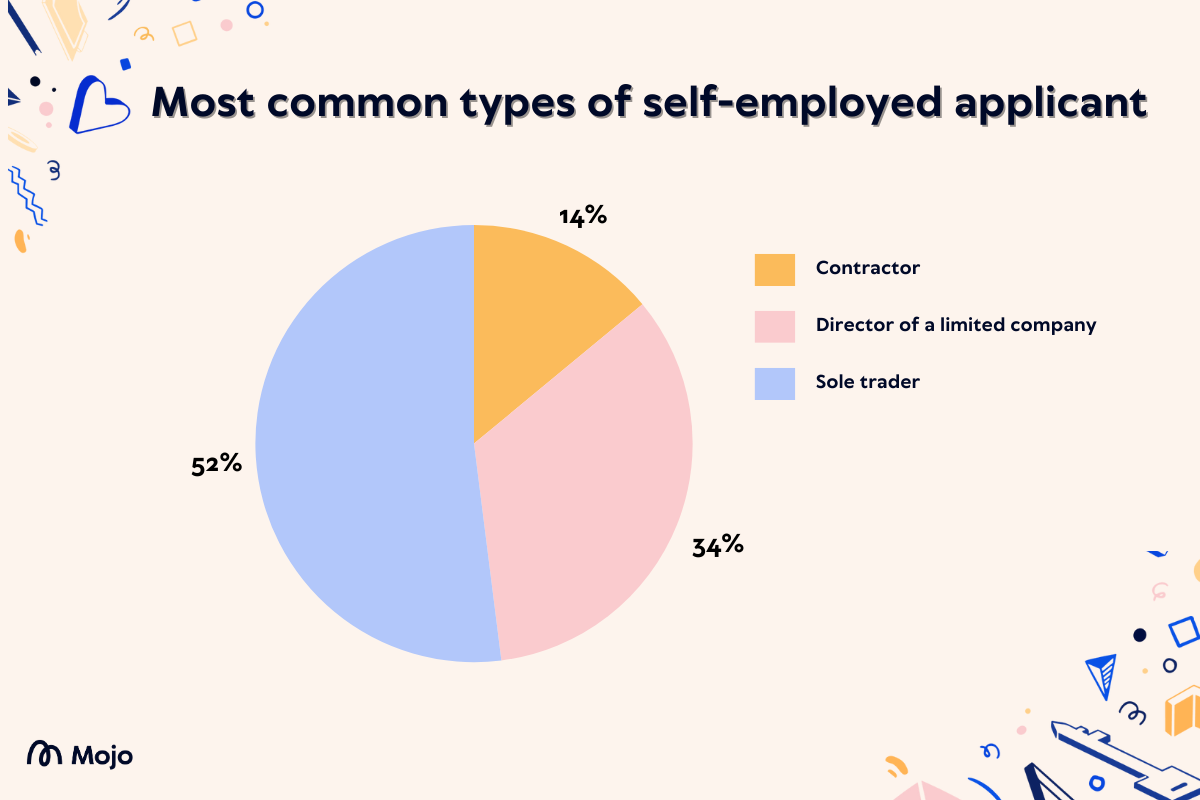

Did you know? Over half of our self-employed home buying customers are sole traders - but we help lots of different types of self-employed borrowers.

How much can I borrow if I’m self-employed?

Just like employed applicants, lenders tend to use an income multiple, typically around 4 to 4.5 times your annual income, to determine how much you can borrow. However, calculating your income looks a little different for self-employed applicants:

-

Income calculations. Lenders usually average your income over a set number of years (usually two or three years) to account for fluctuations. However, some will base their affordability assessment on your most recent tax year or your lowest earning year.

-

Income type. For sole traders, lenders generally look at your net profit whereas for limited company directors it’s often salary plus dividends. Some lenders will be willing to include retained profits, bonuses or commission too so it’s well worth doing your research to understand which forms of income are accepted by each lender.

-

Overall affordability. Lots of factors beyond your income influence your borrowing power, including your credit history, the size of your deposit, your personal and financial circumstances and the lender’s specific criteria.

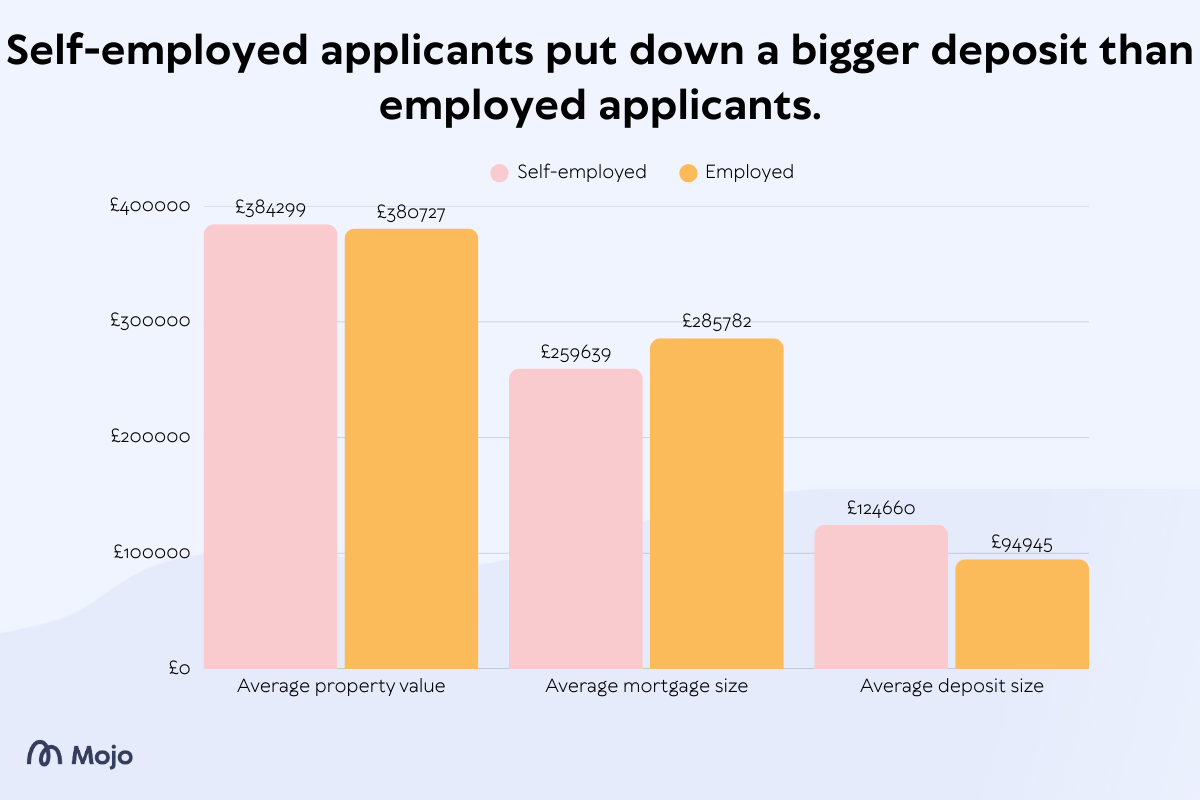

Did you know? Our internal data reveals that, over the last 12 months, the average self-employed home buyer put down almost £30,000 more as a deposit compared to employed applicants. This shows that many opt for lower loan-to-value mortgage options which can not only improve your chances of getting a mortgage offer, but could give you access to more competitive rates too.

Self-employed scenarios we can help with

It can be more challenging to secure a mortgage if you’re newly self-employed and have less than 2 years’ accounts - but it’s not impossible. We can identify lenders who consider applicants with one full year of accounts, especially if you have a strong deposit or a history of working in the same industry.

If your income isn’t consistent, you may be better off applying with a lender who averages income over multiple years or who will be more flexible if your income is on an upward trend. We’ll help to find the most suitable lender and present your income stability in the most effective way.

While putting down a larger deposit can help you access more competitive rates, it’s still possible to secure a mortgage with a smaller deposit. We’ll help you to find a lender offering mortgage products that suit your deposit size.

We understand that contract length and renewals are key. Our Mortgage Experts will recommend lenders who assess your income based on your day rate, even with short-term contracts, provided there's a history of consistent renewals.

You’ll need to provide different supporting information for your joint mortgage application, but ultimately it shouldn’t impact you if one or both of you is self-employed, unless you’re newly self-employed or unable to prove your income.

By nature of the industry, lots of buy-to-let mortgages are taken by self-employed individuals. We assist many self-employed landlords, whether property is your main business or a source of additional income.

"Mojo Mortgages have been absolutely great with us. As myself and my partner are self employed they found the best deal for us and their rate checker made it even cheaper by the time we completed. They also helped us with protection which has also been great."

Alex Walmsley

31 August 2025

How to get the best self-employed mortgage rates

The rates available to self-employed mortgage applicants aren’t going to be different to those available on the market generally.

However, it’s important to make sure your application is in top shape to give you the best chance of accessing the most competitive deals:

-

Have a strong track record. Most lenders prefer to see two or three years of continuous trading history, to show stability and consistency. It’s also a good idea to make sure your accounts are certified by a qualified accountant, to make sure your records are accurate.

-

Maintain a good credit score. The best rates are often reserved for those with a strong track record of responsible borrowing. Check your credit report is accurate and up-to-date, and always ensure all payments are made on time.

-

Put down a larger deposit. A larger deposit can make your application more attractive to lenders. A lower loan-to-value ratio reduces the lender’s risk, which can result in them offering better interest rates.

-

Look beyond your income. Lenders will consider other factors during their affordability assessment, including your outgoings, existing debts and other commitments to ensure the mortgage is affordable for you - even if rates increase in the future. Demonstrate responsible spending habits and keep your debt-to-income ratio down if you’re hoping to access better rates.

-

Work with an expert. Having a broker on-hand to prepare and submit your application can be helpful. Our Mortgage Experts have a wealth of experience working with self-employed applicants - in fact, 7% of our home buying customers in the last 12 months were self-employed*.

Remortgaging if you’re self-employed

It’s possible to remortgage if you’re self-employed:

-

If your circumstances haven’t changed since your last mortgage, the remortgage process should be more straightforward.

-

If you have recently become self-employed, it can be more complex, especially if your income has fallen since you took out your original mortgage. However, it may still be possible to get a product transfer with your existing lender in some circumstances.

-

If you’ve become self-employed and earn more than when you got your mortgage as a full-time employee, you may be able to remortgage - but be prepared to provide additional information to prove your income, such as your accounts or SA302 forms.

When you choose Mojo Mortgages, our experts will…

Get to know your unique circumstances and mortgage needs

Compare self-employed mortgage deals & recommend the most suitable lender for you

Guide you through exactly which documents you’ll need for your application

Handle the entire application process, ensuring it’s submitted accurately and effectively

Keep you updated every step of the way, from offer to completion

Self Employed Mortgages FAQs

There are lenders that don’t require certified accounts as part of your mortgage application, so it’s not the end of the world if you don’t employ an accountant. However, using a qualified accountant is highly recommended. It adds credibility to your application, ensures your records are accurate and may even give you access to a wider pool of lenders.

Yes, but you'll need to have the accounts and tax calculations (SA302). The lender will also want to be certain that your affordability doesn't depend on this extra income more than your full time job.

It can make things more difficult, as both being self-employed and having poor credit are considered risk factors by most lenders, compared to an employed person with good credit, for example.

However, what lenders consider to be ‘bad credit’ is a spectrum that varies from one to the next, so it’s important to apply with a lender most likely to accept your specific circumstances.

Yes, it is possible but your options may be more limited. Specialist lenders can consider applicants with one year's accounts, often requiring a larger deposit or a strong history in the same industry before you became self-employed.

The timeline can be similar to employed applications - around four to eight weeks from application to offer. This can vary depending on how complex your application is, though.

Getting all your documentation ready in advance can speed up the process, as your broker or lender won’t be left waiting. Being responsive to any additional questions or requests can also help to avoid any unnecessary delays.

Nearly all UK mortgage lenders, including high street banks and building societies, will consider applications from self-employed individuals. However, each will have their own specific criteria when assessing self-employed applicants. The best lender for you will depend entirely on your financial situation and the type of mortgage you’re looking for.

Here’s where a broker can really come in handy. We’ll match your specific income structure and self-employment history to the lender most likely to approve your application on the most favourable terms.

*All data taken from Mojo Mortgages’ internal customer records, covering the period from September 2024 to August 2025