Should I buy or rent a home?

Figuring out when to buy is one of the biggest financial decisions you’ll face. Let’s take a look at the pros and cons of buying a property versus renting - plus the costs involved when you become a homeowner.

In summary:

If you’re in a stable financial position to buy (with a big enough deposit and savings to cover upfront costs like stamp duty and conveyancing fees), buying a property can be a powerful investment. Your monthly mortgage payments can help build equity, leading you straight to a mortgage-free future. Plus, your property value is likely to increase over time, securing even more money for your future.

However, if you have limited savings, need extra flexibility or you aren't sure where you want to live long-term, renting may well be the more practical and affordable option in the short term.

Ultimately, the right choice is totally personal to you. Weigh up all the costs associated with both buying and renting while also considering what living arrangements best suit your current lifestyle and future goals. A house deposit saving calculator can also help aspiring homeowners plan and achieve their deposit goals.

How much does buying a home cost versus renting?

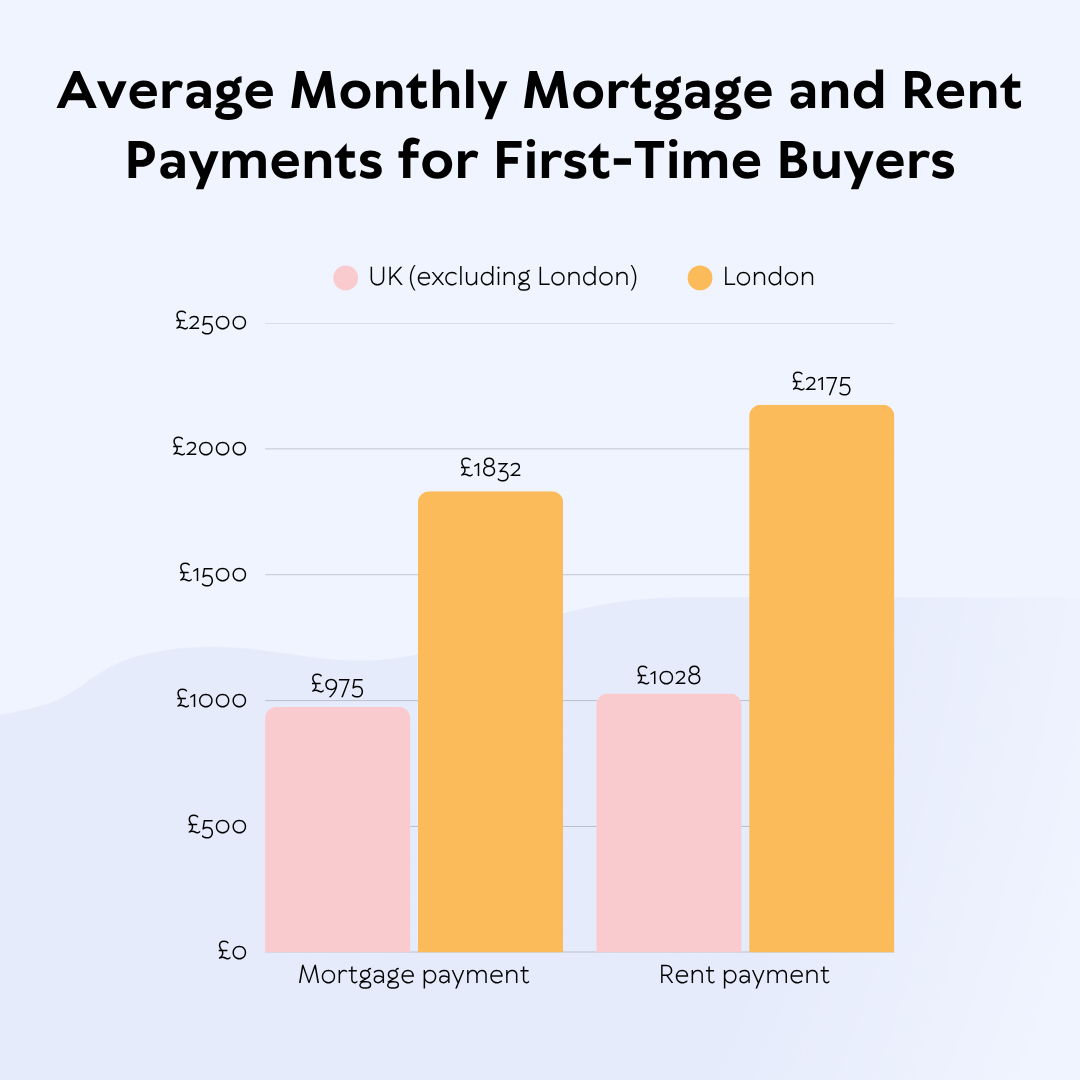

Generally speaking, monthly mortgage payments are often cheaper than monthly rental payments on an equivalent property. But it’s not always a straightforward comparison.

For example, using Zoopla's data on the UK's average house price for first-time buyers (£249,100), a mortgage for a first-time buyer with a 20% deposit on a 25-year term at a 4.5% interest rate would be around £1,108 per month. This is around £180 cheaper than the UK's average monthly rent of £1,287.

The difference is even more stark when we look at London in isolation, where those renting will pay a staggering £343 more each month on average than they would if they bought their first home. The rest of the country - excluding London - fares slightly better, making a smaller saving of around £50 per month when compared to renting.

UK (excluding London)

Average monthly mortgage payment for first-time buyers | Average monthly rent payment |

|---|---|

£975 | £1,028 |

London

Average monthly mortgage payment for first-time buyers | Average monthly rent payment |

|---|---|

£1,832 | £2,175 |

We calculated these figures using Zoopla’s average property price for first-time buyers (£219,160 for homes in the UK excluding London and £411,900 for homes in London), assuming a 20% deposit on a 25-year term at a 4.5% interest rate to find the monthly mortgage payment cost. Average rent figures from Zoopla’s Rental Market Report.

Of course, it’s practically impossible to truly compare like-for-like when working out the costs of buying vs renting a home. But, to help give you a clearer picture, let’s delve into some of the other costs you’ll come across when buying a property.

Other costs you need to consider when buying a new home versus renting

The upfront costs of buying a property can be significantly higher. And, while monthly mortgage payment can be less than rent, once you factor in things like maintenance and insurance, the total monthly cost of owning can be higher too.

That said, typically, every mortgage payment you make invests money into an asset you will hopefully own outright one day whereas rental payments go straight into a landlord's pocket. Plus, if house prices boom, you’ll be able to sell your property for even more money than you bought it for - making a tidy profit in the process. Do bear in mind, though, that house prices could also decrease.

Here are just some of the costs you’ll incur when buying a property, versus the costs you need to consider when renting:

Deposit. Lenders usually ask for a minimum of 5% of the property value, but it’s common for home buyers to put down more than this. Alternatively, if you’re renting, you’ll usually be charged a refundable tenancy deposit which is capped at five week’s rent

Stamp duty. The cost will vary depending on your property price and the type of buyer you are. For example, first-time buyers will be exempt from paying stamp duty when buying a property worth less than £300,000.

Legal fees. When buying a house, you’ll need to instruct a solicitor or conveyancer. Legal fees can cost around the £2,000 mark, plus additional costs for local searches (which usually cost a few hundred pounds).

Property valuation fees. Your lender conducts a mortgage valuation to ensure the property you want to buy is worth the price you’re paying for it. Depending on your lender, a property valuation could cost between £100 to £800.

Survey costs. You don’t have to get a survey when you buy a house, but it’s recommended that you do as it’ll help to uncover any issues with the property before you commit to the purchase. The cost of a house survey will vary depending on the type of survey you receive and the property type/value.

Mortgage product fees. Also known as an arrangement fee, this is charged by the lender to set up and administer the mortgage. Product fees can cost around £1,000 to £2,000 on average.

Land Registry fees. Usually it costs a few hundred pounds for HM Land Registry to update the register of land and property, but it can cost more depending on the property value.

Removal costs. You’ll need to move your things into your new home whether you’re buying or renting. Depending on how far you’re moving and how much you need to move, this could cost anywhere from a few hundred pounds to over a thousand.

Day-to-day bills. Your general living expenses are likely to be roughly the same whether you’re buying or renting - though you’ll need to consider getting additional insurance when buying a property (such as buildings insurance and mortgage protection insurance).

Ongoing maintenance. As a homeowner, you’ll be responsible for all maintenance and repairs - it’s recommended you budget 1% of the property value annually for this. When you rent a property, your landlord will take care of any repair costs.

Remember, this list isn’t exhaustive - depending on your circumstances, you may also incur other costs when buying or renting a home.

Find the right mortgage deal for you

Deciding whether to buy a home is a big decision. Let our mortgage brokers help review your income and outgoings, compare mortgage options and find the best deal for your circumstances.

Pros and cons of buying a property

-

You build equity. With a repayment mortgage, every mortgage payment is a step towards owning your home outright, providing long-term financial security. Eventually, you’ll own a property that can be passed down through the generations.

-

Your home’s value could increase. Properties typically increase in value over time so you could sell it for a profit in the future.

-

Your monthly payments might be cheaper. Mortgage payments can be lower than rent, depending on where you live and how much deposit you put down. Plus, mortgage payments are likely to gradually reduce over time as your loan-to-value decreases (lower loan-to-value mortgages often come with lower rates).

-

You can decorate to your heart’s content. Renovate, redecorate or refresh your home however and whenever you like without needing a landlord’s permission.

-

You pay more upfront. You’ll need a significant deposit to buy a house, but you’ll also need to save up for things like stamp duty, legal fees, arrangement fees and survey costs.

-

Maintenance costs are your responsibility. From a leaky tap to a broken boiler, all repairs are on you, which can be unpredictable and expensive.

-

It’s tougher to move. Selling a property can be a slow and costly process, which might not be suitable if you need more flexibility.

-

You could face consequences if you don’t pay your mortgage. You could end up getting into debt and, as an absolute last resort, your lender could even repossess your home if you don’t keep up with your mortgage repayments.

-

You could end up in negative equity. If property prices fall, your home could end up being worth less than your mortgage, making it more difficult to move or remortgage.

-

Your savings are tied up. It’s likely you’ll put a big chunk of your savings into your deposit, which could limit other investment opportunities.

-

A split could be stressful if you have a joint mortgage. If you rent with another person, parting ways is much more straightforward. Separating ownership of a home can be more complicated and costly.

Pros and cons of renting

-

There are less upfront costs. You won’t need to save for a house deposit or stamp duty. Usually only four or five weeks’ rent is required as a deposit, but you should get this back at the end of your tenancy.

-

You’ll be all moved in sooner. Finding and moving into a rental property is a much quicker process compared to applying for a mortgage and buying a home.

-

It’s more straightforward to move. If you fancy a change, it’s easier to move when your rental agreement comes to an end. You won’t need to find a new tenant or get solicitors involved - you simply need to give your landlord the appropriate notice

-

You’re not responsible for maintenance. Whether it’s peeling paint or broken appliances, your landlord is responsible for arranging and paying for all major repairs and upkeep.

-

Live in areas you couldn't afford to buy in. Renting can give you access to homes or neighbourhoods where property prices are otherwise out of reach.

-

You take on less risk. Changes in the housing market or mortgage rates won’t directly impact you (unless your landlord decides to increase your rent).

-

Your rent payments go solely to your landlords. This means your money doesn’t contribute towards owning an asset, which could ultimately mean you end up renting for your whole life.

-

Your rent can increase. Your landlord can raise the rent when your tenancy is up for renewal, making your housing costs less predictable.

-

If property prices increase, you won’t benefit. If property values in your area boom, you won't see any of the financial upside.

-

You could be asked to move even if you don’t want to. Your tenancy can be terminated by the landlord (though they’ll have to give you proper notice).

-

You’ll need to abide by rules and restrictions. Many rental properties have rules regarding pets, decorating, smoking or other aspects of living that can limit your freedom.

-

You’re reliant on third parties. While plenty of landlords or letting agents are great to deal with, some can be more unreliable or responsive when it comes to discussing repairs or other issues.

“If you’re thinking about buying a home, make sure you’ve worked out your full budget. You’ll need to save enough cash to cover all the costs involved in moving, but it’s also a good idea to set aside an emergency fund for any unexpected costs once you’re all moved in.”

Luke Butcher, Chief Revenue Officer

FAQs

It all comes down to your financial situation, personal goals and how much of a risk you’re willing to take.

Buying a home sooner allows you to get onto the property ladder and begin building equity. However, having a smaller deposit could mean you’ll have to make some compromises to afford a home - such as choosing a more affordable property, or applying for a higher loan-to-value mortgage which may come with less favourable interest rates. Plus - if you plan to move homes again in the future - you’ll have to face all the same costs involved in buying a home all over again (such as stamp duty, solicitor fees and moving expenses).

On the other hand, waiting to save could help you to build up the cash you need to buy your dream home. Putting down a bigger deposit can also help you access better interest rates which could lower your monthly mortgage payments. Of course, the risk here is that property prices could continue to rise while you save, which could make any cost savings negligible while you’ll also miss out on any potential equity growth from buying a house sooner.

Before you jump into buying a home, it's important to make sure you're financially prepared. Look beyond just the monthly mortgage repayments, taking into account the significant upfront costs that come with purchasing a property.

You might find it helpful to get a mortgage in principle. Though not a guaranteed mortgage offer, it gives you an idea of how much you might be able to borrow to buy a property. From here, you can then decide whether to save for a bigger deposit or confidently begin your search for your dream home.