Mortgage deposit saving calculator

Ready to get started on your savings mission? With our mortgage deposit calculator, see how much money you’ll need to save - and how long it could take you to reach your goal.

House deposit saving calculator

See how much you need to save for a deposit and how long it could take.

You'll need to save

£0

towards your £0 deposit goal

It'll take you

0 years

and

0 months

Did you know? You may be able to access better rates with a larger deposit

How to use our deposit calculator

- 1.

Set your savings target. First, find out how much your perfect property might cost, and what deposit percentage you want to save (lenders usually ask for at least 5% of the property price).

- 2.

Tell us how much you’ve already saved. This helps you work out how much more you need to stash away before buying a property.

- 3.

Decide how much you can set aside. Think about how much money you could comfortably save each month. Take away all regular outgoings (including bills and day-to-day expenses) from your income to work out how much spare cash could go towards your savings each month.

Once you’ve entered all the info, we’ll let you know how much money you need to save and how long it could take you before you’re ready to apply for a mortgage.

Why is a mortgage deposit so important?

A mortgage deposit is how much money you pay upfront when you buy a property. The rest of the property’s cost is borrowed from a lender.

Lenders see a larger deposit as less risky, as you’ll be borrowing less of the property’s value from them. So they’ll often reward you with more competitive interest rates - and therefore lower monthly payments - if you can put down a bigger deposit.

Your deposit size is linked to your loan to value (LTV) ratio, which is the percentage of your property’s value that you borrow from your lender. So, if you want to buy a £300,000 home with an 80% LTV mortgage, you’ll need to put down at least 20% of the property price as a deposit. That’s £60,000 you’ll need to save.

How much do you need to save for a house deposit?

You’ll usually need a deposit of at least 5% of the property’s purchase price. However, aiming for a larger deposit can significantly improve your mortgage options.

-

5% deposit: The typical minimum. There are 100% LTV mortgage options out there, but they’re rare.

-

10-20% deposit: Gives you access to a wider range of lenders and more competitive rates.

-

20%+ deposit: Often allows you to access an even better range of mortgage deals.

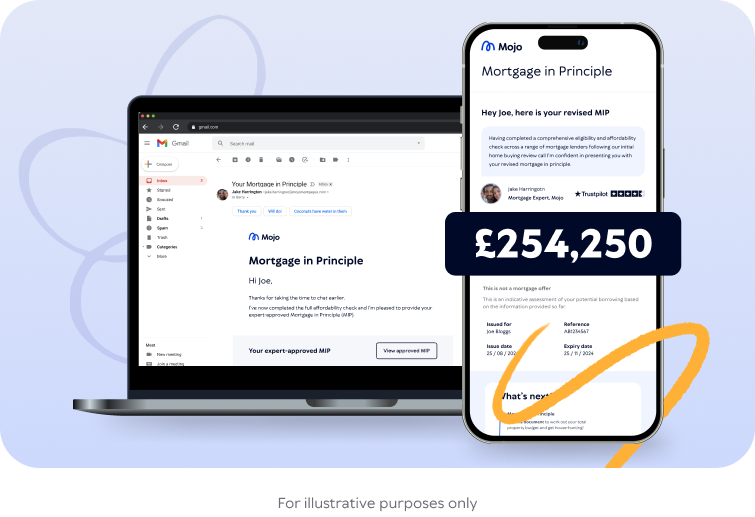

“The amount you need to save for your deposit will come down to your chosen property’s value but also how much your lender will allow you to borrow. It’s a good idea to find out how much you’re eligible to borrow before you get your heart set on a specific property. Speak to a broker to get a mortgage in principle sooner rather than later.”

April Aldridge, Director of Customer

Four ways to help you reach your home deposit goal faster

Our deposit calculator crunches the numbers, but now it’s time to start growing your savings.

1. Reduce your outgoings

Easier said than done, we know. But making small cutbacks or reassessing subscriptions can make a big difference to the amount you can put aside.

2. Team up with loved ones

Whether you can pool resources and buy a house with someone else, or turn to the bank of Mum and Dad, asking loved ones for help is one way to get on the property ladder sooner.

3. Research home ownership schemes

There are several schemes out there designed to support first-time buyers, including shared ownership schemes, the Mortgage Guarantee Scheme and First Homes Scheme.

4. Make the most of our savings

How you save matters. If you’re eligible, look into a Lifetime Individual Savings Account (LISA) and you could see your savings topped up by a maximum of £1,000 each year.

For more top tips, take a look at our guide to saving for a house deposit. It’s packed with 20 deposit-boosting strategies to help you get on the property ladder sooner.

Deposit sorted? Let’s get you a mortgage

Once your deposit goal feels within reach, the next step is to see exactly how much you could borrow and what mortgage options might be right for you. Our expert brokers are on hand to help you figure it all out.