Mortgage protection

Your home is more than just bricks and mortar. It should be your family's foundation, not a financial burden.

Mortgage protection helps to ensure your mortgage payments are covered, so your home stays your safe haven if life takes an unexpected turn.

What is mortgage protection insurance?

Mortgage protection is a broad term covering a range of policies designed to cover your mortgage payments if unexpected events mean you can no longer make them.

At its core, mortgage protection is all about peace of mind. It can be particularly beneficial if other people rely on your income to pay all or part of your mortgage, as your loved ones won’t face the stress of covering mortgage payments or other bills on their own.

Getting a mortgage is a big financial commitment and protecting it is just as important. When you get a mortgage through Mojo, our advisors will provide a free protection review to:

- Explain your options and recommend the types of cover that suit your needs

- Identify potential gaps in any existing cover you have

- Help you feel financially secure and give you peace of mind

According to the Financial Conduct Authority’s Financial Lives survey, less than half (46%) of UK adults hold any kind of protection insurance and just 57% of mortgage holders have a life insurance policy. Let’s make sure you have the right cover in place.

The main types of mortgage protection

| Life insurance | Critical illness cover | Income protection |

|---|---|---|---|

What it covers | Death of the policyholder during the term | Diagnosis of a specific illness or medical condition listed in the policy | Being unable to work due to illness or injury |

How it pays out | One-off lump sum payment | One-off lump sum payment | Regular monthly payment for a set period of time |

Main benefit | To provide for loved ones and dependents, such as paying off a mortgage | To provide a financial cushion to cover costs such as mortgage repayments during recovery from a serious illness | To replace lost income, allowing you to keep up with mortgage payments and other bills |

Typical term | Often aligned with your mortgage term | Often aligned with your mortgage term or retirement age | Can be short-term (often one or two years) or long-term (until retirement age) |

Life insurance

Life insurance is a policy that provides a one-off payment in the event of your death or terminal illness. Your nominated beneficiary can then use this money to pay off all or part of the mortgage, helping to secure their financial future.

How does life insurance work?

There are different forms of life insurance available, and each works slightly differently.

Decreasing term. With a decreasing term policy, sometimes called mortgage life insurance, the amount of cover reduces in line with your mortgage. This is usually a more cost-effective option.

Level term. The amount of cover stays the same throughout the policy, which can be a good option for those with interest-only mortgages or if you’d prefer to leave a fixed sum for your family.

Family income benefit. This is designed to pay out a regular monthly sum to the family for the remainder of the policy term, helping loved ones to manage ongoing living costs. It’s often paired with a decreasing or level term life insurance policy.

Who is life insurance for?

Life insurance is most suitable for any homeowner who wants peace of mind that, if they pass away or become terminally ill, their family can remain in their home without worrying about mortgage debt.

Critical illness cover

Critical illness cover is an insurance policy that pays out a one-off lump sum if you are diagnosed with a serious illness that’s listed in your policy.

A serious illness can have a significant financial, physical and emotional impact, especially if it affects your ability to work. This cover provides a financial buffer, as the one-off payment can help to cover essential costs such as your mortgage. It allows you to focus on recovery without worrying about how you’ll pay the bills.

How does critical illness cover work?

Critical illness cover can often be added to a life insurance policy, or purchased as a standalone product. Different providers may cover different illnesses, so it’s important to check what’s included in your cover before taking out a policy.

Who is critical illness cover for?

If you’re worried about how you’d manage financially should you fall ill, critical illness cover may be suitable for you. It can be especially valuable for those without substantial savings, as it provides the funds to clear mortgage debt, adapt to a new lifestyle or build a financial buffer against any loss of earnings.

Income protection

Income protection is designed to replace a portion of your income if you become unable to work due to illness or injury. It helps to cover your monthly mortgage payments and other living expenses until you can go back to work.

How does income protection work?

Income protection insurance pays out a monthly benefit (usually a percentage of your salary). The payments typically start after you’ve been out of work for a pre-agreed waiting period. You can choose what deferred period best suits your financial situation based on factors like your sick pay benefits or how much you already have in savings.

You’ll usually continue to receive payments for a set period of time stated in your policy (the benefit period may be one or two years, for example). But there are policies that pay out continuously in the event of long term illnesses so it’ll pay out until you return to work or the policy ends.

Who is income protection for?

Income protection can provide vital financial security for anyone whose lifestyle depends on their monthly salary, particularly if you’re self-employed, in a role with limited sick pay benefits or have limited savings.

It’s worth noting that different providers will have different criteria for paying out. For example, many providers won’t cover you for illness or disability relating to pre-existing medical conditions.

How much does mortgage protection cost?

The cost of your premium (the amount you pay monthly for your protection insurance) can vary significantly depending on the type of insurance and the level of cover you want, along with your personal circumstances.

One of the great things about protection insurance is that you can tailor your policy to fit within your budget. Speak to a protection expert about your needs and requirements to get an accurate quotation.

Talk to our protection experts

There are so many different mortgage protection options out there, it can be tricky to know which one’s best for you.

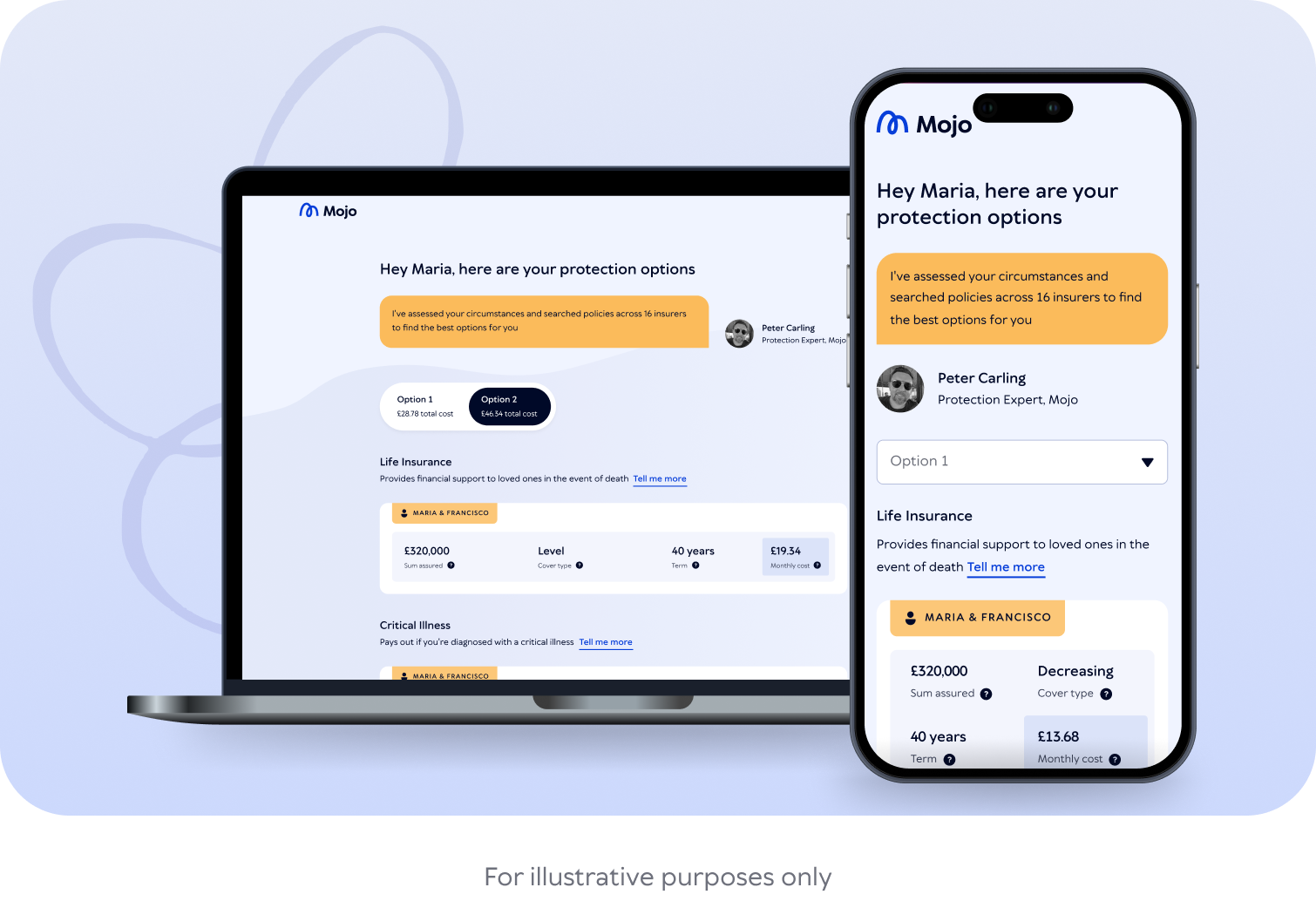

If you take out a mortgage with Mojo, we’ll help you protect it too. Our qualified Protection Advisors can search across the market to help you find the right type of cover for your needs and circumstances.

Mortgage protection FAQs

While lenders might not insist you have mortgage protection in place, it’s generally a good idea to have it.

A mortgage is a big financial commitment, and you and your family probably rely on a steady income to pay it. But what if things change? Protection insurance gives you peace of mind that you’ll be able to keep your home and pay your bills even if you’re no longer able to work.

Payment Protection Insurance (PPI) was a type of policy designed to cover the monthly repayments on a specific debt if you were unable to pay.

Mortgage protection insurance, however, is designed to protect you and your family by providing a lump sum or a replacement income, giving you and your family more flexibility on how the money is used.