Should I overpay my mortgage?

If you’ve got some spare cash or you’ve come into some extra money, you may well be wondering if you should use it to overpay your mortgage.

Overpaying could save you a good chunk of money and set you on your way to becoming mortgage-free sooner. But everyone’s financial circumstances look a little different, so you should always weigh up the pros and cons first.

Author - Aidan Darrall Editor - Stuart Bowman

Last reviewed on 4 September 2025

Quick summary on mortgage overpayments:

Overpaying your mortgage could save you money, as you’ll pay less interest overall - it could also help you become mortgage-free much sooner!

Most lenders will let you overpay up to 10% of your outstanding mortgage balance each year without any penalties… but always double check your terms

It’s often a good idea to clear more expensive debts and build up a rainy-day savings fund before you start overpaying

Calculate your mortgage overpayments

Whether you have a lump sum of cash or want to make regular overpayments, our mortgage overpayment calculator crunches the numbers to see how many years (and interest) you could shave off.

What does overpaying a mortgage actually mean?

When you take out a mortgage, you’ll agree to make regular monthly payments. Overpaying your mortgage basically means you’ll pay an additional amount on top of these monthly payments.

Whether you make a one-off payment or regular top-ups each month, any extra cash you pay should go straight to reducing your outstanding balance. By repaying your loan faster, you’ll not only be mortgage-free sooner but also save on the total amount of interest you’ll pay.

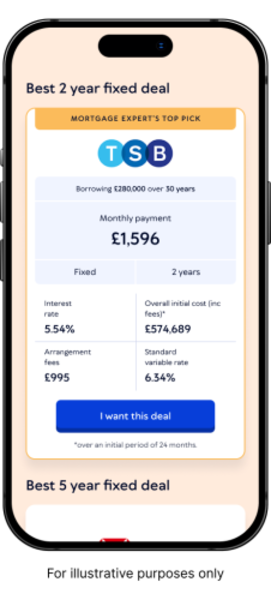

Get free mortgage advice

Our qualified brokers are on-hand to help. Just tell us a bit about yourself & your mortgage needs, and we’ll set up a call with one of our advisors.

How much can I overpay on my mortgage?

Most lenders let you overpay up to 10% of your outstanding balance each mortgage year without charging a fee. This is a very common feature, especially on fixed-rate deals.

If you pay more than your allowance, you could be hit with an early repayment charge (ERC). This penalty fee is usually between 1% and 5% of the amount you’ve overpaid above the limit. It can easily wipe out the savings you were trying to make, so be careful.

If you're on your lender's Standard Variable Rate (SVR) or have a tracker mortgage, you can typically overpay as much as you like.

Always check your mortgage terms before making an overpayment! Each lender has their own rules, and these vary between mortgage products too. You don’t want to risk being charged a pesky fee for overpaying more than you’re allowed to.

How can I make an overpayment?

You can make overpayments in two main ways:

-

Regular overpayments. Might be most suitable if you’ve had a change in circumstance, such as a salary increase, which allows you to add a bit extra to your monthly payment on a consistent basis.

-

Lump-sum overpayments. Could be a good option if you come into some extra cash, such as a bonus or inheritance, which allows you to make a larger one-off overpayment.

So is it better to overpay your mortgage monthly or in lump sum chunks? There’s no ‘better’ way to overpay - it comes down to what suits you and your finances.

Making regular monthly overpayments is often easier to budget for and gives you the satisfaction of chipping away at your loan consistently, which starts saving you interest straight away. You can also choose to stop making the higher repayment amount at any time, giving you greater control over your overpayments.

On the other hand, an early lump sum overpayment can often save you more money, as the sooner you can reduce your mortgage balance, the more interest you'll save in the long run. There’s less flexibility in a one-off payment, though - you won’t be able to get that spare cash back as easily once you’ve ploughed it into overpaying your mortgage.

Whichever option you choose, you’ll usually only be able to overpay up to 10% of your outstanding mortgage balance every year without an early repayment charge.

Top tip: If your goal is to save money, make it clear when you overpay that you’d like to reduce your mortgage term. Some lenders may automatically reduce your next monthly payment by the amount you overpaid, which won’t save you as much in the long run.

How much could I save by overpaying?

You could save thousands by overpaying your mortgage. Of course, how much you can save will depend on your mortgage balance, your method of overpaying, how much you overpay by and whether you’ll need to pay any early repayment charges.

Let’s see how much you could save by overpaying different amounts each month, based on a £250,000 repayment mortgage over 25 years at 5%.

A mortgage overpayment calculator has been used to calculate the figures in the below tables. The figures are illustrative and do not take into account any overpayment restrictions or early repayment charges. The figures assume that interest is charged monthly and stays the same over the full term.

| Interest saved | Term reduced by |

|---|---|---|

Overpaying £50 a month | £13,676 | 1 year and 6 months |

Overpaying £100 a month | £25,383 | 2 years and 11 months |

Overpaying £150 a month | £35,534 | 4 years and 1 month |

Overpaying £200 a month | £44,432 | 5 years and 2 months |

Overpaying £250 a month | £52,304 | 6 years and 2 months |

Now let’s see how overpayment strategies stack up on a £250,000 mortgage over a 25-year term with an interest rate of 5%.

| Standard monthly payments only | Consistent saver (£95 monthly overpayment) | Lump-sum overpayments (£25k one-off overpayment) |

|---|---|---|---|

Your payment strategy | Make only the required monthly payments. | Add £95 to your mortgage payment every single month, from the start. | Make a one-off £25,000 overpayment at the beginning of the term. |

Monthly payments | £1,461 | £1,556 | £1,461 |

Total amount you overpay | £0 | £25,365 (paid over the new, shorter term) | £25,000 |

Time to repay mortgage | 25 years | 22 years and 3 months | 20 years and 7 months |

Total interest paid | £188,443 | £164,155 | £135,538 |

The result | You own your own home after 25 years of keeping up with your monthly payments | You save £24,288 in interest and will be mortgage-free 2 years and 9 months sooner | You save £52,905 in interest and will be mortgage-free 4 years & 5 months sooner |

“To get the best bang for your buck, overpay as early as you can. The sooner you can reduce your loan, the more you'll save because you’ll be paying interest on a smaller amount of debt for the rest of the mortgage term. That said, you may find smaller, regular overpayments more manageable and easier to budget for. It really does come down to personal preference and how much you can comfortably afford to overpay without stretching your finances.”

John Fraser-Tucker, Head of Mortgages

Pros and cons of overpaying a mortgage

Overpaying can be a great move for some borrowers. But whether it’s right for you will usually depend on how your finances shape up as a whole.

Advantages of overpaying

-

Become mortgage-free sooner. Even small, regular overpayments can shave months or even years off your mortgage term. This can help you to own your home outright faster.

-

Pay less in total interest. Because your interest is calculated on your outstanding balance, reducing that balance means you pay less interest month after month. Over the full term, this can add up to thousands of pounds in savings.

-

Increase your equity. The more of your mortgage you pay off, the more of your home you actually own. This could put you in a much stronger position if you’re looking to move home or remortgage, as having a lower loan-to-value ratio (the percentage of your property’s value that you borrow) can help you access more competitive rates.

-

Can be used to lower your monthly mortgage repayments. Making a lump-sum overpayment decreases the total capital you owe. When your mortgage rate is next recalculated (for example, at the end of a fixed term), you could ask your lender to reduce your payments rather than shortening your mortgage term. This results in a lower monthly outgoing, which could help to offset the impact of potential interest rate rises.

When overpaying might not be the right decision

-

You have other, more expensive debts. It rarely makes sense to overpay a mortgage if you have a credit card or personal loan charging a much higher interest rate, so you may wish to focus on clearing the high-interest debts first.

-

You haven’t built an emergency fund. It’s recommended to have between three and six months’ worth of essential living costs saved up. So, before you lock spare cash into your property, make sure you have easily accessible savings for those rainy days.

-

You might be able to get a better return elsewhere. Depending on your mortgage rate, you may be able to make greater returns from long-term investing versus paying off your mortgage balance early. There are no guarantees, though.

-

You’ll exceed your lender’s overpayment limit. If you’ve already hit your maximum annual overpayment limit, you’ll likely be stung by an early repayment charge for overpaying any more, which can outweigh any potential savings you’d make.

Ready to remortgage?

Discuss remortgage rates and your overpayment options with one of our qualified mortgage brokers.

Is it better to overpay my mortgage, save or invest?

There’s no easy way to answer this question, because it all depends on your personal situation, your interest rates and your appetite for risk. It’s important to weigh up the guaranteed and tax-free return of overpaying against the potential return of other options.

-

Overpaying your mortgage. This is a guaranteed way to save interest and own your home sooner, so could be a good option if you prefer a ‘safe bet’ over potential gains.

-

Saving in a cash account. It’s always a good idea to prioritise building up an emergency savings fund but, beyond that, keeping a chunk of money in an accessible savings account can be a sensible move if you’re planning a significant purchase soon. While returns might be typically low, you’ll have the peace of mind that you can access your savings when you need them.

-

Investing your money. Investing in things like your pension or stocks and shares has the potential to generate much higher returns than saving or overpaying your mortgage, but it is not guaranteed.

If your mortgage interest rate is similar or higher than the interest you could earn from savings, overpaying can be a good choice. That’s because you’d save more in interest than you’d earn on your savings. And, remember, you always have the option of saving at a higher interest rate now and then overpaying your mortgage with a one-off payment if things change.

Did you know? Switching to bi-weekly mortgage payments could save you thousands of pounds too. By making smaller, more frequent payments every two weeks, you effectively make 13 full monthly payments each year instead of the typical 12. Overpaying in this way could significantly reduce your mortgage term.

Not all lenders will offer you the option to pay bi-weekly, so you’ll need to check with them first.

Overpayment FAQs

If your current deal is coming to an end and you’re looking to remortgage, it could be a good time to make a large lump sum overpayment without worrying about ERCs.

That’s because when your introductory deal ends, you’re no longer tied into that specific product, and can pay off as much as you like. By doing this, the new mortgage deal you’re remortgaging onto will be for a much smaller loan amount, resulting in lower monthly payments and significant interest savings over the life of your new mortgage.

It’s important to coordinate the process carefully, though, to ensure the timing’s right - a broker will be able to help with this.

Formally shortening your term (for example, remortgaging from 25 to 20 years) means you’ll make a higher payment every single month - even if your circumstances change. It’s generally only recommended to shorten your term if you are completely confident you can sustain the higher payments, no matter what.

On the other hand, making overpayments allows you to gradually reduce your mortgage balance and save interest, without locking you into making higher payments on a permanent basis. While it can be more tempting to skip the overpayment, and therefore perhaps easier to lose focus of your goal, you have more flexibility on how often you overpay and by how much.

When you overpay, many lenders will automatically use it to shorten the length (the term) of your mortgage. This option saves you the most interest and helps you become mortgage-free sooner.

However, some lenders might give you the option to reduce your monthly payment amount instead if you would prefer.

Yes, you can. With an interest-only mortgage, your standard monthly payments only cover the interest. So making overpayments can be a good way to start chipping away at the actual capital you borrowed, which will reduce the final lump sum you have to pay back at the end of the term.

For regular overpayments, you can often just change your mortgage payments online or set up a separate standing order (though make sure you won’t go over your annual overpayment limit). For larger lump-sum payments, you may be able to make a bank transfer online or via your lender’s app - contact your lender first to check their specific process.

It’s always a good idea to let your lender know if you want the overpayment to reduce the loan term, to make sure it doesn’t go towards lowering any future monthly payments.