9 ways to improve your chances of getting a mortgage

Getting that all-important mortgage offer is a big moment in the home buying process. So you’ll want to make sure your application’s in top shape to improve your chances of getting a mortgage!

We’re here to help. Let’s get you ready for that dream home.

Working with a mortgage broker can get you one step closer to an offer!

93% of our home buying customers who submitted an application through us last year successfully received a mortgage offer.

1. Sharpen up your credit score

Lenders like to take a close look at your credit history to figure out what kind of borrower you’re likely to be. A good track record of repaying what you owe tells lenders you manage money well, which can lead to a higher chance of approval (and usually access to better mortgage deals too).

-

Check your credit score for free to get a feel for how lenders might view you

-

Spotted a mistake? Errors on your credit report can drag your score down, so get these corrected straightaway by contacting the relevant lender or credit reference agency

-

Register to vote on the electoral roll (this is used to verify your address and identity)

-

Keep up with your repayments. Even one or two missed or late payments can negatively impact your score

-

Avoid applying for credit in the run-up to your mortgage application - too many hard credit searches in a short space of time can look like you’re desperately trying to borrow money

-

Look out for ways to improve your credit score! Here are 25 tips to get you started

2. Work out your budget

You’ll need to make sure you have enough money coming in to cover the mortgage payments for the home you want to buy. As a rough guideline, most lenders will allow you to borrow up to around 4 or 4.5 times your income. So, if you have a £30,000 income you may be able to borrow around £120,000 - but keep in mind that there are other factors that go into a lender’s decision on how much they’ll lend to you too.

If you’re wanting to borrow a much larger amount, you may need to look at other options such as increasing your income or deposit, choosing a cheaper property or considering more niche mortgage options such as a guarantor or Joint Borrower Sole Proprietor mortgage.

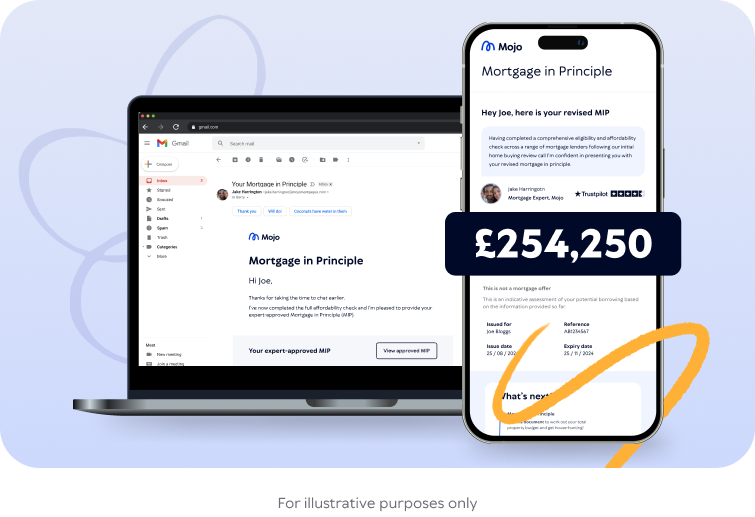

Get realistic about your home buying budget with a mortgage in principle

A mortgage in principle (MIP) gives you an idea of how much a lender might be willing to offer you. This can help set you up for mortgage success. After all, it’s much better to know your budget before you start searching for properties, than apply for a mortgage for a home you realistically won’t be able to afford.

3. Prove your income

Lenders look for reliability and stability - basically, reassurance that you’ll be able to afford your monthly repayments.

It’s usually a good idea to have been in your existing job around six to twelve months before applying for a mortgage, though some lenders do offer mortgages to those still in their probationary period.

It’s particularly important to make sure you can prove your income. This might be trickier if you’re self-employed or have irregular income - but it’s certainly not impossible. Requirements vary by lender, but you’ll usually need:

-

Three months’ worth of payslips

-

Three months’ worth of bank statements

-

Your latest P60

-

One to three years’ worth of personal accounts (if self-employed)

-

One to three years’ worth of SA302 tax calculations (if self-employed)

Self-employed and need more support with your mortgage application?

That’s what we’re here for! We’ll suggest the lenders most likely to accept self-employed applications, and will help to gather all the information you need to set you up for success.

4. Boost your deposit

Putting down a larger deposit means you’ll be investing more in the property yourself upfront. You’ll need to borrow less from the lender, which lowers their risk. It also reduces your monthly repayments, which can make your mortgage more affordable in the long-run.

Many lenders will have a minimum deposit requirement - usually at least 5% - so you’ll need to make sure you meet this if you want to improve your chances of getting accepted.

Top tip: you’ll need to provide proof of your deposit, too!

Whether you’ve been diligently saving for years or a family member’s helping you out, lenders will want to know exactly where you’ve got the money from. You’ll need to provide adequate proof of your deposit funds. So, for example, if you’re putting down a gifted deposit, most lenders will need to see a signed letter from the gift-giver confirming the money is a non-repayable gift. Your broker will be able to advise on the documentation you need to provide depending on your deposit type.

5. Be mindful of debt

The bottom line is that lenders want to make sure you’re comfortably able to afford your mortgage repayments without overstretching yourself financially. Too much debt can impact your affordability, and therefore your ability to get a mortgage.

There are two big factors to consider here:

-

Your credit utilisation. Try to spend less than 30% of your available limit on a regular basis, to show you’re not overly reliant on credit.

-

Your debt-to-income ratio. Lenders generally want to see you spending less than 40% of your overall income on debt repayments. This is to make sure you’re able to meet the extra obligation of a mortgage payment.

If you think your level of debt might hold you back, consider paying some of it off before applying. This could boost the amount you’re able to borrow, potentially making the home of your dreams that little bit more accessible.

6. Be a savvy spender

Lenders will scrutinise your spending habits to make sure you’re financially ready for the responsibility of a mortgage. Evidence you’re regularly dipping into your overdraft, frequent gambling transactions or excessive spending on non-essentials can raise eyebrows.

You should have a good understanding of where your money’s going each month, and start looking for ways to cut back in the run-up to applying for a mortgage. This can positively impact how lenders view your affordability. And, generally, it’s a smart move to set some money aside before moving home anyway to cover the costs associated with buying a property.

7. Pick your property wisely

Most lenders won’t allow you to use a mortgage to buy any property you like. Many will have restrictions on things like properties with a high risk of flooding, properties above commercial premises, homes of non-standard construction, some types of flats, ex-local authority housing or even properties with development works planned nearby. It’s a good idea to make sure you’re choosing a property that will be accepted by your preferred lender.

Once you’ve found your dream home, it’s important to make a realistic offer too. Lenders conduct their own mortgage valuation to make sure your home is worth what you’ve offered for it. If they feel you have overbid on the property, this could result in a down valuation - which could cause problems with the property purchase.

“Once a home buyer gets to the application stage, the most common issue they’ll face is choosing an unsuitable property. Some lenders are reluctant to lend against certain property types, so it’s really important to choose a property that is likely to be acceptable to most lenders - or make sure your preferred lender is happy to offer mortgages on that particular type. Speak to your mortgage broker to compare lender criteria and apply with the one who is most likely to accept you.”

April Aldridge, Director of Customer

8. Find the right lender

You might be the perfect customer for one lender, but not quite right for another. To give yourself the best possible chance of approval, compare a wide range of lenders and only apply with the one who’s the best fit for you and your circumstances.

It might be tempting to apply with lots of different lenders and see which gives you the go ahead - but be really wary of this. Lenders often see multiple applications as a risk, which can make it trickier to get accepted. It’s a far better idea to scrutinise a lender’s eligibility criteria and make sure you fit the bill before applying

Instead, why not work with a mortgage broker? Our advisors know lender requirements and eligibility criteria inside out, so can recommend your mortgage match!

9. Submit a strong application

An incorrect or incomplete application can seriously hold you back, so try to get it right first time. Details on your application that don't match your documents, not disclosing key pieces of information (even if this happens accidentally), or even something as small as a typo, can result in a decline.

That’s why it’s really important to fill out your application carefully, or work with a mortgage broker who’ll prepare and submit it on your behalf. They’ll make sure the information on your application is accurate, detailed and double checked.

It’s also a good idea to get your paperwork in order as soon as you can to avoid delays and keep the momentum going. You’ll need things like bank statements, payslips and proof of deposit - check out our list of documentation you’ll need for a mortgage application.

Revealed: the top 5 reasons mortgage applications are declined

We analysed our internal data* to discover the top reasons home buying customers were declined once they submitted a mortgage application.

Property not suitable - 42%

Did not meet policy criteria - 23%

Affordability issues - 14%

Issues at the audit review stage - 8%

Credit score issues - 6%

Do remember, though, that the vast majority of borrowers (93% of our home buying customers) are accepted once they submit an application through us!

What to do if your mortgage application is declined

It’s important to take a step back and reflect before rushing into action. Applying with a different lender straightaway might end up making the problem worse.

First things first, try to figure out why your application was rejected. A lender might not always tell you exactly why they declined your application, but it’s likely to be because of one of the following reasons:

-

You don’t meet the lender’s specific eligibility criteria. This is unlikely if you work with an expert broker but, if you didn’t check the lender’s criteria or policy requirements before applying, you may well find your application missed the mark. In this case, it can be worth going back to the drawing board and working with a broker to apply with a more suitable lender.

-

The lender isn’t happy with your chosen property. Whether they don’t lend on that specific property type or they don’t believe it’s worth what you want to pay for it, you may need to explore applying with a different lender or choosing a different property.

-

You are asking to borrow too much. You may not have a high enough income or deposit amount to qualify for the amount you’re asking to borrow. Saving for a bigger deposit could lower the amount you’ll need to ask your lender for, making success more likely in the future.

-

The lender isn’t confident you can afford the repayments. Even if you meet your lender’s loan-to-value requirements, and have a good income, lenders will also assess what other demands you have on your finances. It’s a good idea to try and pay down existing debt and avoid taking out any new credit before applying for a mortgage.

-

Your application has been audited. Some mortgage applications are pulled for an audit - think of this as an internal quality control check from your lender. We can’t stress enough the importance of being 100% honest at every stage of the application, and providing accurate, up-to-date documentation. You may have to start the whole process from scratch if the audit throws up a problem with your application, such as your circumstances have changed since you originally applied, or you haven’t declared important information on your application form.

-

Your credit score is too low. Scrutinise your credit report carefully and, if you spot room for improvement, take the necessary steps to boost your credit score. This might take time, but it’ll be worth it.

-

Your situation is complex. If your circumstances are particularly complex, such as you have bad credit or you’re recently self-employed, you may have more success applying with a specialist lender versus a mainstream one.

Thinking of buying soon?

Buying a new property? Our Mojo mortgage brokers can help:

Free expert advice and help with all your mortgage questions

A free affordability assessment so you know how much you can borrow

A mortgage in principle to help you with your property search

*All data taken from Mojo Mortgages’ own customer records from 1 January 2025 to 27 August 2025.