25 ways to improve your credit score

Having a strong credit history can make a big difference to your mortgage application. Not only are you more likely to get accepted if you can prove you’re a reliable borrower with a good track record, but you’ll probably get access to better interest rates too.

First things first, what is a credit score and how does it impact my mortgage?

A credit score is a numerical rating that helps lenders understand how you’ve handled credit in the past (and therefore how likely you are to repay your debts in the future).

The score is based on the information found on your credit file, which details your credit agreements and repayment behaviour. Lots of things make a difference to your score, including the number and types of credit accounts, whether you’re made your repayments on time or even the length of your credit history.

It’s a common myth that each of us has one universal credit score. In fact, each credit reference agency (the three main ones being TransUnion, Equifax and Experian) will generate their own unique score for you.

So, now you know what a credit score is, how do you go about improving it? Here are our top tips to help you get your credit score mortgage ready.

Check your current credit profile

1. Monitor your credit report regularly

Make it a habit to check your credit report at least once every year, or before you’re about to apply for credit (including a mortgage). This allows you to spot potential issues early, such as credit applications you don’t recognise or sudden changes in your score. While errors might be nothing to worry about, they could be a sign of something more serious such as fraudulent activity, which needs addressing right away.

2. Report any errors

Even a small typo, such as a misspelt name or incorrect address, can drag down your score! If something doesn’t look right, reach out to the lender or credit agency to rectify any mistakes.

3. Keep old accounts open

When reviewing your credit report, you may be tempted to close old accounts. But the length of your credit history matters. It could be a good idea to keep old accounts open, especially those with long histories, as they positively contribute to your overall score.

4. Register on the electoral roll

Around 8 million people in the UK are not correctly registered on the electoral roll. Taking just a few minutes to register could help you improve your credit score, potentially unlocking better mortgage deals and saving you thousands in the long run.

5. Sign up for free credit score services

Many credit monitoring services offer free alerts for changes in your credit score, so you can stay on top of your credit health without any extra cost.

Make your credit profile more mortgage-friendly

6. Be cautious with new credit applications

In the six months leading up to applying for a mortgage, limit new credit applications. Each application can result in a hard inquiry on your credit report, and multiple requests in a short period can raise red flags for lenders. That’s because several hard searches in quick succession suggests you’re making lots of credit applications, which may be a sign you’re facing financial difficulties or trying to take on more debt than you can manage.

7. Opt for soft search if you can

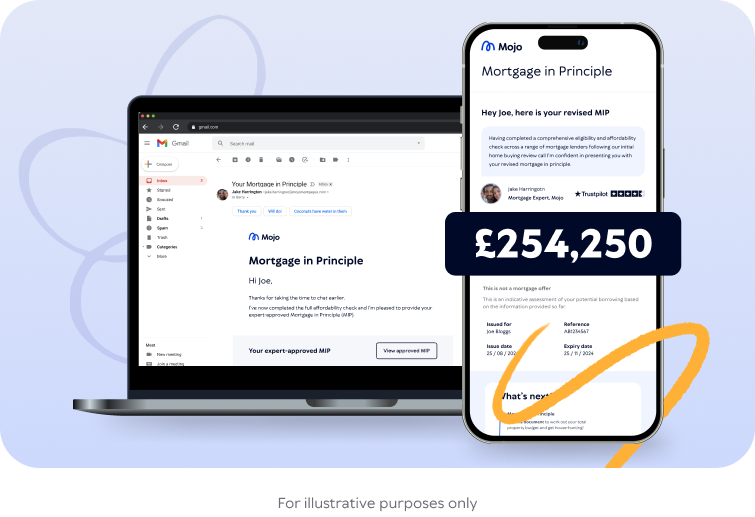

It’s natural you’ll want to shop around when comparing financial products from different lenders, particularly if you just want to compare rates or see how much you might be able to borrow. Look out for lenders who offer soft search, as these enquiries won’t leave a visible mark on your credit file and won’t harm your credit score. For example, here at Mojo, you can get a mortgage in principle to find out how much you might be able to borrow with no impact on your score.

8. Tackle your debts

It’s a good idea to try and pay down your debt before applying for new lines of credit. If you have multiple forms of debt, you may wish to focus on paying off debts with the highest interest rates first as you’ll save on interest fees and pay off your debts quicker.

9. Aim to live at the same address for 3+ years

While this isn’t always possible for everyone, lenders appreciate stability. Living at one address for three or more years demonstrates stable living circumstances.

10. Avoid changing jobs in the run-up to your mortgage application

Lenders also appreciate job stability, so avoid changing jobs in the six months leading up to a mortgage application if you can. This helps assure lenders that you won’t lose your job should you not pass your probation, and that you will be able to keep up with your mortgage payments.

Our brokers can help you prepare your mortgage application

When you work with Mojo Mortgages, we will…

Compare mortgage deals across over 60 lenders

Recommend the lenders most likely to accept you and your circumstances

Identify ways to improve your mortgage application

Help prepare and submit your application, boosting your chances of success

Strengthen your financial relationships

11. Disassociate from past financial ties

If you’ve previously shared finances with someone else but are no longer connected to them, request a notice of disassociation from credit reference agencies so their history doesn’t affect yours.

12. Keep finances separate from less creditworthy individuals

If your partner or flatmate has a poor credit score or spending habits, maintain separate finances to protect your credit history.

13. Be wary of scams

Identity theft can devastate your credit score in moments. Use strong, unique passwords for all your accounts and be extra cautious when receiving unsolicited emails or letters regarding money.

Use your bills to boost your credit score

14. Be responsible for at least one household bill

If you live with friends or family, ensure at least one utility bill is in your name. This demonstrates reliability in managing payments.

15. Report your rent payments

Use services like Experian's Rental Exchange or platforms like Canopy and CreditLadder to report rent payments, showcasing a consistent and reliable payment history that may boost your score.

16. Set up automatic payments for your bills

Automating your bill payments ensures you never miss a due date. Late payments can significantly damage your credit score, so setting up automatic payments can help you maintain a consistent payment history.

17. Or set up payment reminders

If you prefer not to automate payments, set up reminders on your phone or calendar to ensure you pay your bills on time. This simple step can help you avoid late payments that negatively impact your score.

18. Pay for your insurance monthly instead of up front

When you pay for your car or home insurance monthly, the insurer effectively loans you the annual premium, which you repay with interest each month. This counts as credit, so timely payments can improve your credit score. However, it is worth keeping in mind that it will often be more expensive than paying the full premium upfront so you should compare the cost of both options to determine whether it’s the right choice for you.

Use the correct credit methods

19. Stay below 30% credit utilisation

Aim to use less than 30% of your available credit limit. For instance, if your total limit is £1,000, keep your balance under £333. This shows lenders that you’re not overly reliant on credit.

20. Pay more than the minimum amount on your credit card

When paying off credit cards, aim to pay more than the minimum due. This not only reduces interest costs but also decreases your credit utilisation ratio.

21. Never withdraw cash on a credit card

Credit cards aren’t supposed to be used to withdraw cash, and doing so often comes with high fees. Plus, lenders may view frequent cash withdrawals from a credit card as a red flag as it could be a sign of financial strain.

22. Diversify your types of credit

A mix of different types of credit (like loans and credit cards) shows lenders that you can handle various forms of borrowing responsibly. Do, however, make sure that you make all of your payments on time and never take out credit solely for the purpose of trying to improve your credit score.

23. Avoid payday loans

These loans often come with exorbitant interest rates and can signal financial struggle to lenders, damaging your credit rating.

24. Become an authorised user strategically

If a family member or trusted friend has an excellent credit history, ask if they'd be willing to add you as an authorised user on their credit card. Their positive credit history could help boost your score, but ensure they have a long-standing record of responsible credit use.

25. Consider a secured credit card or credit-building loan

If the above isn’t an option and you have a limited credit history, a secured credit card can be a great way to start building credit. These cards require a cash deposit that becomes your credit limit, reducing the risk for lenders while helping you establish a positive credit history.

“Remember, lenders consider various factors when deciding on whether to offer you a mortgage. This includes your income, employment stability, and deposit size. It’s not just about your credit score. However, demonstrating a strong credit history will very likely put you in a better position when it's time to apply for your mortgage."

April Aldridge, Director of Customer

FAQs

While there's no set minimum credit score needed to buy a house in the UK, a strong credit score can significantly improve your chances of securing a better mortgage. By following these tips consistently, prospective home buyers can improve their financial standing and increase their likelihood of securing a mortgage.

You can check your credit score for free and access your credit report via the UK’s main credit reference agencies: Experian, Equifax and TransUnion.

It might be a good idea to check your credit report across all three agencies, as each may hold slightly different information. Don’t worry - checking your own credit score won’t damage it!

This all depends on your current situation and what may be negatively impacting your credit score. For example, correcting errors on your credit report or improving your credit utilisation can result in a credit score improvement after just a month or two. However, reversing the damage of several missed payments to show a history of consistent on-time repayments can take longer.

Speak to our mortgage brokers to find out how much you could borrow

Take the first step on your house buying journey. Tell us a bit about you, and our mortgage brokers will check your eligibility and borrowing potential across a wide range of lenders.

We use a soft credit search, too, so there’s no impact on your credit score!