Compare mortgage rates

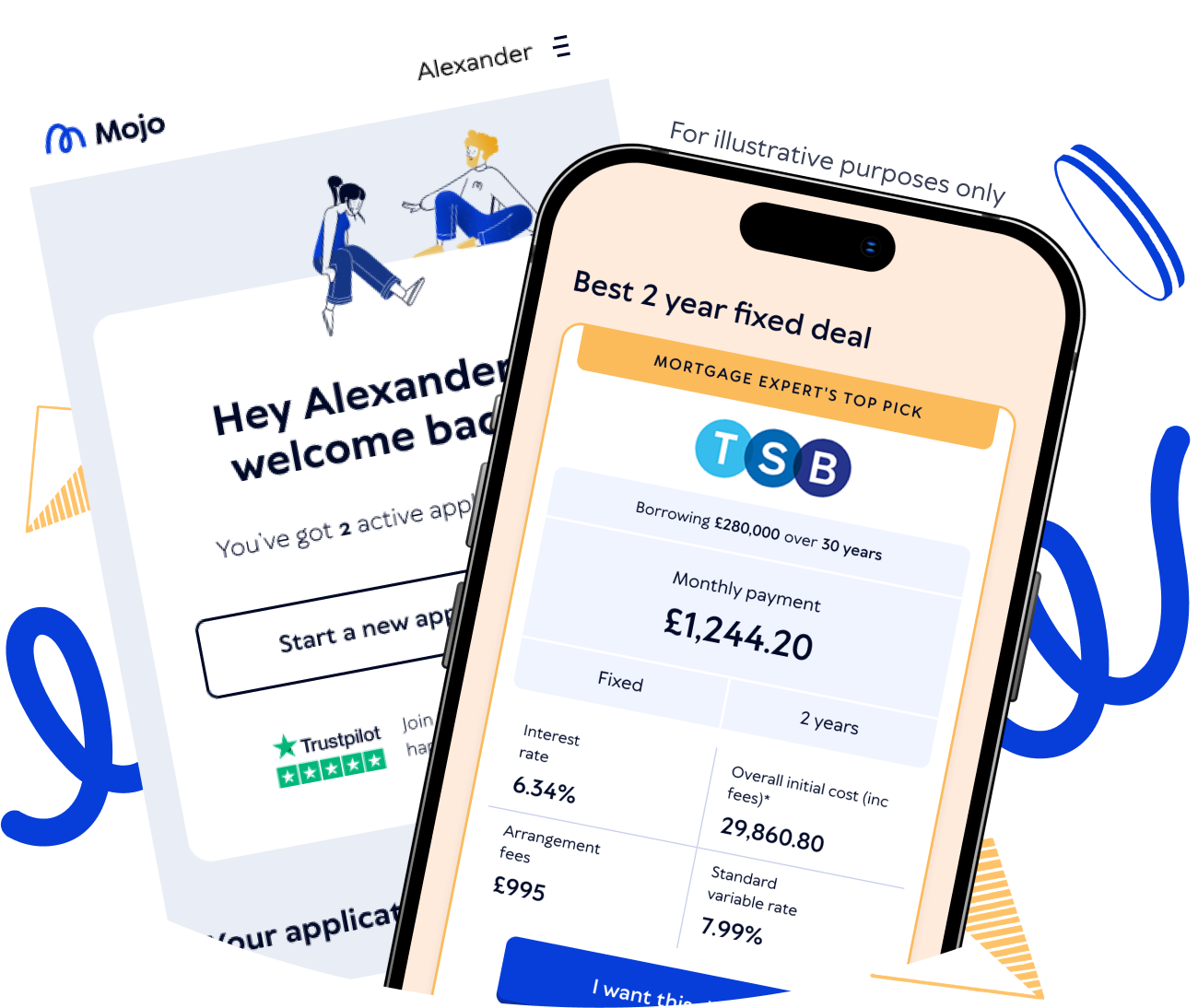

At Mojo, our mortgage brokers will be by your side throughout your home buying journey. They’ll help you compare thousands of mortgage products across over 70 lenders to find the right deal for you.

Compare deals to find your mortgage match

The value of mortgage comparison shouldn’t be overlooked. A mortgage is the biggest financial responsibility most people will ever have, so it’s an important thing to get right.

Whether you’re buying your first ever home, remortgaging, looking for a new investment property or you’re simply in the mood for a move, getting an expert opinion when you compare mortgages can be priceless. And with Mojo, it is - we won’t charge you a penny. So what have you got to lose?

Join over 45,000 homeowners who’ve put their trust in our expert mortgage comparison brokers this year alone!*

How does a mortgage work?

A mortgage is a type of loan that’s used to purchase a property. If you’re approved for a mortgage, you’ll need to put down a deposit (usually a minimum of 5%) and your chosen lender will lend you the rest of the money you need.

You’lll then make monthly payments to the lender over a set period - most mortgages start off with a 25-30 year term. If you’re buying a residential property, you’ll likely choose a repayment mortgage, where your monthly payments cover the interest (the cost of borrowing the money) and a portion of the loan amount until the full borrowing amount is paid off.

While the total repayment term is usually decades long, you’ll be able to lock in mortgage rates for a shorter period of time (most commonly two or five years). This can allow you to lock in the most competitive rates available at the time, giving you the ideal opportunity to compare mortgages and find the best deal for you.

Understanding different mortgage types

To fix, or not to fix. We’re here to help you compare different rate types, so you can get to grips with how rate changes might impact you in the future.

Fixed-rate mortgages - you get a rate that's usually cheaper than the lender's standard rate (SVR) which remains the same for an initial period. The most common deal lengths are two-year fixes and five-year fixes, but it can be much longer (with 10-year fixed-rate mortgages not unheard of). Fixed rates are typically a bit higher than variable rates, but you benefit from the security of no unexpected changes for a set length of time.

Variable-rate mortgages - also have an initial period with a cheaper rate, however, they can change at any time. While both variable deal types (tracker and discount rate) are usually cheaper than fixed rates, this is because they could potentially rise immediately. Of course, they could also fall, but the risk lies in a rise in interest.

Standard variable rate mortgage (SVR) - while strictly another variable, it's not really a deal type. This type of rate has no initial period and tends to be lenders’ default rate of interest. If you take either a fixed or variable rate deal as described in the earlier points, you end up on the SVR when your initial period ends.

98% of our mortgage applicants opted for a fixed-rate mortgage in the third quarter of 2025.

How can changing mortgage rates impact my payments?

Changing mortgage rates can impact what you pay each month. Most rate changes are influenced by changes to the Bank of England base rate, either directly or indirectly. However, SVR and discount rates can also change at the lender's discretion, whether the base rate moves or not.

Fixed rates only change when the deal period ends, so the way to avoid changes here is to remortgage onto a preferable rate. This can be done up to six months in advance in most cases.

Steps to compare mortgage deals effectively

Here are the most important things to consider when comparing mortgages:

-

Interest rates - the rate is the most obvious one. Be sure to choose the right mortgage type for you, though, rather than just opting for the lowest rate available

-

Fees - high fees can impact the overall deal cost, so always keep this in mind when a rate seems particularly low. The APRC can help you compare the overall cost of a deal with fees included, but keep in mind that most people remortgage after the initial deal ends

-

Loan terms - the longer the term the more interest you’ll pay in total, though you’ll have lower monthly payments. On the flip side, a shorter term mortgage comes with higher monthly payments but ultimately lower total interest

-

Loan-to-value - a larger deposit reduces your loan-to-value (the percentage of a property's total value that you borrow from the mortgage lender). Lower LTV mortgages typically come with lower interest rates, as you’re seen as less of a risk

-

Lender conditions - does your deal allow overpayments, for example, or the ability to port your mortgage if you needed to? Look out for early repayment charges, too, particularly if you’re likely to move home before your deal ends

Receive mortgage rate comparisons, tailored to you

No matter what type of mortgage you’re looking for, there are many lenders and options available. Thousands, in fact. It’d be practically impossible for you to wade through them all yourself.

That’s why having an experienced online mortgage broker, like us, compare them quickly, with your preferences and circumstances in mind, can save you both time and money.

Find your mortgage joy with Mojo

Boost your chance of success: 92% of Mojo applicants successfully received a mortgage offer last year

Find the best deal for you: Our brokers provide a quick and clear recommendation of the best deal based on your circumstances

State-of-the-art tech with personal service: We use impressive tech to find you the best deal, with our mortgage experts stepping in to offer real, upfront advice

On-hand to help, whenever you need: You’ll be supported by your broker and case manager whenever you need them, including evenings & weekends

Keep on top of the current rates: We’ll compare your new mortgage deal against other rates on the market, giving you peace of mind you’re on the best rate available to you

We’re fee-free: That’s right, our service won’t cost you a penny

Ready when you are: Whether you want to chat about your options, compare mortgage prices, get a MIP or apply for a mortgage, we’ll speak to you ASAP

Mortgage comparison FAQs

Although all lenders tend to look at the same qualities when assessing your suitability for a mortgage, such as credit score, income and outgoings, among others, they each score this information differently.

This means that your circumstances could be declined by one lender and accepted by a range of others - each with different interest rates and loan size offers.

That’s why we recommend turning to the experts. How much you’re able to borrow can become much clearer throughout mortgage comparison, and your broker will be able to recommend the lender who’s most likely to look upon your application favourably.

It’s certainly worthwhile kick-starting your home buying journey by having a little look at an online mortgage calculator. Word of warning, though - while a calculator will give you a rough estimate of how much you might be able to borrow, it’s by no means an accurate assessment or a guarantee of what you’ll be able to afford.

After all, there is only so much a calculator can do. It won’t know, for example, detailed information about your income or outgoings, or the type of property you’re looking to buy.

The reason a broker can often find you the most suitable deal compared to searching yourself online, is a combination of human consideration, knowledge and experience.

You can read more about LTV (loan to value) here, but in simple terms, it’s the percentage of your home's value you borrow.

So, for example, if you have a 10% deposit, you’re borrowing 90% of the cost of your home. This is called 90% LTV.

Usually higher LTV mortgages have higher interest rates, so the greater the deposit you can afford, the better interest rates that are typically available to you.

Aside from comparing deals, making yourself a lower risk option for all lenders will generally give you access to better rates. There are a number of ways to do this. Including:

Use a larger deposit - this lowers the LTV of your lending, making you more attractive to lenders

Improve your credit score - there are multiple ways to do this, such as ensuring you make any repayments on time consistently, keeping an eye on your credit utilisation and making sure you’re on the electoral register

Reduce your debt-to-income ratio - pay off outstanding debt, such as loans or credit cards, and avoid taking on new debt before applying to keep your debt-to-income ratio (the percentage of your monthly income that goes towards paying debt) low

Get a joint mortgage with someone else - this balances the financial risk and can also allow you to borrow more

Stick to standard property - the more unusual the property type, the more reluctant most lenders are to invest

Consider different mortgage types and loan terms - a mortgage broker can help you compare your options and work out which mortgage product comes with the best rate for you and your needs

Your deposit determines your loan-to-value, which is the percentage of your home’s value that you borrow.

If you have a small deposit, you may need to opt for a larger mortgage - the maximum amount you can usually borrow is 95%, unless you get a guarantor mortgage or family assisted mortgage. However, high loan-to-value mortgages tend to come with higher interest rates.

If you can save a larger deposit and bring that LTV ratio down, you’ll naturally have access to more competitive rates, which will in turn lower your monthly mortgage payments.

Use a basic online mortgage calculator to compare how different deposit amounts could impact how much you could borrow and the cost of your monthly payments.

During your mortgage comparison, it’s worthwhile considering whether you want to opt for a repayment or interest only mortgage.

Repayment mortgage: Each monthly payment covers both the interest on the loan and a portion of the original borrowing amount. By the end of the mortgage term, the full amount is paid off and you’ll own your home outright.

Interest only mortgage: Your monthly payments only cover the interest on the loan. This means, at the end of the mortgage term, you still owe the full loan amount and must find a way to repay it in one full lump sum.

It’s most common to choose repayment mortgages for a residential property, with buy-to-let landlords normally choosing an interest only option.

Mojo’s brokers make finding and applying for a mortgage straightforward. In a nutshell:

Fill out our quick online form to tell us a bit about your personal details, income and outgoings and what kind of property you’re looking for

Speak to one of our Mortgage Experts to get your personalised mortgage recommendations

Get an expert-verified mortgage in principle, giving you an idea of how much you can borrow

Find the ideal home within your property budget and make an offer

Come back to us when you’re ready to compare mortgage deals and choose the right product for you

We’ll prepare and submit your mortgage application on your behalf, giving you the best chance of success

You’ll get personalised support right up until completion - and we’ll be here for you when it’s time to remortgage, too

Read more about how a mortgage application works through a broker.

Excellent service and support from beginning to end

Cannot fault the team, and the rate check meant we got a better deal as interest rates fell during the conveyancing process. Thoroughly recommended.

Matthew Stroh

1 August 2025

*Data taken from Mojo Mortgages’ own customer records, covering the period from 1 January 2025 to 3 November 2025.

Last reviewed by John Fraser-Tucker on 3 November 2025