How the Bank of England Base Rate impacts your mortgage

The Bank of England base rate influences the cost of everything in the UK, mortgage rates included.

Read on to find out how the base rate works and how your mortgage repayments are impacted by changes in it, depending on the type of deal you're on.

The current Bank of England base rate is 4%

The next meeting to review the base rate is on Thursday 18th December 2025

The current inflation rate in the UK is 3.8%

"The Bank of England recently decided to hold the base rate at 4%. We’re not likely to see an immediate surge in fixed rate pricing, though, as the market will have already factored in the expected ‘hold’ decision. The pace of future cuts still remains uncertain and those looking for a mortgage or remortgage deal should consider their options carefully.

Remember, you can lock in a deal now and potentially switch again before your completion date. Our Mojo brokers are always available to check the rates before completion to ensure you're on the best possible deal."

John Fraser-Tucker, Head of Mortgages

What is the Bank of England base rate?

The Bank of England (BoE) base rate, also known as ‘the bank rate’ is the central interest rate set by the BoE, and the rate at which other banks and lenders are charged when they borrow money. This, therefore, influences how much all banks charge when they lend to customers.

The base rate is currently 4%. It was last reduced from 4.25% on 7th August 2025, but has been held at 4% since.

Banks usually base their interest rates for both savings and lending on the UK base rate - so this includes mortgage lending. This means that an increase in the base rate usually leads to your bank charging higher mortgage interest rates and a decrease in the base rate, lower interest rates.

On the other hand, if you’re saving money, you’ll typically benefit more from a rise in the base rate, than a fall.

How does the base rate work?

The Bank of England Monetary Policy Commission (MPC) uses the base rate as a tool to help control inflation - which is the rate at which all prices rise. Their goal, which is set by the UK Government, is to keep inflation at or close to 2%. Inflation peaked at 11% at the end of 2022 and is currently above the target at 3.8%.

In summary:

- 1.

Increasing the base rate discourages spending and encourages saving

- 2.

Decreasing the base rate encourages spending and results in lower appetite for saving

- 3.

So when the base rate changes, it impacts how much people spend and, therefore, how much things cost

How often does the base rate change?

The base rate has the potential to change every six weeks, as this is when the MPC sits to decide. They can also add emergency meetings, if they feel that this is necessary. However, an MPC meeting does not guarantee a change in the base rate.

The Bank of England MPC consider the following at each meeting:

-

The speed at which prices are rising

-

The current state of the UK economy and how it’s growing

-

How many people in the UK are working

They then vote on whether this information warrants a change in the central interest rate or not.

What are swap rates?

Swap rates are the interest rates at which banks agree to lend to each other in the future, based on a set price. They are influenced by the base rate, internal bank profit targets, the pricing of competitors, and the wider economy. They change quickly and can be tough to predict.

Not all lenders interpret base rate changes in the same way, and that won’t be their only consideration when setting rates. When lenders set their SVR and fixed-rate deals, they look at swap rates as an additional economic indicator. Swap rates provide lenders a reflection of future market interest rate expectations.

Want to stay up to date with the latest mortgage rates?

We’ll send the latest mortgage rates straight to your inbox every month - all we need is your email.

What happened at the latest base rate review?

At the base rate review on 6 November 2025, the MPC voted by a majority of 5–4 to maintain the Bank Rate at 4%. Four members preferred to reduce the rate by 0.25 percentage points.

At the base rate review on 18 September 2025, the MPC voted by a majority of 7–2 to maintain the Bank Rate at 4%. Two members preferred to reduce the rate by 0.25 percentage points.

At the base rate review on 7 August 2025, the MPC voted by a majority of 5–4 to cut the rate to 4%. Four members preferred to hold the rate at 4.25%.

At the base rate review on 19 June 2025 the MPC voted by a majority of 6–3 to hold the rate. Three members preferred to reduce Bank Rate by 0.25 percentage points, to 4%.

At the base rate review on 8 May 2025 the MPC voted by a majority of 5–4 to reduce Bank Rate by 0.25 percentage points, to 4.25%. Two members preferred to reduce Bank Rate by 0.5 percentage points, to 4%. Two members preferred to maintain Bank Rate at 4.5%.

At the base rate review on 20 March 2025 the MPC kept the bank rate at 4.5%. The MPC voted by a majority of 8 - 1 to maintain the bank rate. One member preferred to reduce Bank Rate by 0.25 percentage points, to 4.25%.

At the base rate review on 6 February 2025 the MPC dropped the bank rate at 4.5%. The MPC voted by a majority of 7 - 2 to reduce the bank rate by 0.25 percentage points. Two members preferred to reduce Bank Rate by 0.5 percentage points, to 4.25%.

At the base rate review on 19 December 2024 the MPC kept the bank rate at 4.75%. The MPC voted by a majority of 6–3 to maintain the bank rate, but three members preferred to reduce Bank Rate by 0.25 percentage points, to 4.5%.

At the base rate review on 7 November 2024 the MPC decided to drop the bank rate by 0.25% from 5% to 4.75%. This is the second cut of the year, the last time the MPC cut rates was 1 August.

When will the Bank of England base rate next be reviewed?

The date of the next BoE base rate decision is 18th December 2025.

How does the Bank of England base rate impact my mortgage rate?

It depends on the type of mortgage rate you have, but most will see some form of impact eventually, as this is not always immediate. The below table shows how your mortgage rate may be impacted when the base rate changes:

Mortgage type | Base rate rise | Base rate fall | When you’ll see the impact |

Tracker rate - a rate that tracks and changes in line with an economic indicator, usually the base rate | Your rate will increase at the same increment as the base rate has - so if it rises by 1%, so will your interest rate | Your rate will decrease at the same increment as the base rate has - so if it falls by 1%, so will your interest rate | Immediately |

Standard variable rate (SVR) - the lender’s general rate of interest, which you are usually moved onto once your deal ends unless you remortgage | Lenders may or may not choose to increase their SVR - but they will also take swap rates into consideration | Lenders may or may not choose to decrease their SVR - but they will also take swap rates into consideration | Usually in the weeks following a base rate announcement, although some lenders alter rates prior to the decision, based on industry expectations |

Discount rate - this is a rate that offers a discount on the lender's SVR. It changes in line with any increases or decreases in the SVR. | As above - but your rate will always rise at the same increment as the SVR does | As above - but your rate will always fall at the same increment as the SVR does | As above, as these rates are tied to the lender's SVR |

Fixed-rate - this is a rate that is set for a defined length of time and cannot change during that period, regardless of the base rate or economy | Your rate won’t be impacted straight away and stays the same until your deal ends | Your rate won’t be impacted straight away and stays the same until your deal end | As soon as your deal ends - how the base rate has changed during your fixed-rate period will impact the rates available to you when you remortgage |

According to the Financial Conduct Authority (FCA), 74% of borrowers are on a fixed-rate mortgage deal. This shows that most people would rather have certainty in their mortgage repayments, than deal with potential fluctuations when the base rate moves up or down.

To make sure you maintain the most competitive fixed-rate deal available to you, especially if the average SVR has risen since you took your last mortgage, it’s important to consider remortgaging onto a new fixed deal around 6 months before your current one is due to end. Speak to a UK mortgage broker with specialist knowledge of the market to find out the best remortgage deals available to you.

Why is the base rate so high?

If we look at the historic base rates, we can see that it is not currently particularly high. It feels much higher as there were uncharacteristically low base rates of interest in recent history, skewing how today's mortgage borrowers perceive the current base rate.

While 4% may seem high compared to the historically low base rate of 0.01% seen during the early 2020s, in 1979-80, it was actually at 17%. The current bank rate is actually fairly average over time - but it has impacted borrowers due to the dramatic increase from 0.01-5.25% over a very short duration.

Therefore, a mortgage borrower who took out their deal when rates were very low could have afforded a much more expensive home than if they tried to take out an equivalent mortgage today on the same income.

How have inflation and base rate changes impacted the average mortgage rate since 2023?

Month | Base rate | Inflation rate | Average mortgage rate (2 year fix 75% LTV) |

February 2023 | 4% | 10.4% | 4.79% |

March 2023 | 4.25% | 10.1% | 4.74% |

May 2023 | 4.5% | 8.7% | 4.72% |

June 2023 | 5% | 7.9% | 5.49% |

August 2023 | 5.25% | 6.7% | 6.18% |

September 2023 | 5.25% | 6.7% | 5.91% |

November 2023 | 5.25% | 3.9% | 5.28% |

December 2023 | 5.25% | 4% | 5.03% |

February 2024 | 5.25% | 3.4% | 4.76% |

March 2024 | 5.25% | 3.2% | 4.96% |

May 2024 | 5.25% | 2% | 5.19% |

June 2024 | 5.25% | 2% | 5.16% |

August 2024 | 5% | 2.2% | 4.8% |

November 2024 | 4.75% | 2.0% | 4.5% |

December 2024 | 4.75% | 2.6% | 4.6% |

February 2025 | 4.5% | 2.5% | 4.7% |

March 2025 | 4.5% | 3% | 5.18% |

May 2025 | 4.25% | 2.6% | 4.3% |

June 2025 | 4.25% | 3.4% | 4.3% |

August 2025 | 4% | 3.6% | 4.1% |

September 2025 | 4% | 3.8% | 4.8% |

October 2025 | 4% | 3.8% | 4.2% |

Sources: Base rate and average mortgage rate data is from the Bank of England. Inflation rate is the Consumer Prices Index from the Office for National Statistics.

Is the base rate likely to go down?

Even the most prestigious economists are reluctant to state with any certainty when the base rate is likely to fall further. This is because so many factors are considered when determining it, all of which have the potential to change quickly.

The BoE took the decision to make three cuts in 2025 so far, however, whether it will continue to fall remains to be seen. Which means it's also tricky to know whether mortgage rates will go down throughout the rest of the year.

Should I wait until the base rate falls to remortgage?

Unless you’re on a tracker rate mortgage, it’s a risky move to wait until the central interest rate is cut to remortgage your home. This is because if your deal ends and you choose not to remortgage, you’ll be placed onto your lender's SVR immediately.

Lenders tend to set their SVR a fair bit higher than any of the mortgage deals that they offer, so even if the price of the range of fixed-rate mortgages available to you is higher than you expected, they are still likely lower than staying on the SVR rate for any length of time.

The good news is, you’re not tied into a new mortgage deal until the previous one ends, so it’s possible to secure the best rate available now and then change again if rates do fall before your current deal ends.

For this reason, it’s best to look at new deals six months ahead of your current deal ending. Most lenders will allow you to lock in a new deal that far in advance, and others from four months to the end. Speak to a mortgage advisor to explore your mortgage options.

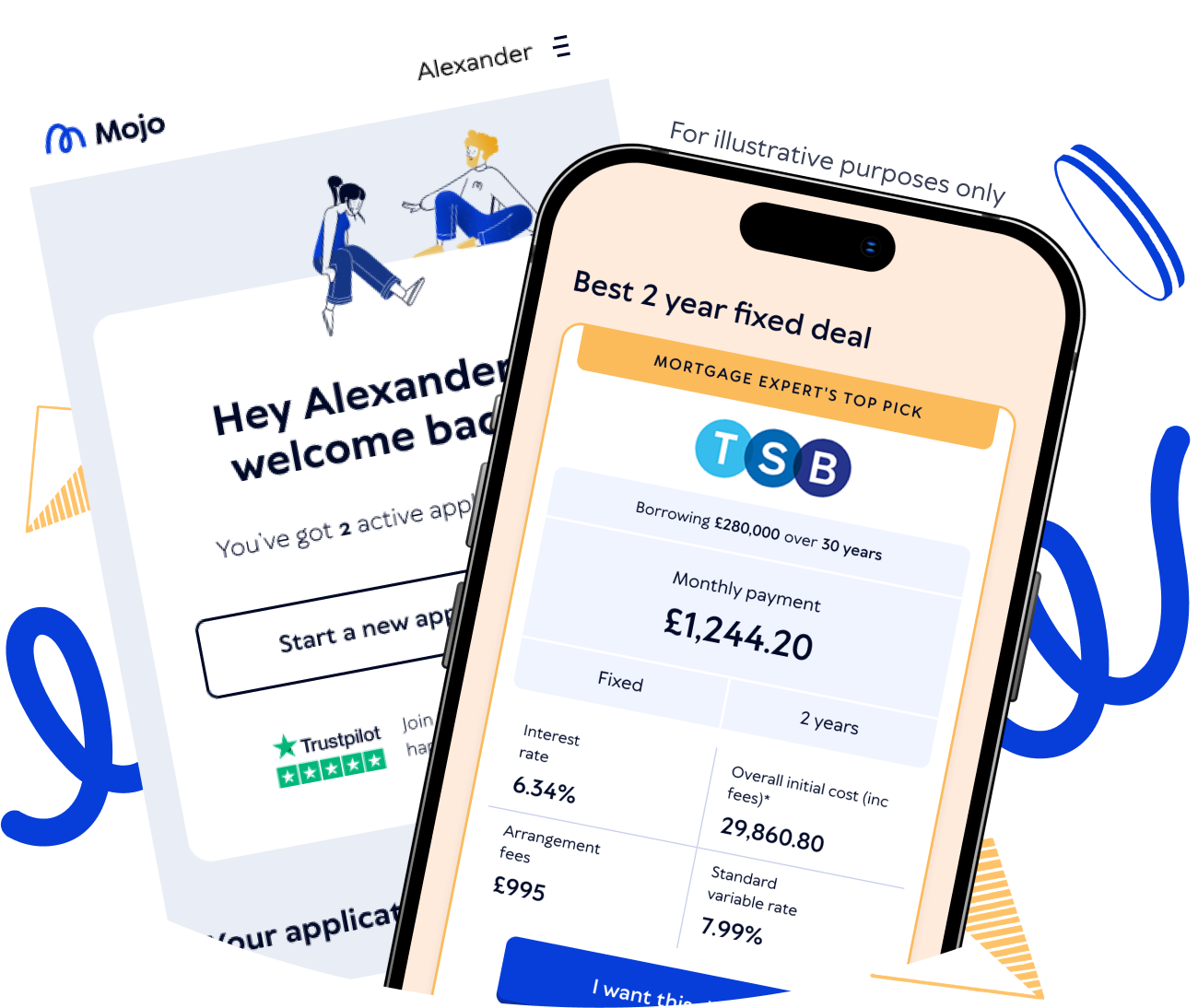

Secure your new mortgage rate now

Lenders have been changing rates recently. Act now to secure your best deal!

Mojo Mortgage advisors can search across 70+ lenders to find the right mortgages for you.

Simply answer questions about your mortgage needs, and if you're eligible, we can book you in to speak to one of our experts.