First-time buyer mortgage advice

Getting a mortgage is a big deal - particularly if you’ve never owned a home before. A mortgage expert can really help. They’ll be the voice of support and reassurance - all while making sure you choose the right mortgage for you.

We helped over 12,000 first-time buyers find a mortgage last year*. Can we help you, too?

What is a first-time buyer mortgage?

A first-time buyer mortgage is a type of loan you take out to buy your first property. You’ll put down a deposit, and your chosen lender will give you the rest of the funds you need. You’ll then repay them by making monthly payments over a set period until the full mortgage is paid off. This takes time, with most mortgages starting off with a 25 to 30 year term.

You might be surprised to know that being a first-time buyer probably won’t make much difference to the mortgage you get. That’s because most products are available to all buyers. However, being a first-time buyer could make a difference to the stamp duty charges you’ll pay and the home ownership schemes available to you.

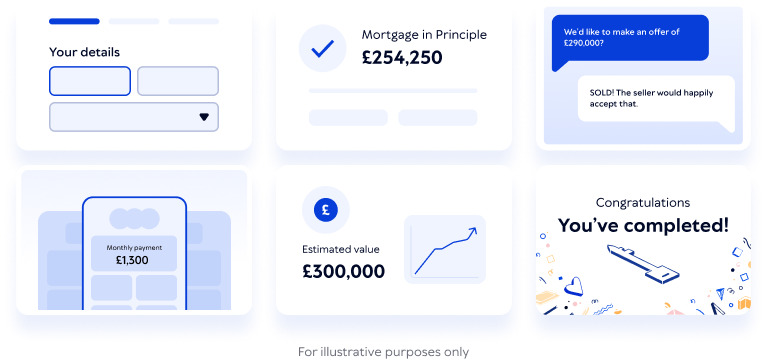

How to get a first-time buyer mortgage

- 1.

Find out how much you could borrow. Getting a mortgage in principle is an exciting first step on your house buying journey, giving you an idea of your buying budget.

- 2.

Start house hunting. Once you’ve found the perfect property, make an offer on the place you love.

- 3.

Compare mortgages and decide on a deal. Explore different mortgage options to discover the best mortgage type, terms and rates available to you.

- 4.

Submit your mortgage application. Gather the documentation you need to apply for your chosen mortgage - a mortgage expert can support you through the application process.

- 5.

Arrange a property valuation. Your lender will want to make sure the property is worth the amount you want to pay for it.

- 6.

Receive your mortgage offer. Assuming your lender is happy with everything, you’ll get a formal document outlining the terms and conditions of your mortgage.

- 7.

Complete the conveyancing process. Your solicitor or conveyancer will handle the legal work, including carrying out searches and drafting up contracts.

- 8.

Exchange contracts and complete. You legally commit to buying the property once you exchange, and the sale will be finalised at completion. Now it’s time to collect your keys and celebrate!

When you work with a mortgage broker, you’ll get tailored support at every step. And - with Mojo Mortgages - we’ll do it all for free.

First-time buyers: you’re not alone

It can feel daunting buying a home for the first time, but you’re in safe hands. Over 12,000 first-time buyers worked with one of our mortgage experts to help them find a mortgage last year.

Buying a property is a huge milestone and there’s often a lot of pressure to get it right. Don’t worry too much - even if you’re just starting to think about buying a home, that’s already a great first step.

23% of our customers looking for a mortgage so far this year are first-time buyers**

The average age of a first-time buyer in the UK is 33 years, 8 months

On average, it takes two years and five months for a solo first-time buyer to save for a 5% deposit

Last year, just 9% of our joint mortgage applicants were first-time buyers

71% of our first-time buyer customers borrowed 80% or more of their property's value through their mortgage**

Your first-time buyer mortgage questions answered

Buying your first home? Here’s how our experts can help you

The easiest way to find the best first-time buyer mortgage deal available to you is to enlist the help of mortgage experts - like us. A mortgage expert can help you by:

Comparing first-time buyer mortgages on your behalf to find deals that work for you

Arranging a mortgage in principle, so you can get a better idea of your home buying budget

Explaining jargon or key mortgage terms that you might otherwise overlook

Preparing and submitting your application, improving your chances of success

Key factors to consider when choosing a mortgage

-

What type of mortgage will suit you best. You may prefer the security of a fixed-rate mortgage as your interest rate and monthly payments won’t change, though a variable-rate could be cheaper initially and may give you greater flexibility

-

Interest rate costs. The amount of interest charged can significantly affect how much you’ll pay both monthly and in total, so it’s likely this will play a big part in your decision when choosing a mortgage

-

Any additional fees. Fees such as product or valuation fees can impact the overall cost of your deal, so you may need to weigh up whether paying these fees are worth a potentially lower interest rate

-

How long you need to pay off your mortgage. Your mortgage term length affects your monthly payments. A longer term means lower monthly payments, but you'll pay more interest overall. The average mortgage term for first-time buyers is 30 years

-

Lender terms and conditions. Some lenders offer greater flexibility when it comes to things like overpayments and early repayment charges, so it’s important to choose a provider that offers terms that suit your needs.

Everything went to smoothly

"I had not much knowledge around mortgages as a first time buyer, they both helped me through the process and everything went so smoothly!"

Alfie Claxton

02 May 2025

Help available for first-time buyers

There are plenty of specialist mortgages and home ownership schemes available to first-time buyers.

Each of these schemes comes with their own eligibility criteria, so it’s important to read up on them carefully or ask an expert about your options.

Other mortgage options for first-time buyers

-

Gifted deposit - not all lenders allow this, but most will, so long as whoever is giving you the gift confirms its gift-status in writing

-

Guarantor mortgages - where a parent or family member agrees to cover the loan costs if you’re not able to, usually when you don’t meet affordability requirements for repayments on the loan size you need

-

Family assisted mortgage - this lets relatives (often parents) use their savings in lieu of a deposit - it’s then repaid to them when you’ve paid off enough to satisfy the lender’s deposit criteria

-

Joint borrower sole proprietor mortgage - you’ll get a joint mortgage with someone else, sharing responsibility for the mortgage payments, but you’ll be the sole legal owner of the property

Did you know? 13.6% of first-time buyers looking for a mortgage in the last 12 months enquired about using a home ownership scheme***.

6 tips to help you secure your first mortgage

- 1.

Find the right lender. To improve your chance of approval, find a lender with criteria that matches your circumstances. An expert broker can help you to compare mortgage providers for first-time buyers

- 2.

Improve your credit score. Lenders like to know you’re a safe bet, and are more likely to approve applicants with a strong credit history. Review your credit report to make sure it’s accurate and up-to-date, and look out for ways to boost your credit score

- 3.

Compare deals from across the market. No two mortgage deals are the same. It’s a good idea to compare mortgage products from a wide variety of lenders to make sure you’re choosing the right option for you

- 4.

Boost your deposit to bring your loan-to-value down. Sometimes even a small increase in your deposit can take you into a new LTV bracket, giving you access to better deals. Use our mortgage deposit saving calculator to help you experiment with different saving scenarios.

- 5.

Apply for a joint mortgage. You may find that getting a mortgage with someone else allows you to boost your affordability, and your chances of getting approved

- 6.

Pick a lender-friendly property. You may find it harder to get a mortgage if you choose a more unusual property type

Start your home buying journey with a Mojo mortgage in principle

Find out how much you might be able to borrow to buy your dream home, helping you search for properties with more confidence!

First-time buyer FAQs

Your mortgage broker is here to help you. No question is too small or too silly. Their job is to help you understand the process and find the right deal for your personal situation.

However, there are a few key questions you should ask:

Do you charge a fee for your services? Broker fees can add unexpected costs to the process (though you’ll be pleased to know that, here at Mojo, we don’t charge you a penny for our services).

Which lenders do you have access to? a whole-of-market broker like Mojo is able to compare a wider range of lenders and products

Are you qualified? All brokers should hold a Certificate in Mortgage Advice and Practice (CeMAP) or Certificate in Mortgage Advice from the Chartered Insurance Institute

Are you regulated by the Financial Conduct Authority? It’s important to double check your broker is regulated, as this ensures you’ll get access to a certain quality of advice

Read more about what happens during your first mortgage broker appointment.

Each lender has their own eligibility criteria. They’ll usually assess things like your financial situation (income and outgoings), credit history and deposit amount to decide whether they’ll be able to lend to you.

Working with a mortgage expert can be really useful, particularly to first-time buyers. They’ll be able to identify and recommend the mortgage providers most likely to accept you.

You'll usually need at least 5% as most lenders offer mortgage loans at a maximum of 95% LTV, although there are a few no-deposit mortgage options available in certain circumstances.

In England and Northern Ireland, you won't pay any Stamp Duty Land Tax on properties worth less than £300,000. You'll then pay 5% SDLT on the portion from £300,001 to £500,000. You won't be able to claim the first-time buyer SDLT discount if the property price is over £500,000, or if you're buying with someone else who is not a first-time buyer.

In Scotland if you're a first-time buyer, you won't need to pay Land and Buildings Transaction Tax on properties up to £175,000.

Use our stamp duty calculator to find out how much stamp duty you might need to pay for your property.

Last reviewed by John Fraser-Tucker on 15th July 2025

*Data shown is from Mojo Mortgages' own customer records, covering the period between 1 January 2024 to 31 December 2024

**Data shown is from Mojo Mortgages' own customer records, covering the period between 1 January 2025 to 12 May 2025

***Data shown is from Mojo Mortgages’ own customer records, covering the period from 7 May 2024 to 6 May 2025.