Interest-only mortgages

Whether you’re looking for a buy-to-let property or interested in residential interest-only options, our experts can help find an interest-only mortgage to suit you.

Last reviewed by John Fraser-Tucker on 3 September 2025

Quick summary

Your interest-only mortgage payments only cover the interest on your loan for a set period. You don't repay any of the original loan amount (the capital) during this time.

While this results in lower monthly payments compared to a repayment mortgage, you’ll end up paying more in total interest over the life of the loan.

At the end of the mortgage term, you’ll need to repay the amount you originally borrowed in one lump sum.

Lenders have strict criteria for interest-only mortgages, often requiring a larger deposit and a clear repayment strategy.

Interest-only mortgages are often used for buy-to-let investments. They’re much less common for residential properties but, if you want to explore your options, a mortgage broker can help.

About interest-only mortgages

With an interest-only mortgage, you borrow the money you need to buy a property, but don’t repay that sum until the end of the mortgage term. All you pay on a monthly basis is the interest charged on it - but as you’re not reducing the balance, the amount of interest you pay each month won’t decrease as it would with a repayment mortgage.

This can keep your monthly payments significantly lower than a standard repayment mortgage, where you pay back both the interest and some of the capital. However, if you’re tempted by an interest-only option, you'll need a solid plan to repay the entire loan in one lump sum when the term ends.

Interest-only mortgage calculator

Calculate how much an interest-only mortgage might cost you each month and in total.

Monthly interest-only payment:

£0

Total interest:

£0

Figures are illustrative and assumes a fixed interest rate.

The full loan amount must be repaid at term end.

Your property may be repossessed if you do not keep up repayments on your mortgage.

Compare interest-only mortgages to capital repayment mortgages

With a repayment mortgage, you pay down the loan amount over the course of the mortgage term alongside interest charged each month. As your balance lowers, so does the interest, as it’s charged on a lower amount. However, as you’re repaying both the loan and interest, monthly payments are considerably higher than with an interest-only mortgage. Of course, the trade-off is that with a capital repayment mortgage you own the property outright once you’ve finished making payments for the full term.

For example…

Let’s look at the difference in costs on a £300,000 mortgage with a 4% interest rate over a 25 year term. Keep in mind that, over the lifetime of your mortgage, your interest rate will change, but we’ll stick with 4% for this example to keep things more straightforward.

| Interest-only mortgage | Repayment mortgage |

|---|---|---|

Monthly payment amount | £1,000 | £1,584 |

Interest paid in total | £300,000 | £175,053 |

Amount owed at the end of the mortgage term | £300,000 | £0 |

Total amount paid over 25 years | £600,000 (£300,000 in interest plus the £300,000 capital outstanding) | £475,053 |

As you can see, opting for an interest-only mortgage will cost you £584 less each month but you’ll end up paying nearly £125,000 more in interest over the lifetime of the loan - and you’ll still owe £300,000 at the end of it too.

Thinking of switching mortgage types?

Your financial circumstances can change over time, and so can your mortgage.

-

Switching from interest-only to a repayment mortgage is usually a pretty straightforward process. Most lenders are happy to let you switch as it reduces their risk. The main change for you is that your monthly payments will most likely go up, as you’ll be paying off both the interest and a portion of the capital itself.

-

Switching from a repayment to an interest-only mortgage is a little more complicated. You’ll need to meet the lender’s stricter criteria for an interest-only product, as well as coming to the process with a credible repayment plan to clear the capital at the end of the term.

Changing mortgage types is a big decision, and shouldn’t be taken lightly. It’s well worth getting advice from our experts before making your next mortgage move.

“Great service and better deals. Provided me with excellent advice and helped me find a better deal for my buy-to-let mortgage. The process was quick and simple, and all the online portals involved are super user friendly.”

George

23 December 2024

Is an interest-only mortgage the right option for you?

An interest-only mortgage is best suited to those in specific financial situations - usually those buying a buy-to-let property. Ultimately, you’re going to be left footing the bill for potentially hundreds of thousands of pounds in one lump sum - so you need to make sure you’re in a position to do so.

An interest-only mortgage could be a good fit if you:

-

Are a buy-to-let investor. It’s far more common for landlords to take out an interest-only mortgage. That’s because, by only paying the interest, you can keep your costs low and make the most of the monthly profit from any rental income. It’s a popular strategy for landlords to sell the property at the end of the term to pay off the mortgage.

-

Have a reliable repayment plan. If you have a clear and realistic investment strategy, an interest-only mortgage could be an option. It’s essential that your plan is robust enough to instill confidence in the lender that you can comfortably repay the loan when the time comes.

-

Are expecting your financial circumstances to change. If a repayment mortgage is currently unaffordable for you, but you’re expecting a windfall, large inheritance or change in income in the near-future, you could explore an interest-only option to keep costs down in the short-term. However, it’s important to note that relying on future changes that are not guaranteed carries significant risk and may not be seen as a valid repayment strategy by most lenders.

-

Are a high earner with irregular income. Lower monthly payments can keep your regular outgoings manageable, with larger bonuses or commission used to overpay your mortgage or build up your repayment fund.

“While residential interest-only mortgages are harder to get, it’s for a good reason: to protect both you and the lender. Lenders aren't just checking if you can afford the monthly interest - they're scrutinising your ability to pay back the capital potentially decades down the line. A broker can help you figure out whether your repayment plan really is plausible, or if other mortgage options may be more suitable for you.”

John Fraser-Tucker, Head of Mortgages

Interest-only mortgage eligibility requirements

Criteria varies from one lender to another, but every lender will want to be confident that you can manage the monthly repayments and pay back the capital at the end of the term. Here’s what you’ll need to have in place:

For all applicants

-

Have at least a 25% deposit. You'll usually need a larger deposit than for a standard mortgage, typically 25% or more of the property's value (this can go up to 50% for residential interest-only mortgages). Some lenders have a minimum equity requirement, which means you must invest a certain amount of your own money upfront in order to take out an interest-only mortgage.

-

An approved repayment strategy. You must have a clear, credible strategy for how you’ll repay the loan at the end of the term.

-

Strong credit history. Most mainstream lenders like to see you have a good track record of repaying what you owe. While there are subprime lenders out there, you’ll likely face paying higher interest rates if you have a poor credit history.

For residential applicants (you’re buying a home to live in)

-

Higher income. Having an income of £50,000-£75,000+ for a residential purchase is usually required - though landlords won’t always need you to meet a minimum income requirement.

For buy-to-let applicants (you’re buying a home to rent out)

-

Strong rental yield. Lenders will want to ensure the expected rental income covers at least 125% to 145% of your monthly mortgage payments.

-

Prior experience. While not always essential, some lenders prefer applicants to have prior experience as a landlord.

-

Be buying a suitable property. Lenders will want to know that the property is in a desirable rental area, in good condition and is likely to be consistently occupied.

What happens at the end of an interest only mortgage?

At the end of your mortgage term, the amount you originally borrowed will need to be paid back to the lender in one single payment. This is not always easy to find - especially when it’s likely hundreds of thousands of pounds.

That’s why, when you take out the mortgage, your lender will need to agree to a repayment plan (sometimes known as a repayment vehicle). Each lender has preferences in the repayment vehicles they accept, but here are some options for repaying the final lump sum of an interest-only mortgage:

-

Use savings or investments. You may be able to use funds accumulated from property rental in the case of a buy-to-let mortgage, or private investments that you expect to mature. It’s really important to review your investments regularly to make sure everything’s still on track.

-

Use a pension lump sum. You are entitled to take a tax-free lump sum from your pension when you retire, which could be used to pay off your mortgage assuming the forecasted amount covers it.

-

Sell your property. This is a common strategy for buy-to-let landlords, who sell the property to clear the mortgage. For a residential mortgage, using the future sale of your main home as a repayment strategy is possible with some lenders, but it is considered higher risk, so make sure you check your lender’s terms.

-

Switch to a new mortgage. While this likely won’t be accepted as your initial repayment strategy, some lenders will accept a remortgage onto a capital repayment or part and part repayment plan to pay off the final balance over a new term if you can afford the higher payments. For those in or approaching retirement, a Retirement Interest-Only (RIO) mortgage could also be an option.

“Having a realistic and robust repayment plan is crucial if you’re considering going for an interest-only mortgage. It’s not enough to just have a rough idea of how you’ll pay off the loan. We help you think through the details and prepare for the 'what-ifs' to ensure you're completely prepared.”

John Fraser-Tucker, Head of Mortgages

How do I get the best interest-only mortgage?

Securing the best rate for you starts with the fundamentals. Lenders will usually always offer their most competitive deals to applicants with a strong credit score and a larger deposit (as this lowers your loan-to-value ratio).

For buy-to-let investors, the property itself and the tenants you intend to have can influence the rates offered to you.

Beyond that, a good way to make sure you’re getting a competitive rate is to thoroughly search the market. Using a mortgage broker like us can help you find the right deal for your specific circumstances - saving you time, hassle and money.

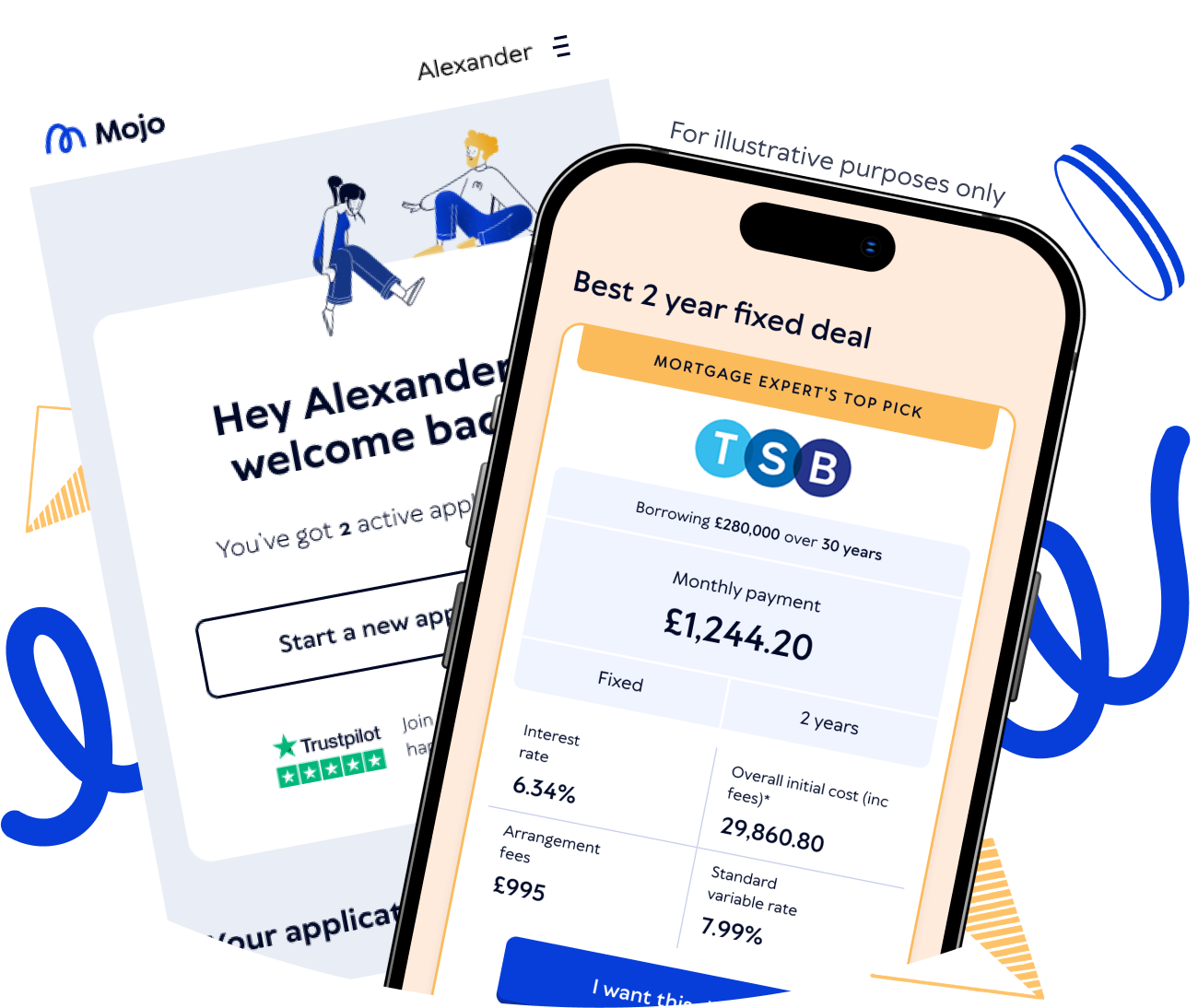

Find the right lender for you

We can compare thousands of deals from lenders who are able to offer the best rates for the interest-only mortgage you need. And what’s more, our service is completely free of charge, so what do you have to lose?

What are the advantages of an interest-only mortgage?

-

Lower monthly repayments. This can free up cash flow for other investments or expenses.

-

Potentially access to a wider range of properties. Due to the lower monthly repayments, an interest-only mortgage can make properties in pricier areas more affordable on a monthly basis (though remember you’ll have to repay the full borrowing amount at the end of the term).

-

Keeps business costs down. Ideal for buy-to-let landlords looking to maximise their monthly returns.

-

Buy a property sooner. If you’re awaiting a windfall, you may be able to buy a property sooner by opting for an interest-only option - though this can be risky if you don’t receive the money you’re expecting.

What are the disadvantages of an interest-only mortgage?

-

You’ll still owe the full amount borrowed at the end of the term. That’s because you don’t reduce your mortgage balance over time, so you must repay the entire loan at the end. This can also increase the risk of negative equity if the property value falls.

-

Solid repayment plan needed. If your repayment vehicle doesn’t enable you to pay off your loan, you’ll be left facing a shortfall which can cause financial strain.

-

Higher overall cost. You'll pay more interest overall than with a repayment mortgage, because you’re not paying the loan down over time.

-

Tougher lender criteria. You’ll need a larger deposit and to meet lenders’ stricter eligibility criteria to get an interest-only mortgage.

Interest-only mortgage FAQs

On a monthly basis, yes they are, but they’re typically much more expensive than capital repayment mortgages in the long term. This is because the quantity of interest you pay overall is greater, due to being charged on the full loan amount over a long period of time.

Capital repayment mortgages get progressively cheaper as they are repaid. So if you borrow £100,000 with an interest-only mortgage and £100,000 on a capital repayment mortgage at 4.5% interest - you’d pay about £45,700 more back using an interest-only product.

Reach out to your mortgage lender as a first step. Some may allow you to extend the end term, switch to capital repayment, remortgage or make overpayments.

Repossession is usually a last resort, but it might be necessary to sell your property if you’re unable to repay the loan any other way.

Yes, it’s possible to pay off your interest-only mortgage early. However, always check your mortgage terms as early repayment charges (ERCs) or overpayment charges may apply if you pay off more than the allowed amount during an initial deal period.