Understanding your credit score and how it affects your mortgage

When you apply for a mortgage, one of the things a lender looks at is how you've handled credit in the past. But what exactly is a credit score and why does it matter? We cover everything you need to know about your credit rating and how it could impact your mortgage application.

What is a credit score?

A credit score (or rating) is a numerical representation of how reliable you are when borrowing money. Nobody in the UK has a truly universal credit score. A credit score is based on the information found in your credit file (or report). There are three major credit reference agencies (CRAs) that hold credit files - and each one scores differently.

Credit reference agencies record all of the details about any credit agreements you enter into, and how you manage them. Missing payments will harm your score, while your rating will climb if you pay what you’re meant to, when you’re meant to.

What information is on my credit report?

Your credit report shows details about any credit agreements you have entered into, and how you manage them. This includes:

-

Credit accounts you’ve opened or closed

-

Any missed or late payments

-

Public records, such as bankruptcies or County Court Judgements (CCJs)

-

If your home has been repossessed in the past

-

Recent credit applications, including any recent hard credit checks

-

Financial associations (people you’re financially connected to)

-

How long you’ve been registered on the electoral roll at your address

Why your credit score matters for your mortgage

You’re asking lenders to extend a huge amount of credit to you, so they want to know if you’ve been responsible when borrowing in the past.

Especially if you use a small deposit, banks are taking a significant risk in loaning you three quarters of the cost of a property, or more. They need to be as confident as possible that they’ll get that money back.

Lenders ideally want proof that…

You’ve got a good track record of managing money (including loans, credit cards and other bills such as your mobile phone contract) - this shows you’re a reliable borrower, and likely to repay what you owe on time

You are not overly reliant on credit (a high credit utilisation ratio or applying for too many credit applications in a short space of time can be red flags)

You have a stable address and employment history

We’re sure you’d feel the same if you were lending someone potentially hundreds of thousands of pounds!

What credit score do you need for a mortgage?

There isn’t one specific score. There is just so much variation between how the different CRAs work, and how lenders interpret credit files, that there is no magic score that will guarantee you a mortgage.

That said, those with a strong credit score and better credit history overall will be more likely to get a mortgage (and at a more competitive rate) than someone with poor credit.

Here’s how the scoring system works across the three main credit reference agencies, so you can get a feel for what a ‘good’ score might look like depending on which CRA your lender works with:

| Experian | Equifax | TransUnion |

|---|---|---|---|

Excellent | 961-999 | 811-1000 | 628-710 |

Good | 881-960 | 671-810 | 604-627 |

Fair | 721-880 | 531-670 | 566-603 |

Poor | 561-720 | 439-530 | 551-565 |

Very poor | 0-560 | 0-438 | 0-550 |

“Every lender has a different attitude to risk, with some requiring applicants to have a higher credit score than others do. Working with a broker can be really helpful. We have strong knowledge of lender criteria, so can recommend the mortgage provider who is most likely to accept you and your circumstances.”

Luke Butcher, Chief Revenue Officer

How does a good credit score help mortgage applicants?

If you have a good credit score, not only are you more likely to be accepted, but you may also be able to access a wider range of mortgage products. This could include mortgages with more favourable terms, lower deposit requirements (higher loan-to-value ratios) and better interest rates. This gives you greater flexibility when choosing your mortgage.

That’s because having a good credit score and affordability shows you are:

-

A lower risk borrower

-

More likely to make your repayments on time

-

More likely to be able to comfortably afford the repayments

Can I get a mortgage with a fair credit score?

It’s possible, but it depends on the lender. With most lenders, you’ve got a better chance of getting a mortgage if your score falls into a ‘good’ or ‘excellent’ category. However, having a fair score does not mean you will necessarily be rejected.

You probably won’t be able to access your lender’s very best rates if you have a fair credit score, though. So you’ll need to factor that in when working out how much your mortgage payments might cost you both monthly and overall.

Can I get a mortgage with a bad credit score?

It’s not always impossible to find a mortgage with bad credit, but you’ll usually need to apply with a specialist bad credit mortgage lender, also known as subprime lenders. You’ll likely be offered higher interest rates than those with excellent credit, and you may be required to put down a larger deposit too. Our guide on getting a mortgage with bad credit goes into much more detail.

You may find you have a poor credit score simply because you don’t have much experience managing credit yet. This is called having a thin credit file. It makes it harder for lenders to assess what kind of borrower you’ll be if you don’t have a track record. While it may be possible to find a lender who may be willing to accept your application, you may prefer to build up your credit history first before applying. Registering on the electoral roll, using a rent-reporting service, getting a credit builder card or even keeping up with your mobile phone contract can be helpful.

"The digital experience was seamless and the personal touch of talking to the advisors, using chat and text messages made this easy to fit around my busy life."

Jessica

3 October 2025

Will applying for a mortgage affect my credit score?

Lenders usually conduct a soft check at the mortgage in principle stage, and a full credit search on application. So, yes, it’s likely that your credit score will be impacted, but it’s unlikely any negative effect will last for long (unless you keep applying with lots of different lenders, which isn’t recommended).

In the long-term, keeping up with your mortgage payments could actually help to improve your credit score. Though, of course, missing or making late mortgage payments could have the opposite effect.

The largest impact may well be on your affordability. Your mortgage is likely to be one of your largest bills - it’s a big commitment, and could affect how much you’re able to borrow in the future. For example, if you’re already spending a large chunk of your income on your mortgage payments, a future lender might be more reluctant to offer you a personal loan or a higher maximum credit limit, particularly if they think it might put strain on your finances.

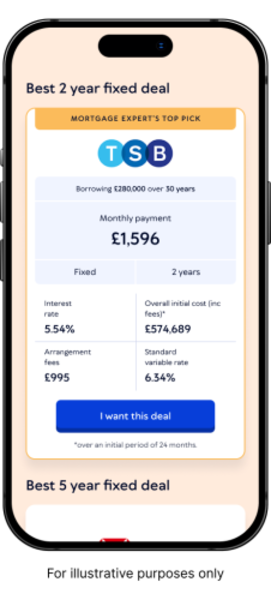

Work with a broker to compare your options

Finding the right mortgage match can be a challenge. When you work with Mojo, our brokers will do the hard work for you:

Compare deals from over 60+ lenders

Recommend the most suitable lender for your circumstances

Offer advice on ways to improve your application

Check your eligibility and affordability

Help you discover how much you could borrow

How to check your credit score before applying for a mortgage

It's a really good idea to check your credit report before you make a mortgage application. It’s recommended to get a copy from each of the main three CRAs (Equifax, Experian and TransUnion), as this allows you to see what information each holds about you.

It also gives you an idea of what lenders will find out, and whether there is anything on there that needs to be corrected. This can help you to see if you’re ready for an application, but also prevent you from further damaging your score.

If you do spot an error on your credit report, contact the relevant lender and the credit reference agency as soon as you can. Once they’ve investigated, they’ll be able to remove the mistake for you.

Remember: lenders look beyond your credit score when deciding whether to offer you a mortgage

Checking your credit file is an important part of the mortgage application process, but lenders also consider many other factors. These include:

-

Your income - lenders want to know that you can afford to pay your mortgage

-

Income vs expenditure - by understanding your spending habits and commitments, lenders can get a better idea of where your cash is going (and how much you could have leftover to make your mortgage payments)

-

Your debt-to-income (DTI) ratio - lenders look at what percentage of your income goes towards repaying debt to see if you’re someone who overextends themselves financially. Most lenders have a DTI limit of around 40-50%

-

Personal circumstances - things like living at the same address for a while or staying at the same job can suggest stability, which reassures lenders that you’re a safe bet

-

Your mortgage deposit amount and whether or not you can prove where it came from - putting down a bigger deposit can reduce the lender’s risk, and can therefore give you access to more competitive rates

-

Rental income (if looking for a buy-to-let mortgage)

Each lender will have their own lending policy, so it’s important to compare mortgage deals from across different lenders to find the right mortgage for you. A mortgage broker’s encyclopedic knowledge of lender criteria can be a big help here!

How to boost your credit score before applying for a mortgage

There are usually a number of things you can do to improve your credit score before you apply for a mortgage. Few people find that their score is optimised as much as it could be unless they have made a concerted effort to raise it.

Here are some simple improvements you can make to enhance your credit file:

-

Have a proper look at your credit file in detail. If there is anything showing that you think is incorrect, reach out to the CRA to get it changed

-

Make all of your payments on time. Try to ensure that any bills that can possibly be paid by Direct Debit are set up to do so, to avoid any late payments

-

Make sure you appear on the electoral roll at your current address - this allows lenders to confirm your address and trace your credit history

-

If you have a low credit score due to not having used much credit in the past, a credit builder card can help you show you’re a responsible borrower. Just keep the limit low and repay your debts straight away

-

Try to use less than 30% of your available credit limit, to show you’re not overly reliant on borrowing money

-

Avoid applying for new lines of credit in the run-up to your mortgage application, as this could affect both your credit score and your affordability

Going above and beyond to save you time and money on your mortgage

Paperwork help ✅ Online mortgage broker exclusives ✅ Works alongside 60+ lenders ✅

1. Add your details online

No 2-hr phone calls or branch visits. It takes a few minutes to tell us what you need from your next mortgage online

2. Choose how & when to speak to your broker

ASAP? Or choose the perfect time - 6 days a week and evenings

3. Get your mortgage with Mojo

We’ll check and chase to help avoid delays. Get regular updates from your broker and case manager

Mortgage credit score FAQs

A good credit score could be a different number with each agency, as they all have different scoring systems.

Good scores for the main three agencies are:

Experian: 881-960

TransUnion: 604-627

Equifax: 671-810

As you can see, there is a significant variance in the numbers applied to a good score. Some lenders focus on one of these, using their preferred agency. Others may combine the agency scores and then apply further internal scoring.

Mortgage lenders will usually look at the last six years of your credit history, but that doesn’t necessarily mean you have to have evidence of managing credit for six whole years to get a mortgage.

If you do have a thin credit file, though, it’s important to focus on making sure you keep up with your repayments and maintain a strong recent credit history.

It really depends on how poor your score is, and why. Some people can make a few basic improvements, such as getting on the electoral roll, and their credit score will improve within a few months.

If you’ve got CCJs or defaults, for example, it can take longer to fix. That said, some lenders are willing to re-look at your credit file a year or so after a bad credit event, such as a CCJ, to see how you’re managing your finances now.

Reputable mortgage lenders will always run a hard credit check. However, there are specialist lenders who are willing to take a more holistic view of your circumstances, and don’t base their decision on a credit score. However, these tend to be on the specialist side, and can usually only be accessed through a broker. It’s likely their mortgage products will come with much higher rates than traditional lenders, too.

If you’re concerned about your credit score, speak to us. We can give you honest feedback on your chances of being accepted in your current circumstances, but also recommend ways to become more mortgage-worthy in the future, if now isn’t the right time.

When you apply for a mortgage with someone else, your lender will assess the creditworthiness and affordability of each applicant individually. So it’s a good idea to make sure the person or people you’re applying with have reviewed their credit report beforehand, to make sure there are no nasty surprises.

Once the joint mortgage is in place, you will become financially associated with the other applicant(s). This means their financial behaviour could impact your credit score (and therefore the ability to get credit in the future). Applying for a mortgage with someone else is a big decision and can come with credit score consequences - so make sure you choose your fellow applicants wisely!

As long as your broker or lender uses a soft credit check, getting a mortgage in principle won’t impact your credit score. This allows you to get a feel for how much you could borrow, without committing to a full mortgage application.

Having good affordability can certainly help restore some of the lender’s faith in your financial stability, and ability to fix your credit issues. However, it won’t guarantee you a mortgage, no matter how much you earn.

Don’t be disheartened, though. With credit issues, the more time has passed since they happened, the greater your chances of securing a mortgage.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.