10 common MIP-conceptions: your mortgage in principle questions answered

We’re here to help bust some common MIP myths to help you kick-start your mortgage journey with more confidence.

Here are the 10 MIP myths you need to know the truth about...

1. A mortgage in principle is just a fancy name for a mortgage offer

A mortgage in principle and a mortgage offer are totally different things. Getting a MIP gives you a good indication of whether you’re eligible to apply for a mortgage and, if so, how much a lender might be willing to offer you. But it doesn’t guarantee your mortgage application will be accepted. Unfortunately, around 7% of house buyers who submit a mortgage application after getting a MIP aren’t successful.

That’s because, at the MIP stage, only preliminary checks based on basic financial details are conducted. A full application includes deeper affordability checks and credit assessments, which could throw up some unexpected issues. Check out our guide for more information about why your mortgage application might be declined after getting a MIP.

“Once your MIP’s secured you can quit your job and take out a loan for that fancy all-inclusive holiday, right? Please don’t! A mortgage in principle is based on your current personal and financial circumstances. If anything changes between getting a MIP and submitting your mortgage application, you may find the amount you’re offered changes… or you may even be rejected for a mortgage entirely. Working with a broker can help you make sure your application is in the best possible shape before applying.”

John Fraser-Tucker, Head of Mortgages

2. The amount stated on my mortgage in principle is the exact amount I’m eligible for

A mortgage in principle gives you an idea of how much you might be able to borrow when you come to submit a full mortgage application. But that doesn’t mean you’ll be offered that exact figure when you apply.

All sorts of things can impact the amount you’re eligible to borrow for a mortgage - including:

The property you want to buy

The type of mortgage you choose

The interest rate you’re offered

Results of in-depth credit and affordability checks

Any changes to your personal or financial circumstances since getting a MIP

Use a MIP to help you search for properties roughly within your budget. Once you’ve found a home and put an offer in, it’s best to speak to a mortgage broker who can recommend the most suitable mortgage options for you.

It’s also worth keeping in mind that just because you’re offered (in principle) a certain amount doesn’t mean you should borrow to the max. It’s important to consider how much you’ll feel able to comfortably afford without putting a strain on your day-to-day finances.

3. If I get a MIP once, I’ll never need another

Not quite. MIPs typically last between 30 and 90 days (a Mojo Mortgages MIP will last 90 days). If you can find a property and put an offer in within that time - great! If not, you’ll need to renew or reapply for a mortgage in principle and, if your circumstances change, you may not get the same outcome. On average, though, it takes house buyers 52 days to get a mortgage offer after securing a MIP so 90 days should give you plenty of time.

Our experts explain more in our guide on how long a mortgage in principle agreement lasts.

4. A mortgage in principle will impact my credit score

Most lenders and brokers (including Mojo Mortgages) perform a soft credit check when you apply for a mortgage in principle. A soft credit check provides a high-level view of your credit history which helps to assess your eligibility. Don’t worry - this won’t leave a mark on your credit file that's visible to other lenders, and has no impact on your credit score.

Getting a MIP will only affect your credit score if your broker or lender uses a hard search to conduct the relevant checks.

5. If I’m declined for a mortgage in principle, I’m never going to get a mortgage

While being declined for a MIP can feel disheartening, it doesn’t discount you from ever getting a mortgage.

Working with a mortgage broker could really help you here. They’ll be able to suggest ways to strengthen your application, and can help you compare the market to make sure you’re only applying with lenders if you meet their eligibility criteria.

6. I’ll definitely get the house of my dreams if I have a mortgage in principle

Having a mortgage in principle can help you look more attractive to sellers, as it shows you’re financially ready to move forward with a purchase. But it doesn’t guarantee that a seller will accept your offer or that you’ll automatically win a bidding war if other buyers are also interested in the property.

You’ll also have to make sure that your chosen lender will approve the mortgage for that specific property before a final mortgage offer will be issued.

“Your MIP may be for a higher amount than the value of the property you want to buy - but this doesn’t mean you should bid way over asking price just because you think you can afford to do so. Remember, lenders will conduct a property valuation once you’ve submitted a full mortgage application and they’ll be sure to tell you if they don’t think it’s worth what you’ve offered for it! This could cause issues later down the line, so it’s important to offer responsibly.”

Luke Butcher, Chief Revenue Officer

7. I can just create my own MIP to impress a seller

No, you can’t! A mortgage in principle needs to be issued by a regulated lender or broker. Your seller’s estate agent can and may well verify your MIP, so it’s a truly terrible idea to try and create a fake one just to try and show you’re a serious buyer. You also can’t use someone else’s MIP, even if you think you earn roughly the same amount.

If you’re worried you won’t get approved for a MIP, you’ll have the same problem when it comes to submitting a formal mortgage application. Speak to a broker to discuss your options instead.

8. I can only get a mortgage in principle once I’ve found a property I want to buy

Nope - in fact, a mortgage in principle is perhaps most useful at the very start of your house buying journey! It gives you a good idea of how much you might be able to borrow, so you can search for properties within your budget.

Whether you’re a first-time buyer or moving properties, having a MIP can help you get a better understanding of your borrowing potential and may strengthen your position with estate agents and sellers.

It’s more unusual for someone to get a MIP when remortgaging. You probably won’t need to get an idea of how much you can borrow from a broker as you already own your property - so you can usually dive straight into comparing remortgage deals. However, a MIP could help you to work out your affordability if you’re looking to borrow more or if your financial situation has changed significantly recently.

9. My MIP amount is the same across all lenders

No - different lenders may offer you different amounts. That’s because each lender has their own criteria and eligibility requirements. So, while one may be comfortable offering you £250,000, another may be willing to offer more than that.

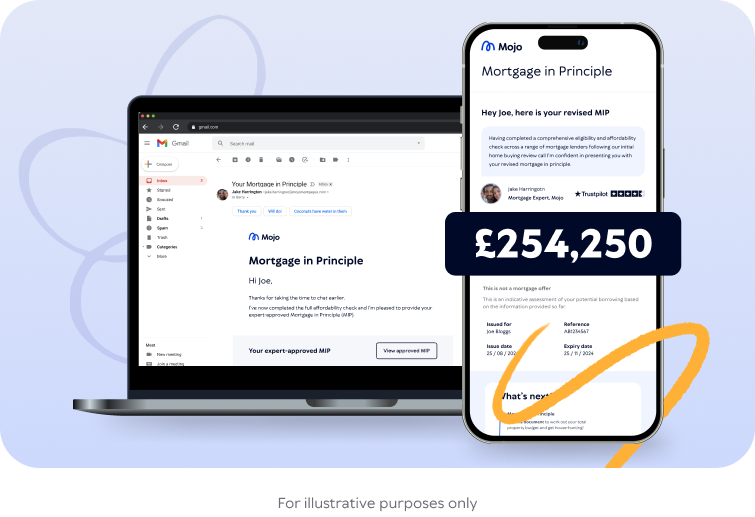

It’s therefore always worth comparing lenders (you can apply for multiple MIPs - just make sure the lender uses a soft credit check). Alternatively, speak to a broker who'll do the hard work for you. At Mojo, we scour the market to find out your borrowing limit across a wide range of lenders. This gives you a lender-neutral MIP that showcases your max borrowing potential, so you can start your property search with confidence.

10. My MIP is guaranteed if I have a high income

Not necessarily! It’s true that, theoretically, having a higher income could help you access a larger mortgage amount. However, that doesn’t mean you’ll automatically be approved for a mortgage in principle - or a mortgage at all, for that matter.

Lenders don’t just consider your salary. They also take into account things like your typical outgoings (including debts and other day-to-day spending) and your credit history. So, while you might earn a lot, if you spend more than you can afford or you’ve made some money mistakes in the past, you could find it harder to be approved for a MIP.

Now you’re armed with the information you need to know… are you ready to apply for a MIP?

Fill out your details online - we need to know a bit about you, your finances and the kind of property you’re looking to buy

Our mortgage brokers will check your eligibility and affordability to provide an expert-verified MIP. This tells you your maximum borrowing potential across a wide range of lenders.

Once you’ve made an offer on a property, come back to us to help you find your mortgage match