Joint mortgages

There’s strength in numbers when it comes to your mortgage prospects. It’s possible for two, three or four prospective homeowners to combine their buying power to get a mortgage that suits everyone.

Our experts can help you and your fellow applicants find a deal to suit you all.

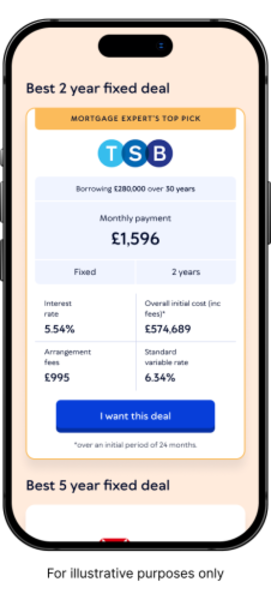

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 70+ lenders & broker exclusive products

We've helped 1000s of people find and get their best deal

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

Going above & beyond to save you time ⏳ & money 💰 on your mortgage

Paperwork help ✅ Mortgage broker exclusives ✅ Works alongside nearly every lender ✅

1. Add your details online

No 2-hr phone calls or branch visits. It takes a few minutes to tell us what you need from your next mortgage online

2. Choose how & when to speak to your broker

ASAP? Or choose the perfect time - 6 days a week and evenings

3. Get your mortgage with Mojo

We’ll check and chase to help avoid delays. Get regular updates from your broker and case manager

What is a joint mortgage?

A joint mortgage is simply one that you take on with at least one other person, but some lenders allow up to four people to buy jointly together.

This can aid affordability and help you to get onto the property ladder sooner than trying to buy your own home individually.

How does a joint mortgage work?

It works in exactly the same way as any other mortgage - but all parties involved will need to agree to the mortgage terms and sign the ownership documentation, accepting responsibility for their role in the mortgage.

All parties involved will need to qualify for the mortgage, although income is generally combined, which can make the affordability easier to meet. However, it’s worth noting that one applicant’s credit score will impact the others’ either positively or negatively.

The legal ownership of a jointly owned property can be split in different ways, depending on what suits the applicants:

Joint tenants: Mortgage repayments are shared equally amongst all parties, so this option is usually best for couples. Decisions on remortgaging or selling the property must be reached jointly, however, if one or more parties leave the mortgage, the remaining applicants become responsible for it. This can be problematic if they’re unable to afford to do so

Tenants in common: Ownership can be divided as preferred, there is no need for all owners to have equal shares. This could work better for friends, especially if they are contributing to the property in different amounts. This also means that shares can be sold separately and that each party can leave their stake in the mortgage to whomever they wish in their will, it doesn’t need to be another of the owners, and their choice doesn’t require approval from the other owners.

A Declaration of Trust is a document that lays out the above agreement in legal terms, which all owners must sign. This usually details who owns and pays what percentage of the mortgage, who must agree upon a sale, and how any proceeds are to be split.

Who can get a joint mortgage?

Most people think of couples when it comes to joint mortgages, but it’s actually possible to buy a property with anyone you like, including family and friends. This can be both for residential or investment purchases, so allows for business partners to jointly own a buy-to-let property, for example.

At Mojo Mortgages, we can help you get a joint mortgage deal to suit everyone involved.

How much can you borrow with a joint mortgage?

Usually more than you’d be able to on your own, assuming the other applicant(s) have some form of income. This is because lenders are typically willing to consider at least 2 applicants’ income for a joint mortgage application - and some even consider up to 4.

Is the income multiple the same for joint mortgages?

It depends on the lender. Most lenders offer around 4.5 times your annual income in their loan calculation for a single applicant mortgage .

When there are multiple applicants, some lenders offer 4.5 the combined income of all applicants, but others offer a variation on that. For example: 4.5 times the highest applicant’s income, plus the second applicant’s income.

It’s worth noting that some lenders allow 3 or 4 applicants to buy a property together, but will only consider the income of the 2 highest earners in their loan calculation.

What are the pros and cons of having a joint mortgage?

-

Affordability - The deposit requirement and repayments can be split with others, and multiple incomes can help you qualify for the loan and get onto the property ladder sooner

-

Buying power - Aside from reducing pressure on each individual, sharing the responsibility for the mortgage can allow you to borrow more, and therefore buy a larger, or more suitable home

-

Vulnerability - All applicants must qualify, so those with poor credit could impact the other applicants

-

Risk - Do you trust that the other applicants will maintain their share of the expense and would you be able to afford it if they decided that they no longer wanted to be on the mortgage?

-

Division of assets - this can be more complex when there are multiple owners, whether it’s dividing up the proceeds of sale, or when any of the owners pass away

How can parents help children buy their first home?

It’s possible to take out a joint mortgage with your children to aid their affordability in buying their first home, and there are a few products that lenders offer to enable you to do so:

Guarantor mortgages - where you help them meet affordability and agree to pay if they can’t

Family assisted mortgages - where you can use your savings or an asset as their deposit

Joint borrower sole proprietor mortgages - where you help them to meet affordability requirements, but do not appear on the property deeds