New build home mortgages

Thinking of buying a brand new home? A new build property can have its perks, but there are some things you need to be aware of - particularly when it comes to getting a mortgage. Our expert brokers are on hand to help you explore your mortgage options.

What is a new build property?

When you hear ‘new build property’, you probably think of a home that has recently been developed and has never been lived in before. However, some lenders also consider a property ‘new build’ if it's less than a few years old or if an existing property has been extensively renovated. New build properties are typically part of larger developments, but can also refer to smaller, individual projects.

The property may be bought ‘off-plan’ which means it hasn’t even been built when you commit to buying it. It’s pretty cool to imagine stepping foot into a home that’s never been lived in before, allowing you to put your own stamp on it straightaway. But it’s also important not to get swept up in the dream. There are pros and cons to buying all sorts of different properties and a new build is no different.

Did you know? According to the latest Office for National Statistics data, the average price for a newly built home in England and Wales is £349,995.

Are new build properties popular?

Buying an existing house is still far more common than choosing a new build home. According to our own data, just 4.5% of home buyers in the last twelve months were looking for a mortgage to buy a new build property.

However, with the UK government committed to building 1.5 million new homes by 2029, it’s likely we’ll see more homebuyers considering new builds in the future.

How does buying a new build work?

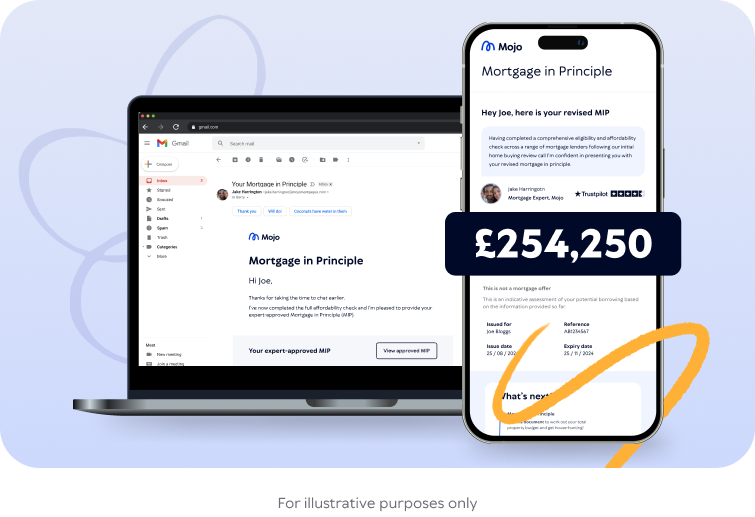

Step 1 - Understand your budget. It could be helpful to get a mortgage in principle to give you a more accurate idea of your home buying budget before you start your search.

Step 2 - Find your home. You’ll start your new build journey by visiting a show home or viewing plans of the available properties. Here, you’ll get a feel for the development and the types of homes on offer.

Step 3 - Make a reservation. Once you’ve found your dream home, you’ll be asked to pay a reservation fee (usually £500 to £2,000) to secure it and take it off the market for a set period (typically 28 days, or around four weeks). You’ll have that amount of time to arrange your mortgage and exchange contracts.

Step 4. Seek mortgage advice. Now it’s time to compare mortgages and find the right deal for you. A mortgage broker can compare hundreds of deals across a wide range of lenders, which not only saves hassle but you’ll also have a mortgage expert available to answer any questions.

Step 5. Submit a formal mortgage application. Skip the stress by working with a mortgage broker - they’ll prepare and submit your mortgage application on your behalf.

Step 6. Get a mortgage valuation. Your lender will conduct a mortgage valuation to make sure they believe the property is worth what you’re paying for it.

Step 7. Receive a mortgage offer. If your application is successful, your lender will make you a formal offer. These usually expire after six months, so keep an eye on your mortgage validity if it looks like your new home won’t be ready in time. You may need to request an extension or reapply.

Step 8. Conveyancing process continues. Though you’ll have probably appointed a solicitor long before this point, they’ll continue to complete the necessary legal checks and paperwork. They’ll support you on a variety of things, from exchanging contracts to transferring your deposit.

Step 9. Completion. Once the property is finished and all funds are transferred, you’ll receive the keys to your new home!

It’s well known that the process of buying a new build property can take much longer than buying an existing one. Many buyers are understandably anxious about their mortgage offer expiring before their home is completed. This doesn’t happen as often as you might think. According to our own data, it took on average 70 days (just over two months) for those buying a new build home to go from mortgage offer to completion.

Want to get ahead of the mortgage application process?

Our experienced mortgage brokers can help you:

Arrange a mortgage in principle

Compare hundreds of new build mortgage deals

Prepare and submit a mortgage application - and quickly

Advantages and disadvantages of a new build home

-

Brand new condition. You’ll be the first person to live in your new home, which is very exciting. It also means you don’t have to worry about any pricey renovations or repairs for a good while yet.

-

Incentives and perks. Developers may offer incentives like deposit contributions, paying your stamp duty or offering free upgrades to help seal the deal.

-

Developer warranty. New builds usually come with a 10 year warranty from the National House Building Council (NHBC) which provides cover for certain defects. This provides peace of mind that, if something isn’t quite right, you won’t be left footing the bill.

-

Modern features. New builds adhere to the latest building regulations, which means your new home is bang up-to-date. It’ll also be kitted out with modern fixtures and fittings.

-

Energy efficient. Your home is likely to have the latest energy-efficient systems, potentially leading to lower utility bills.

-

Make your house a home. If you’re buying off-plan, you may have the opportunity to choose fixtures and fittings (such as carpets, kitchen cupboards, bathroom tiles and more) to match your personal style.

-

Chain free. Buying a new build can simplify a property chain or, if you’re a first-time buyer, eliminates the chain altogether. This can really de-stress the home buying or moving process.

-

Government schemes available. You may be eligible for additional support to help you get on the property ladder, such as the First Homes scheme in England.

-

Premium price. New builds may well be priced higher than other existing properties in the area, as you’ll be paying the “new build premium” for the privilege of it being brand spanking new.

-

Construction delays. Developments can be complex, and it can be frustrating to have to wait a while for your home to be completed.

-

Snagging issues. Though everything is new, things can still go wrong. And dealing with defects can be a hassle - even if it’s just a few cosmetic niggles.

-

Smaller plot sizes. New builds may offer smaller rooms or gardens compared to older properties in the same price range. You might also find the layout of your home or the room shape slightly non-conventional compared to older properties.

-

Building work continues. Some larger developments can take years to complete so, if you’re one of the first to move in, you could be stuck living on a building site for a little while.

-

Price depreciation. New builds can go down in value after their first few years, which could be an issue if you plan to move home soon. But over the long-term it’s likely their value will appreciate in the same way older homes do.

-

Extra charges. You’ll need to pay a reservation fee to secure the property, which you’ll lose if you don’t go through with the house purchase. You could also face service charges (also known as estate management fees) for the upkeep of communal areas. It’s worth being aware of these annual costs before signing on the dotted line, as your lender will want to know what you’ve committed to.

-

There’s a first for everything. As you’re the first person to live in the property, you’ll be the first person to set things up like utilities, broadband and even postal deliveries. This can often feel like a slog, particularly when you just want to bask in that ‘new home’ feeling.

What else should I consider before buying a new build?

The mortgage process is fundamentally the same when buying a new build. Lenders will still assess your financial situation (such as your income, outgoings and credit history) as they would for any other property purchase. However, there are some extra things to take into consideration:

-

Stricter lender criteria. Some mortgage lenders have specific criteria regarding new build properties as they often consider them riskier. That’s because the value of the property is likely to fall in the first few years once it’s no longer brand new. Having a broker on hand can be invaluable as they can help you to cut through the jargon and understand what lenders are looking for.

-

Valuation challenges. It can be tricky for lenders to value a property that hasn’t been built yet. Different lenders may use different methods of valuation, but they often rely on the developer’s plans, quality of other builds on the development and comparable properties to estimate its worth.

-

Longer completion times. There can be a longer period of time between reserving your new home and completing on it. Sometimes a mortgage offer can expire within this time, and you may end up needing to extend or even reapply for the mortgage. This can be problematic if your financial circumstances have changed in between, as your mortgage offer may change (or your application could be rejected altogether - though this is unlikely)

-

Developer incentives. Some developers offer incentives like deposit contributions or even mortgage assistance. It’s important you make sure your lender knows about any incentives you’re receiving, as this could affect your mortgage. If the lender decides to knock off some of the incentive value off the purchase price this could impact your loan-to-value and potentially even the rates offered. It could be a good idea to seek out non-cash incentives, such as upgraded fixtures or fittings, as this may not affect your mortgage application.

“Every lender has different criteria. Some may be willing to extend your mortgage offer by three or even six months if your new build property is taking a little longer to complete. Others may only accept developer financial incentives up to a certain percentage of the property’s purchase price, or they’ll reduce the amount you can borrow. It’s important to work with a broker who has in-depth knowledge of lender criteria, so they can recommend the lender that’ll offer you a mortgage with terms to suit your needs.”

John Fraser-Tucker, Head of Mortgages

What deposit will I need for a new build mortgage?

Just like any type of mortgage, the deposit required can vary depending on the lender and the type of property you want to buy (i.e. whether you’re buying a new build home or a flat). This is usually 10% to 25% of the purchase price.

5% deposit mortgages for new builds are available - though they’re much tougher to find (you should also expect higher interest rates and stricter eligibility criteria). The Deposit Unlock scheme may be worth looking into as this is designed to help people purchase new build homes with a 5% deposit.

Typically speaking, the higher your deposit, the more competitive rates available. That’s because lenders usually reserve their best interest rates for lower loan-to-value mortgages (how much you want to borrow compared to the value of the property).

What help is available when buying a new build home?

Home ownership schemes are a popular way to help buyers get on the property ladder sooner. Around one in seven (14%) first-time buyers looking for a mortgage enquired about using a home ownership scheme.

There are several home ownership schemes available in the UK to help people buy new build homes. These include:

FAQs

Yes, it is possible to get a 5% deposit mortgage on a new build home but you may need to use a home ownership scheme such as Deposit Unlock. It’s worth being aware that your options may be more limited and you may be subject to higher interest rates. Speaking with a qualified mortgage broker can help you to compare your options.

You won’t need a formal mortgage offer to reserve a new build property. However, developers may well ask to see a mortgage in principle (MIP) before allowing you to reserve a property. A MIP shows you’re financially ready to proceed with the purchase, as it demonstrates how much a lender may be willing to offer you in principle.

You should ideally start exploring your mortgage options as soon as you start your house hunt. Getting a mortgage in principle can help you understand how much you can borrow, so you can look for new build properties within your price range.

Once you've reserved a property and paid your reservation fee, you'll need to formally apply for your mortgage as quickly as possible. Developers often have tight timescales, sometimes requiring exchange of contracts within 28 days of reservation.

You usually start making mortgage payments after completion, so once you own the property and have received the keys.

Most mortgage offers come with a specific validity period - usually around six months. However, if your new build takes longer to complete, you may understandably be concerned about what happens next.

Many lenders offer the option to extend your offer and some lenders even offer specific mortgages to cater for new build properties that come with a longer validity period. Worst case scenario, your mortgage offer does expire and you’ll need to go through the application process again, which could result in different interest rates and fees.

This is where working with a broker really comes in handy. They’ll be able to recommend the most suitable, flexible lenders and will manage the application process from start to finish. It’s always reassuring to have an expert on-hand to help you navigate the process.

It’s also worth asking your developer about their long-stop date, which is essentially the date the property must be completed by. Ideally, try to negotiate this date to be before your mortgage offer expires. That way, if your developer misses the long-stop date, you’ll be entitled to walk away and get a full refund (including a refund on your reservation fee).

It’s much like selling any other type of property. If you decide to move home before your mortgage deal expires, you’ll usually have to pay early repayment charges (ERCs). However, you may be able to avoid ERCs if you port your mortgage (which essentially means transferring your current mortgage to your new home).

There are some extra things you’ll need to consider when selling a new build home, though, such as whether any remaining years on the original warranty are transferable to the new owners.

You’ll have to use your own savings to pay the developer’s reservation fee (which is essentially a deposit to secure your home). However, the reservation fee can usually be taken off the overall price of the home so it shouldn’t have any affect on the total deposit amount you’re able to put down.

Do keep in mind that, if you decide not to buy the property after all, you will lose your reservation fee.

Yes, you will still have to pay stamp duty if your home is worth more than £125,000 (or £300,000 if you’re a first-time buyer). However, ask your home builder about the incentives on offer. Some developers may offer to pay your stamp duty to tempt you into buying one of their new homes, which can make a huge difference to the overall cost of moving house.

Getting a mortgage offer for a new build property, in principle, shouldn’t take longer than it would to get a mortgage on an older property. That said, sometimes buying an off-plan property can be a little more complex, which could result in slight delays getting your mortgage application reviewed and your valuation completed.

*All data shown is from Mojo Mortgages' own customer records, looking at the period from 7 May 2024 to 6 May 2025.