90% LTV mortgages

A 90% mortgage allows you to borrow the money you need to buy a home with just a 10% deposit.

In this guide, we dive into the pros and cons of a 90% mortgage, and how our brokers can help find the right option for you.

Here’s how a 90% mortgage works

You’ll borrow 90% of the property’s value from a mortgage lender, and invest the remaining 10% of the value yourself.

For example, if you buy a property worth £400,000, you’ll need to put down a 10% deposit of £40,000 and borrow £360,000.

This is known as a 90% loan-to-value (LTV) mortgage. As a higher LTV option, a 90% mortgage can help you buy sooner with a smaller deposit. However, lenders may perceive it as carrying more risk, which could result in higher interest rates.

Loan-to-value explained

Loan-to-value (LTV) is what percentage of the property’s value is borrowed.

The remaining portion of the property's value represents the equity you hold in your home. To start off with, your deposit is usually your initial equity. But once you start making repayments on your mortgage, your equity will build up and you’ll gradually own a larger share of your property.

Can I get a 90% LTV mortgage?

You’ll usually be able to apply for a 90% LTV mortgage if you:

-

Meet the individual lender’s eligibility criteria

-

Have at least a 10% deposit available

-

Are able to afford your mortgage payments

-

Are applying for a residential mortgage - you’ll usually need to put down a much bigger deposit for most buy-to-let mortgages

Find out how much you can borrow with a mortgage in principle

Our brokers can provide a personalised mortgage in principle to give you an idea of your maximum borrowing potential across a wide range of lenders.

Once you know this, you’ll be able to work out how much deposit you need to save to access a 90% mortgage. Then it’s time to start house hunting with confidence.

90% LTV mortgage rates

Mortgage type | Average 90% LTV mortgage rate* |

|---|---|

2-year fixed-rate mortgage | 4.7% |

5-year fixed-rate mortgage | 4.4% |

*The average rate is based on Mojo analysis of products available from five of the biggest UK lenders (Santander, Nationwide, Natwest, Halifax and HSBC) on 2 September 2025.

Your loan-to-value really can make a difference to your rates

You can see from the table below that putting down an extra 5% deposit could potentially save you hundreds of pounds each month as you’ll not only be borrowing less but you may be able to access more competitive rates too.

Deposit size | Property price | LTV ratio | Example rate | Monthly payment |

|---|---|---|---|---|

£60,000 | £400,000 | 85% | 4.5% | £1,890 |

£40,000 | £400,000 | 90% | 4.8% | £2,063 |

£20,000 | £400,000 | 95% | 5.1% | £2,244 |

*These are illustrative examples based on a £400,000 property and a 25-year loan term. Actual rates and monthly payments will vary based on individual circumstances, lender and the specific mortgage product.

Did you know? The average loan size for our customers looking for a 90% LTV mortgage is £254,955, meaning the average deposit for 90% mortgage customers is £25,496*.

Why should I get a 90% LTV mortgage?

-

Allows you to get on the property ladder. Saving for a 10% mortgage will take less time, so you can achieve your home ownership goals sooner

-

Avoid rising property prices. If house prices rise, you may save money in the long run by buying a home with a smaller deposit (versus waiting to access a lower loan-to-value mortgage, only to find properties are much more expensive)

-

Typically cheaper than 95% LTV mortgages. As you’re able to put down a slightly bigger deposit, you may be able to access better rates compared to 95% LTV mortgages

What are the disadvantages of a 90% LTV mortgage?

-

Interest rates might be higher. Lenders take on a greater level of risk when they loan 90% of a property’s value, so may charge higher rates

-

Lenders may have stricter criteria. Lenders will need to know you can manage your mortgage payments, so you may need to have a strong credit history and affordability to qualify for higher loan-to-value mortgages

-

It’s easier to fall into negative equity. If property prices fall, you may end up owing more than your property’s value

-

You could find it harder to remortgage. While there may be some 90% remortgage products available on the market, you might not be able to access the best remortgage deals if you only have a small amount of equity in your home

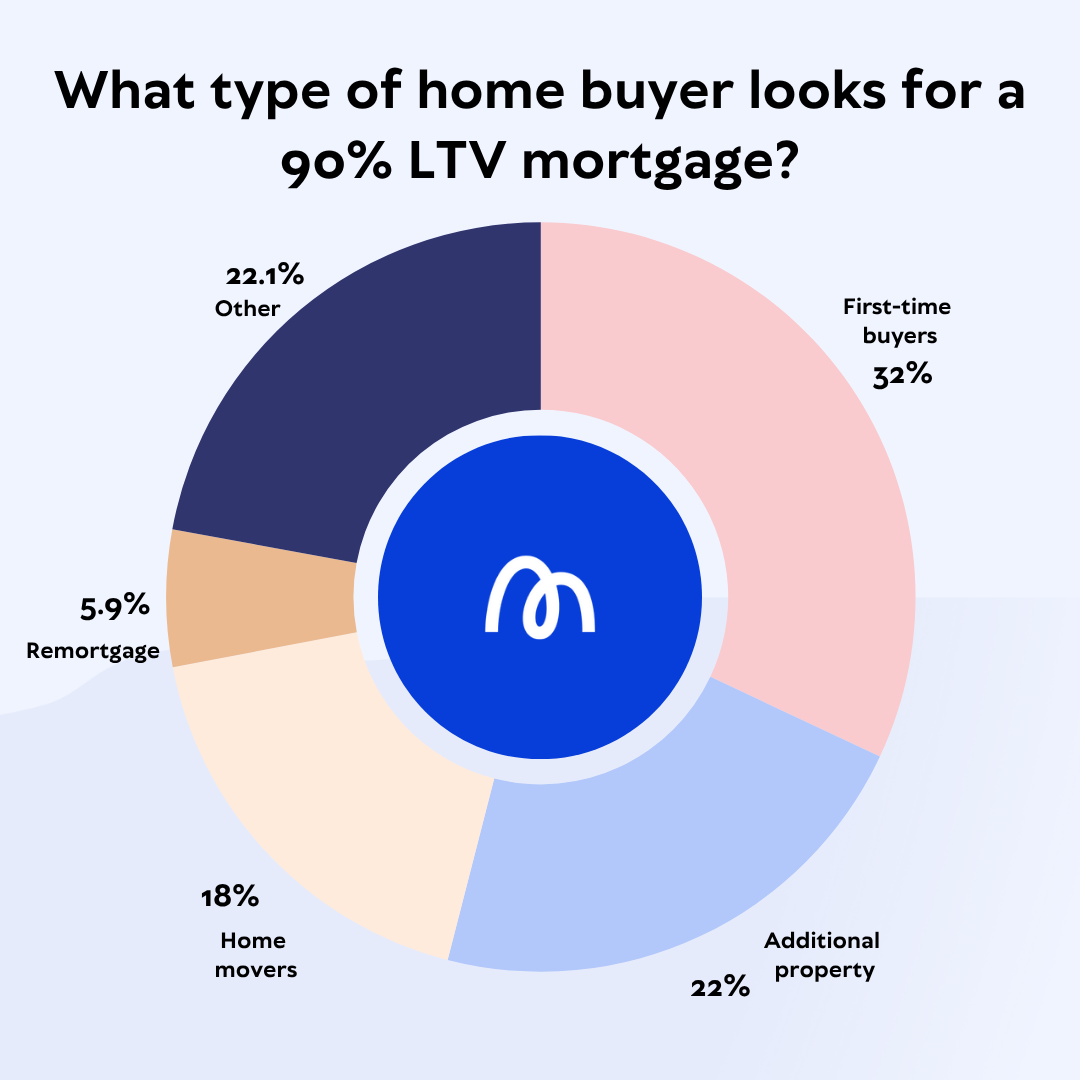

90% mortgages are particularly popular amongst first-time buyers, who may be keen to start climbing that property ladder sooner. However, it’s not uncommon for home movers or those buying an additional property to put down a 10% deposit too.

32% of our first-time buyer customers, 22% of those buying an additional property and 18% of home movers were looking for a 90% LTV mortgage last year. Just 5.9% of remortgage customers asked for recommendations for a 90% mortgage*.

How to apply for a 90% LTV mortgage

Once you’ve compared your mortgage options, it’s time to submit an application. You’ll need to gather a range of documents, including proof of income and outgoings.

But don’t worry - when you work with one of our mortgage brokers, they’ll prepare and submit your application for you. Giving you the best chance of success when applying for a 90% mortgage.

What are my other mortgage options?

Many lenders offer mortgages across a range of different loan-to-value ratios, and moving into a different LTV threshold may allow you to access different rates. This gives you a couple of different options.

Save for a larger deposit

The bigger deposit you can save, the more competitive rates are typically available. If you can save up enough money to access a lower loan-to-value threshold, you may be able to access more favourable rates and therefore save money in the long run. However, waiting to save up can be frustrating - and potentially expensive, if you’re renting.

Choose a smaller loan-to-value mortgage

95% LTV mortgages are available, but your options might be more limited. However, if a 10% deposit will wipe out your savings, you may prefer to put down a slightly smaller deposit in order to keep some funds back for emergencies.

“Getting a good understanding of how much you can borrow is a really important first step before you start house hunting. This will save you from falling in love with a property just outside of your budget. Needing to borrow more than expected really can impact your loan-to-value, or you may even find your lender isn’t prepared to offer you the money you need which can put pressure on you to increase your deposit. Use an online mortgage calculator or get a personalised mortgage in principle to get an idea of your property buying budget early.”

April Aldridge, Director of Customer

FAQs

It’s unlikely you’ll be able to get a 90% buy-to-let mortgage. Usually lenders ask for at least a 25% deposit.

While the deposit amount undoubtedly makes a difference to the type of property you’re able to access, the amount you’ll be able to borrow will depend on lots of other factors including your:

Income (lenders will usually offer between 4 to 4.5 times your salary)

Outgoings (including day-to-day spending and other credit commitments)

Lender criteria

Ultimately, you’ll only be able to borrow the amount your lender thinks you’ll be able to comfortably afford to repay.

Let’s say you have a 10% deposit (£40,000) ready to go for a £400,000 property. If your lender is only willing to offer you a maximum of £300,000 then you’ll need to find another £60,000 in order to afford that particular property - or start your search for properties worth around £340,000 instead. That’s why it’s so important to find out how much you can borrow before starting your house hunt.

A mortgage broker will be able to check your affordability and eligibility across a wide range of lenders, giving you an idea of your property buying budget.

You’ll be able to choose between a fixed-rate 90% mortgage and a variable-rate one.

With a fixed-rate mortgage, your interest rate remains the same for the duration of your deal. This means your monthly payments stay the same too. When you opt for a variable-rate mortgage, your interest rate and monthly payments can fluctuate.

*All data shown is from Mojo Mortgages' own customer records, covering the period from 21 May 2024 to 21 May 2025