Santander Mortgages

Find out about the range of mortgages offered by Santander, plus how our Mojo experts can help you to compare them with other lenders, and make a successful application

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 60+ lenders & broker exclusive products

We've helped 1000s of people find and get their mortgage

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

Santander, one of the UK's top four mortgage lenders, commands almost 10% of the market. They offer an extensive array of deals ranging from first-time buyers to experienced buy-to-let investors.

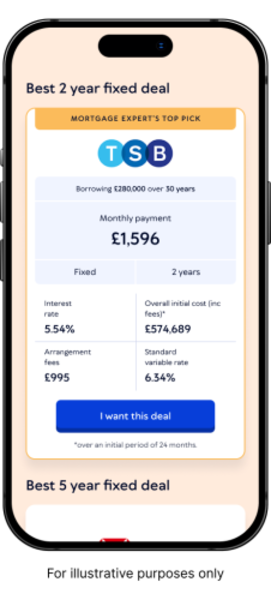

What are Santander's best mortgage rates?

Santander offers competitive mortgage rates, particularly if you have a higher loan-to-value (LTV). However, the concept of 'best' is not solely determined by the lowest interest rate, as the lowest rates may not necessarily translate to the best deal over the course of your whole mortgage term.

Mojo can check your eligibility for Santander's offerings, and compare deals from over 60 other lenders, to ensure you make an informed choice.

What type of mortgages do Santander offer?

Santander offers first-time buyer and home mover mortgages and remortgages at up to 90% LTV. They also offer interest-only remortgages with minimum equity of £25,000.

How can I make a Santander mortgage application?

Santander mortgages can be applied for online, via a phone, or by visiting a branch. However, it’s important to understand that going directly to any lender won’t give you a full picture of what’s on offer throughout the mortgage market.

Why use Mojo to apply with Santander?

At Mojo, we secure mortgage offers with Santander on a daily basis, so possess an in-depth understanding of their application process and requirements. Our fully qualified and FCA registered advisers will help you compare Santander’s offering against other deals, and scrutinise your paperwork to prevent any potential roadblocks later on. Our service is entirely cost-free.

How much can I borrow from Santander for a mortgage?

Santander offers an income multiple based on individual circumstances, but typically offers up to 5.5 times your total annual income. Keep in mind that a high loan-to-value (LTV) ratio, poor credit and significant existing outgoings can reduce this multiple.

Does Santander offer buy-to-let mortgages?

Santander does offer buy-to-let mortgages, but you won’t be able to go to them directly for this. This type of product is offered through a broker only, but we can help you in accessing Santander buy-to-let mortgages.

Does Santander offer remortgages?

Yes, they offer remortgages to both residential and commercial customers. However, you’ll need to qualify as you did with your original mortgage, especially if you're a new customer.

Santander mortgage FAQs

Typically, it takes up to two weeks from the point of application before you receive your mortgage offer from Santander.

Most Santander mortgages are portable, but always check your terms. Porting won’t always be the most cost effective option, but we can help you to determine whether you'd save more through remortgaging.

Early repayment charges typically depend on your specific mortgage deal, whether you’re in your introductory offer period, and the size of your overpayment.

Details about your early repayment charges can be found in your mortgage illustration, mortgage offer, or annual statement.

Santander allows overpayments of 10% per annum of the outstanding loan balance.

Santander mortgage offers last for 6 months.

Santander may accept some minor defaults, CCJs, and satisfied DMPs (debt management plan), so long as they’re older than 3 months. However, if you have more serious credit issues, such as a current DMP (debt management plan) or IVA (Individual voluntary agreement) they’re unlikely to be able to help you.

If you’re worried about your credit history, we can look at bad credit lenders for you.

Like most lenders, Santander accepts self-employed applicants that have been trading for at least 24 months and can back this up with accounts and tax documentation.