Nationwide mortgages

Find out about the range of mortgages offered by Nationwide, plus how our Mojo experts can help you to compare them with other lenders, and make a successful application

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 60+ lenders & broker exclusive products

We've helped 1000s of people find and get their mortgage

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

Nationwide is a prominent player in the realm of UK mortgages, capturing a considerable 14% market share, making it the second-largest in the nation. This equates to an impressive £35.7 billion worth of mortgage funds managed by Nationwide.

They cater to a wide range of residential homebuyers, as well as commercial products through their intermediary, The Mortgage Works. Mojo can assist you with both.

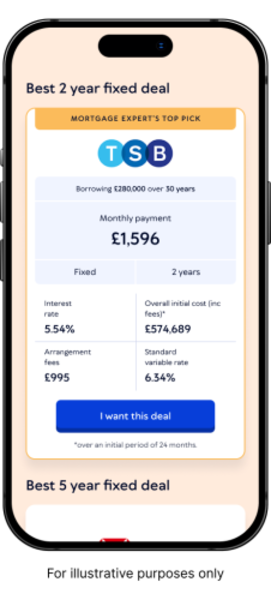

What are Nationwide's best mortgage rates?

The Nationwide mortgage rates available to you will depend on your specific financial situation. Below are some of Nationwide's best current rates, however, keep in mind that these examples are illustrative only, so won’t necessarily be the rates you’ll get on application.

What type of mortgages do Nationwide offer?

Nationwide offers a wide range of residential mortgage products with both fixed and variable rates, for:

First-time buyers at up to 95% LTV

Home movers at up to 95% LTV

Those remortgaging at up to 90% LTV

They also deal with a lot of specialist areas of lending, being a building society, rather than a bank. This means that they will usually accept Shared ownership, First Homes Scheme, Right to Buy Scheme and Help-to-buy scheme mortgage applications. They also offer:

Expat mortgages

How can I make a Nationwide mortgage application?

You can apply for a Nationwide mortgage online, over the phone, or by visiting a Nationwide Building Society branch. However, given the significance of a mortgage, many prefer to engage with a mortgage expert, particularly if they're first-time buyers. Nationwide's online application also isn't accessible if your mortgage requirements exceed 85% LTV (Loan to Value).

Why use Mojo to apply with Nationwide?

We successfully get people mortgage offers with Nationwide every day, so know exactly what it takes to meet their criteria

Our fully qualified and FCA registered advisers will guide you through Nationwide's application process, but also make sure you’re not missing out on a deal from elsewhere that may suit you better

We can double and triple check your paperwork – to avoid any delays further down the line in your application

Nationwide offers broker exclusive mortgages, which you wouldn’t get directly

It's all free

How do I get a mortgage agreement in principle with Nationwide?

You’ll need to provide us with details of your

Name and address

Income

Outgoings

Employment

There will be a credit check, but it’s a soft credit check. Remember, an Agreement in Principle from Nationwide isn't a guarantee of a mortgage offer, it's just the first stage.

How much can I borrow from Nationwide for a mortgage?

Nationwide offers up to 4.75 times your gross salary, but this is likely to be less if you have a lot of fixed outgoings, poor credit, or your LTV (loan to value) is high.

Does Nationwide offer buy-to-let mortgages?

Not directly, although we can help you to access them through their intermediary, The Mortgage Works. We can also compare Nationwide with all other buy-to-let lenders to find your best deal.

Does Nationwide offer remortgages?

Yes - and like all lenders, a Nationwide remortgage is basically like getting a new mortgage all over again. That means you'll have to pass new affordability and eligibility criteria - but using equity instead of a deposit.

If you already have a mortgage with Nationwide and want to remortgage to avoid their higher Standard Variable Rate (SVR), you could opt for a product transfer. Mojo's Mortgage Rate Checker will keep you up to date with any rate reductions that your lender may make, so you don’t miss out.

Comparing your Nationwide offer side by side with market competitors is also quick and easy with a Mojo mortgage broker, but if you decide to remortgage with Nationwide, we can expedite the process, usually concluding within a day.

Nationwide mortgage FAQs

Once you've submitted your mortgage application, Nationwide typically takes up to two weeks to provide your mortgage offer.

Most Nationwide mortgages are portable, allowing you to transfer the terms of your current mortgage to a new property.

Porting may not always be the most advantageous option, but at Mojo we can help you determine if you'd save more in the long run by remortgaging.

Nationwide's early repayment charges depend on your deal, the remaining duration of your introductory offer, and the extent of your overpayment.

Details about your early repayment charge can be located in your mortgage illustration, mortgage offer, or annual statement.

Nationwide allows overpayments of 10% per annum of the original loan amount.

Nationwide mortgage offers last for 6 months.

Nationwide may accept some minor defaults, CCJs, and satisfied DMPs (debt management plan), but if you have more serious credit issues they’re unlikely to be able to help you.

However, unlike most lenders you only need to have have been discharged from bankruptcy for 3 years, in order to be considered. Six years is more common with high street lenders.

Like most lenders, Nationwide accepts self-employed applicants that have been trading for at least 24 months and can prove this with accounts and tax documentation. There are no specific products for self employed individuals.