Free Mortgage Broker

Expert home-buying & mortgage help

Secure a mortgage in principle (MIP) & mortgage offer

Find and firm up your max borrowing limit from 70 lenders

Understand mortgage rates in the current market

We've helped 1,000s of homebuyers get clarity on their mortgage options

Mojo helps 1000s of people every month discover new mortgage options.

We have whole-of-market teams of remortgage, home-mover, first-time buyer and buy-to-let mortgage experts.

What you'll get:

-

Advice and help - get in the perfect position to get an offer accepted on your ideal property

-

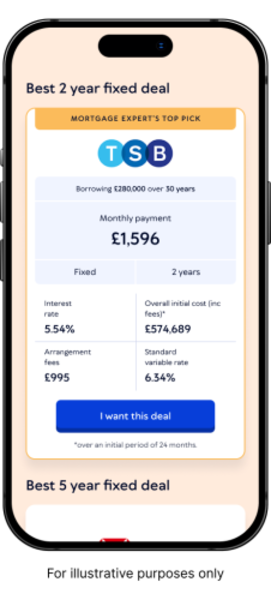

A quick and clear recommendation of the best mortgage lenders, rates and deal based on your circumstances

-

A personal service with clear communication from your broker or case manager - including evenings & weekends

What you won't get:

-

Any broker fees. We're fee-free 😊

-

Long waits. Unlike some brokers & lenders we'll aim to speak to you ASAP & submit as soon as you're ready

Trusted mortgage partner to our family of money-saving finance and property brands

Mojo's trusted by 1000s of happy customers and the biggest money-saving brands.

What our customers say

Excellent service & quick turnaround!

Mojo managed to turn my re-mortgage around in a month. From start to finish they were brilliant to deal with. Excellent guidance from Sandra on the products available to me and weighing up the pro’s and con’s of various options. I felt very informed and was kept up to date at every stage. Wouldn’t hesitate to use again if like me, mortgages blow your mind!

Heather Kennedy

01 March 2024

Ready to be clear about your homebuying mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's help you understand your homebuying options... for free, all from the comfort of your sofa.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE

All mortgage deals are subject to eligibility and affordability criteria. Rates are not guaranteed and can be subject to change.

*Our customers saved an average of £398 per month in April 2024 against reverting to the average lender standard variable rate