Halifax Mortgages

Find out about the range of mortgages offered by Halifax, plus how our Mojo experts can help you to compare them with other lenders, and make a successful application.

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 60+ lenders & broker exclusive products

We've helped 1000s of people find and get their mortgage

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

Halifax was established in Halifax in 1853, as a building society. It’s since become one of the leading banks in the UK, as well as one of the largest mortgage lenders. They are owned by the Lloyds Banking Group and publish the longest running house price index, which was created in 1983.

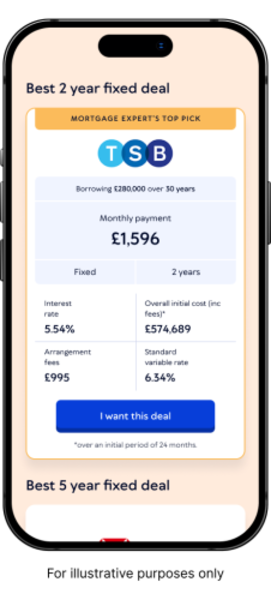

What are Halifax's best mortgage rates?

The best rates currently offered by Halifax range between 3.8% and 4%* on 5 year fixed-rate deals, based on meeting the criteria of these deals. It’s possible to borrow at a high loan-to-value (LTV) for some of these rates, but this will vary depending on the total loan required.

Halifax serves the following customers:

home movers

may also consider shared ownership and self-build applicants

Halifax offers remortgages at up to 90% LTV in some circumstances. Both fixed and variable rates (including tracker mortgages) are available and in some cases, interest-only repayment will be available.

Mojo can check your eligibility for Halifax's offerings, and compare deals from over 60 other lenders, to ensure you make an informed choice.

*September 2024

How can I make a Halifax mortgage application?

Like most lenders, Halifax accepts mortgage applications online, by phone, or in person. However, be sure to compare offers from a range of lenders, as going directly to any lender will limit your perspective of the market and potentially more suitable deals that may be available elsewhere.

Why use Mojo to apply with Halifax?

At Mojo, our experienced mortgage brokers secure mortgage offers with Halifax on a daily basis, so have an in-depth understanding of their criteria and application process. Our qualified and FCA registered mortgage advisers will help you to compare Halifax’s offering with those offered by other lenders, and check your application, for free.

How much can I borrow with a Halifax mortgage?

As with all lenders, income multiples are based on your individual circumstances, however, it’s possible to borrow as much as 5.5 times your income on both single and joint applications.

Halifax doesn't publish a maximum loan size, however, there are a number of factors that will determine how much you can borrow, including your deposit size, the property type and condition, and your income level.

Does Halifax offer remortgages?

Halifax offers both residential remortgages at a maximum LTV as high as 90%. They also offer buy-to-let remortgages up to a potential maximum of 85% LTV, depending on the purpose of the loan.

Assuming you meet their criteria, it’s possible to get a remortgage for buy-to-let purchase, debt consolidation, home improvement and even for gifting purposes.

Can I get a Halifax mortgage with bad credit?

Halifax may consider defaults and CCJs, as well as a satisfied debt management plan (DMP), However, they will have additional criteria in respect of applicants with adverse credit.

For more extreme credit issues, such as an independent voluntary agreement (IVA) or bankruptcy, you’ll need to seek out specialist sub-prime lenders.

Halifax mortgage FAQs

Yes, it’s possible to get a range of buy-to-let mortgages from Halifax.

Lenders don’t tend to work to rigid timelines when it comes to mortgage offers, as this will depend on both your specific circumstances, and how busy they are at any given time. Generally, you could expect an offer within six weeks.

Yes, Halifax mortgages are portable as standard. Be sure to check terms and conditions on your specific deal for further information.

For product transfers, Halifax usually waives ERCs for the last three months of your existing deal as a thank you for staying with them.

ERCs will be payable before that and if you switch to a different lender before you deal is up. However, the fees will depend on the remaining deal length and your outstanding balance, so check your mortgage terms or contact Halifax for the exact fee amount.

Halifax allows overpayments of up to 10% of your remaining mortgage balance each year, as standard on all mortgages.

Halifax mortgage offers are typically valid for 90 -180 days, but this may be longer for new-build properties. It’s not possible to extend a mortgage offer with Halifax, however, so if it expires before your purchase is complete, you’ll need to reapply.

Halifax can serve self-employed applicants, so long as they can provide:

Two years’ evidence of a regular income and account statements

Have been self-employed in the same role for at least 12 months

Profits are not showing at a loss in the latest year of accounts