Virgin Money Mortgages

Find out about the range of mortgages offered by Virgin Money, plus how our Mojo experts can help you to compare them with other lenders, and make a successful application

ALL FREE: Speak to an expert today about your needs & the current market

Clear mortgage recommendations with access to 60 lenders & broker exclusive products

We've helped 1,000's of people get their best deal

Virgin Money was established in 2003 and has rapidly become one of the UK's most prominent mainstream lenders. They provide various mortgage options, including fixed-rate deals with terms spanning from 2 to 15 years.

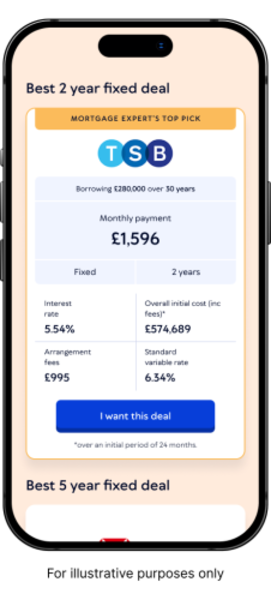

What are Virgin Money's best mortgage rates?

Virgin Money offers a range of mortgage deals, with rates that vary based on individual circumstances. Keep in mind that ‘best’ is a relative term, so while we tend to think of this as meaning the lowest rate, for some people, the best rate will be that with the most flexible mortgage terms.

It’s also important to keep in mind that not everyone will necessarily qualify for every rate offered by Virgin, and that it’s wise to compare their rates against other lenders.

What type of mortgages do Virgin Money offer?

Virgin Money offers a range of mortgages for homebuyers, investors and those looking for a remortgage. They may offer interest-only options to those with a minimum income of £75,000 or a minimum equity of £300,000 in their property.

Rates are offered at both fixed and variable interest rates over a maximum term of 35 years.

How can I make a Virgin Money mortgage application?

You can apply for a Virgin mortgage over the phone or at a Virgin branch, however, with few branches, it can be easier to apply for a Virgin mortgage online. Keep in mind that it’s also a good idea to compare Virgin Money’s offers against their competitors to ensure you’re getting the best deal.

Why Use Mojo to Apply with Virgin Money?

Applying for a Virgin Money mortgage through Mojo offers several advantages. We can save you time by helping to scour the market for the most competitive deals available to you, also potentially saving you money.

We can also aid in a hassle-free application process, as once with Mojo, we can take care of the application forms, liaising between estate agents and solicitors, and moving the process past any bumps in the road.

How much can I borrow from Virgin Money for a mortgage?

Virgin can offer loans of up to 5.5 times your gross annual income. However, the actual loan amount is determined on a case-by-case basis, considering your income, expenses, loan-to-value (LTV) ratio, and whether the repayments would overstretch your finances.

You can check your MortgageScore with Mojo to understand how lenders view your creditworthiness.

Does Virgin Money offer remortgages?

Yes they do, but remortgages are treated like new mortgage applications unless you opt for a product transfer - a new mortgage with Virgin Money. This can still save you money on the Standard Variable Rates (SVRs) but not always as much as you would save by remortgaging.

To ensure you're securing the most cost-effective remortgage, use Mojo's Mortgage Matcher to compare deals quickly. While the remortgage process can be more extensive than a product transfer, it has the potential to save you money in the long run.

Does Virgin Money offer buy-to-let mortgages?

Yes Virgin Money offer buy-to-let mortgages to those able to meet their specific eligibility criteria:

Minimum income of £25,000

Rental income must cover 145% of mortgage repayments for purchases and 125% for remortgages with no additional borrowing

You must be a homeowner

Personal income cannot be used for affordability assessment if you're a portfolio landlord (own more than four mortgaged buy-to-let properties), have an LTV exceeding 75%, or will be aged 75 by the end of the mortgage term

You can compare Virgin with all other buy-to-let lenders to discover the best deal through Mojo.

Virgin Money mortgage FAQs

It typically takes around 2 weeks to receive your mortgage offer from Virgin Money.

Virgin Money mortgages are portable by default, but always check your terms and conditions. Porting your mortgage isn’t always the most cost effective option - we can help you investigate all of the options available to you when moving home.

Early repayment charges depend on your specific mortgage deal, whether you’re still in the introductory offer period, and the size of your overpayment. Virgin Money typically charges around 1.5%, although it can vary based on how 'early' you make your repayment.

Your offer letter should detail the applicable rate and the amount you can repay without triggering these charges. Mojo's expert advisers can assist you in calculating early repayment charges when considering a remortgage.

Virgin Money allows overpayments of 10% of the outstanding loan balance per annum on most mortgages, however, their Flex mortgages allow for unlimited overpayments (up to a maximum of 99%) of the mortgage balance.

Virgin mortgage offers for house purchase mortgages are typically valid for four months and it’s not usually possible to extend them.

Virgin Money is fairly strict on bad credit applications, so it can be tricky if you have a history of debts, defaults or CCJs.

If you’re concerned about your credit score affecting your mortgage options, speak to one of our helpful advisers.

Virgin Money accepts self-employed applicants that have been trading for at least 24 months and can back this up with accounts and tax documentation.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.