NatWest mortgages

Find out about the range of mortgages offered by NatWest, plus how our Mojo experts can help you to compare them with other lenders, and make a successful application

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 60+ lenders & broker exclusive products

We've helped 1000s of people find and get their mortgage

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

NatWest is one of the UK's biggest banks and one of the ‘big six’ mortgage lenders in the UK. At Mojo mortgages, we regularly work with Natwest, and can help you make a successful application with them, should you select them as the best lender for your needs.

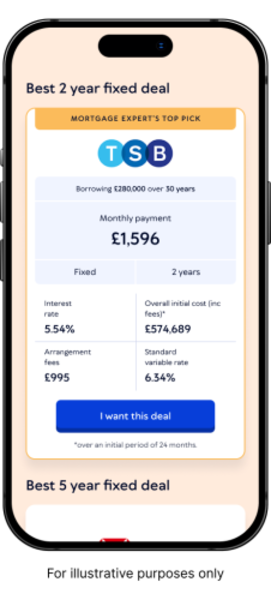

What are NatWest's best mortgage rates?

It's important to remember all NatWest mortgage rates will depend on your personal circumstances, and what you want from your mortgage.To get the best Natwest rates you'll need a good sized deposit and strong credit history, as with any lender.

Sometimes people want the option to overpay without being charged fees - NatWest allows overpayment of up to 20% of outstanding mortgage balance per year as standard. Others want to avoid arrangement fees, but often, people just want to see the lowest rate a lender can offer.

What type of mortgages do NatWest offer?

NatWest offer a wide range of residential and commercial mortgage products in both fixed and variable rate options, including:

First-time buyer mortgages at up to 95% LTV

Home mover mortgages at up to 95% LTV

Remortgages at up to 85% LTV

Interest-only mortgages (maximum 75% LTV)

Offset mortgages

Buy to let and Let to buy

They are also receptive to home ownership schemes, such as the Right to Buy Scheme, Help-to-buy scheme (Wales) and shared ownership.

How can I make a NatWest mortgage application?

You can apply for a NatWest mortgage deal online, over the phone, or by visiting a branch - but a free mortgage broker like Mojo can also make the application on your behalf, reducing your stress and administrative burden.

You don't need to have a NatWest bank account to apply for a mortgage with them. They also have a handy feature called a Mortgage Tracker that lets you login and see the status of your application. It's very similar to our My.Mojo tool.

Why use Mojo to apply with NatWest?

We're really familiar with their application process and paperwork needs, so we successfully get people mortgage offers with NatWest every day

You can book an appointment in a few minutes

fully qualified and FCA registered advisers will guide you through NatWest's application process

We can double and triple check your paperwork – you'll avoid any delays further down the line this way

We'll check if you can find a cheaper mortgage deal elsewhere too

It's all free

NatWest offers broker exclusive mortgages - so if you're eligible for one and it looks like a good fit for your needs, our mortgage advisers can talk you through any exclusives.

How do I get a mortgage agreement in principle with NatWest?

You’ll need to provide us with details of your

Name and address

Income

Outgoings

Employment

There will be a credit check, but it’s a soft credit check. Remember, an Agreement in Principle from NatWest isn't a guarantee of a mortgage offer, it's just the first stage.

How much can I borrow from NatWest for a mortgage?

NatWest offers up to 5 times your gross salary, but this is likely to be less if you have a lot of fixed outgoings or your LTV (loan to value) is high.

Does NatWest offer buy-to-let mortgages?

Yes, NatWest offers buy-to-let mortgages with the following eligibility criteria:

Expected rent of at least 125% of the monthly interest payments

A minimum deposit of 25%, or 35% for a new build purchase

A property worth at least £50,000

A total loan less than £3.5 million

You can compare NatWest with all other buy-to-let lenders to find your best deal with Mojo.

Does NatWest offer remortgages?

Like all lenders, a NatWest remortgage is basically like getting a new mortgage all over again. So that means you'll have to pass new affordability and eligibility criteria - but you’ll use equity instead of a deposit.

If you're an existing mortgage holder with NatWest and just want to remortgage to a new rate with them you could opt for a product transfer. Mojo's Mortgage Rate Checker will keep you up to date with any rate reductions that your lender may make, so you don’t miss out.

Can I do a product transfer with another lender from the NatWest Group?

No you can’t, each brand is considered a separate lender, so product transfers can only be onto another NatWest deal.

NatWest mortgage FAQs

Usually about 2 weeks before you get your mortgage offer, but this can vary from one application to the next.

Yes. Most NatWest mortgage deals allow porting. To be sure you can check the details on your mortgage illustration.

Porting may not always be the best option. Our expert advisers can help you work out if you'll save more in the long term by remortgaging.

NatWest early repayment charges tend to reduce over the length of your introductory offer.

That means the exact charges will depend on how long is left on your introductory deal and how much you overpay by.

Mojo's expert advisers can help you work out your early repayment charges ahead of a full remortgage.

New NatWest mortgage offers last for 6 months. Home movers and those remortgaging will have a three month mortgage offer validity period.

NatWest may accept some minor defaults, CCJs, and satisfied DMPs (debt management plan), but if you have more serious credit issues they’re unlikely to be able to help you.

Like the vast majority of lenders, NatWest accepts self-employed applicants that have been trading for at least 24 months and can prove this with accounts and tax documentation. There are no specific products for self employed individuals.