What is loan to value?

Loan to value (LTV) is the percentage of a property’s total value that you borrow from the mortgage lender. Lower LTV deals usually come with better rates. We explain more about this important term below.

Looking for a mortgage? Let us help:

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 70 lenders & online mortgage broker exclusive products

We've helped 1,000s of people find their best deal

Author - Aidan Darrall Editor - Stuart Bowman

Last reviewed on 17th October 2023

How does LTV affect interest rates?

The more you borrow, the more risk the lender takes on, so they charge higher interest rates to balance out that risk.

This means that those who invest more towards their own property will be seen as lower risk. Typically the lower your LTV, so the lower the percentage of the property value you borrow, the lower the interest rates that are available to you.

Why mortgage lenders care about LTV

Although it’s unusual, if the lender had to repossess your home, they’d want to know that they could get their money back on their investment when they sold it.

If the lender is unable to sell your property for the same amount of money they lend you for it, they’ll make a loss. So lenders use higher interest payments as a buffer to prevent them losing too much money, should house prices have fallen if they’re in a position to need to repossess your home.

How do I work out my LTV?

It’s a simple calculation:

How much you’re borrowing (or current mortgage balance for remortgage) / current property value x 100

How do I reduce my LTV?

The LTV of your borrowing is determined by your deposit size, so to reduce your LTV you'd have to reduce the amount you're borrowing overall. There are a few ways you could potentially do this:

-

Save a larger deposit or wait until you’ve got more equity if you already own your home - you can speed this up by making overpayments

-

Try to get a lower offer accepted if you're buying a new home - a detailed survey can be helpful here if it picks out any issues that may warrant a discount

-

If you’re trying to remortgage, adding value to your current home by expanding or improving it

-

Look for a cheaper property if you’ve not yet bought, although this might not be the most appealing option for many people

What’s the maximum LTV mortgage you can get?

Usually 95% LTV, although it’s possible to get 100% LTV mortgages in certain circumstances.

They are not as readily available as they once were, but some lenders offer guarantor and family assisted mortgage products that enable you to borrow 100% of the mortgage loan. There is also a 100% mortgage available from Skipton Building Society that’s aimed at renters looking to get onto the property ladder.

In most cases, however, the maximum LTV is 95%, meaning you’d need at least 5% deposit to be accepted.

What’s the lowest LTV mortgage available?

There is no lowest LTV, although most lenders have a minimum loan size, so if your LTV is so low that you need to borrow less than that, you may not get a mortgage.

Generally speaking, however, the lower your LTV, the better the interest rate you’ll get. The best rates on the market tend to kick in at 60% LTV, meaning you’d need a 40% deposit to access them.

What are the different LTV thresholds for mortgages?

Interest rates are offered based on the LTV, and LTV bands are usually in 5% increments. Equally, some lenders have wider LTV thresholds than others, so deals between 80% and 95% LTV could potentially have the same interest rates.

To save money your deposit or equity would need to take your borrowing into the next LTV band down, this usually gives you access to better rates.

Usually the thresholds are:

-

100%

-

95%

-

90%

-

85%

-

80%

-

75%

-

65%

-

60% LTV

Keep in mind: not all lenders offer loans at every LTV level

What’s a good LTV for a mortgage?

Getting your LTV as low as possible generally gives you the most choice of deals and access to better rates.

Lenders each have their own idea and appetites towards risk, but largely, 85-100%LTV is considered high, 70-80% LTV is mid-range and 65% or lower is considered as low LTV borrowing.

However, you typically get access to significantly more deals at around 75% LTV, so when you have a 25% deposit.

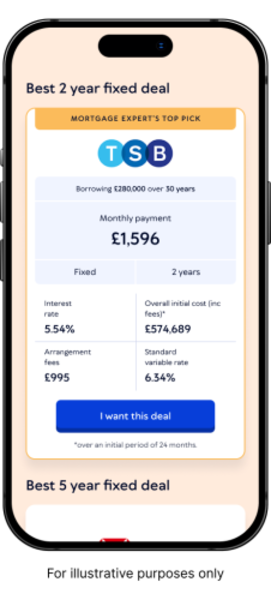

Our Mortgage Matcher can show you what your monthly repayments could look like at various LTVs. Try entering different deposit amounts and property values to see what could be available to you. Click here and choose ‘new mortgage’ or ‘remortgage’ to begin.

Loan to value FAQs

Most buy-to-let lenders require at least 25% deposit, as they typically lend at a maximum of 75% LTV. That said, it’s possible to find them at up to 85% LTV in some cases. It’s also sometimes possible to offer your existing properties as security, especially if you’re a portfolio landlord.

Remortgaging is slightly different, as in most cases you won’t provide an additional cash deposit. The LTV still matters, and determines the rates you’re offered, but your equity is used in place of a deposit.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.