Stamp duty rates, bands, changes and calculator

There are lots of costs to be aware of when buying a home, including stamp duty. Learn more about how much stamp duty you may have to pay, whether you're a first-time buyer, moving to a larger home, or even buying a second home or investment property.

Stamp duty calculator

Calculate how much stamp duty you'll need to pay for your property.

Stamp Duty Land Tax (SDLT):

£0

Effective tax rate applied:

0.00%

Your property may be repossessed if you do not keep up repayments on your mortgage.

What is stamp duty?

When you purchase a property above the current threshold of £125,000, Stamp Duty (or SDLT) is the tax you’ll pay in England and Northern Ireland. Scotland also has a version of stamp duty, known as LBTT, which is due on properties purchased above £145,000 and Wales has LTT, which applies on properties of £225,000 or over.

How much you pay depends on the total value of the property. The percentage of tax payable rises in increments, the higher the property value. The charges also only apply to the element of the cost that you go over that band.

For example: If you buy a house for £950,000, only the element above £925,001 would be charged at 10%. The element between £250,001 and £925,000 would be charged at 5% and you would pay 2% on the portion between £125,001 and £250,000.

What is the stamp duty threshold and bands for buying a house in England?

In both England and Northern Ireland, the stamp duty thresholds are as follows:

-

Nothing is payable on the first £125,000

-

2% SDLT payable on properties between £125,001 to £250,000

-

5% SDLT payable on properties between £250,001 and £925,000

-

10% SDLT payable on properties between £925,001 and £1.5 million

-

12% SDLT payable on properties above £1.5 million

What is the stamp duty threshold and bands for buying a house in Scotland?

Stamp duty in Scotland is called Land and Buildings Transaction Tax (LBTT). It applies to properties that cost over £145,000 and uses a similar banding system.

-

Nothing is payable on the first £145,000

-

2% LBTT payable on properties between £145,001 and £250,000

-

5% LBTT payable on properties between £250,001and £325,000

-

10% LBTT payable on properties between £325,001 and £750,000

-

12% LBTT payable on properties between £750,001+

What is the stamp duty threshold and bands for buying a house in Wales?

Stamp Duty in Wales is called Land Transaction Tax (LTT). It applies to properties valued at over £225,000 and, again, uses a banding system.

-

Nothing is payable on the first £225,000

-

6% LTT payable on properties between £250,001 and £400,000

-

7.5% LTT payable on properties between £400,001 and £750,000

-

10% LTT payable on properties between £750,001 and £1,500,000

-

12% LTT payable on properties above £1,500,000

Does everyone have to pay stamp duty?

No, not all property buyers will need to pay stamp duty. Buyers falling into the following circumstances would likely have no stamp duty bill:

Anyone buying a residential home valued below the minimum stamp duty threshold in their respective country, so:

up to £125,000 in England and Northern Ireland

up to £225,000 in Wales

up to £145,000 in Scotland

Anyone transferring property following a court order related to divorce, separation, or dissolution

When a home is gifted or bequeathed to you, so long as there is no outstanding mortgage on the property

First-time buyers in England or Northern Ireland who are purchasing a property below £300,000

First-time buyer stamp duty

First-time buyers in England and Northern Ireland will not need to pay stamp duty on their first home so long as it costs below £300,000. You'll then need to pay a 5% stamp duty on the portion of the property between £300,001 to £500,000.

In Scotland, first-time buyers will not need to pay stamp duty on their first home as long as it costs under £175,000. There are no specific rules around stamp duty for first-time buyers in Wales, but they would still benefit from not paying stamp duty if their first home cost below their country's stamp duty threshold.

A first-time buyer for tax purposes, is someone who has never owned residential property in the UK or abroad. For joint mortgages, all applicants would need to meet this criteria.

How much is stamp duty on a second property or a buy-to-let?

If you already own a home, and buy an additional property, whether that’s a second residential home, or a buy-to-let property, you’ll be liable for an additional 5% on top of whatever stamp duty tax band you fall into.

So, for example, if your second home was worth £500,000 and you bought in England, you’d pay 10% stamp duty, not 5%.

You may also need to pay higher residential tax rates if you choose to own more than one property in Wales or Scotland.

What about if I sell the second property?

If you own two properties in England or Northern Ireland for less than 36 months, you can often claim back the extra stamp duty when you sell one of them on. This can be helpful for those in a let-to-buy scenario, where a new home is purchased before the original property is sold.

Stamp Duty for non-residents

If you live outside of the UK, but buy residential property in England or Northern Ireland, you may have to pay a non-UK resident premium of an additional 2% for properties costing more than £40,000.

So if you bought a property worth £120,000, you would pay 2% stamp duty, instead of none.

Stamp duty FAQs

Yes, the changes to stamp duty thresholds in England and Northern Ireland that were introduced at the end of 2022 ended on 31 March 2025.

Most property transactions utilise a solicitor or conveyancer, who usually pay this on your behalf when you complete your property purchase - so you’d give the funds to them, rather than HMRC.

However, where this is not the case, it’s the home buyers responsibility to ensure they pay the money directly to HMRC.

You have 14 days from the completion date of your property purchase to file and pay your stamp duty land tax.

HMRC may charge penalties and interest if this deadline is missed.

Somme lenders do allow for stamp duty to be added to your mortgage borrowing. However, keep in mind that you'll pay interest on it if you choose to add it to your mortgage balance. It's also important to consider that it will be taken into consideration when your LTV (loan-to-value) is calculated, which could affect your affordability.

The 3-year rule refers to the ability to apply for a stamp duty refund, if you temporarily own multiple properties and return to a single main residence. An example of this may be when you buy a new home before you've sold your previous one, meaning you'll be liable for stamp duty on both. You'll actually pay a higher rate on the second property.

However, if you sell off the original home within 3 years, you can apply for a refund for the stamp duty paid as an owner of multiple properties.

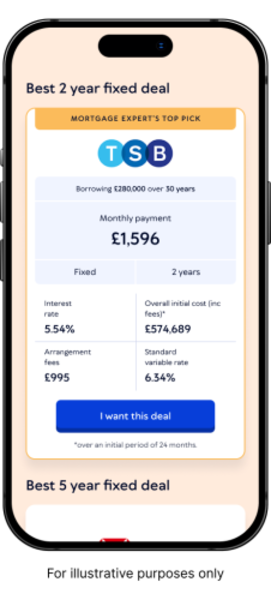

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.