How long does it take to buy a home in the UK?

You've found your dream property, your offer's been accepted, now what? Many UK homebuyers, especially excited first-time buyers, often believe getting the keys is just around the corner. However, new data from Mojo Mortgages reveals a different reality.

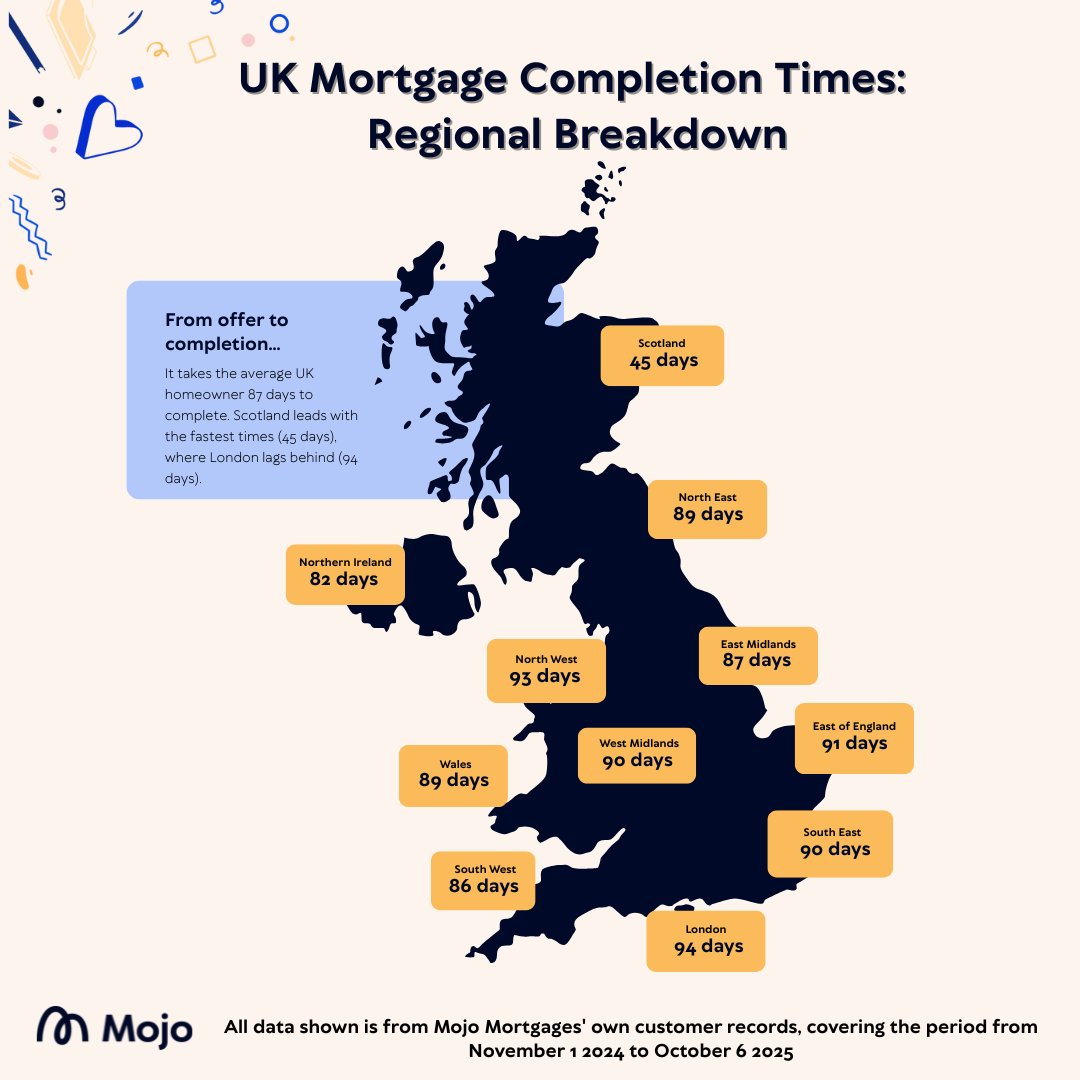

It takes an average of 87 days to go from offer to completion

Getting from submission to an accepted mortgage offer is relatively swift at just under 18 days

Buyers in Scotland enjoy a significantly faster process, averaging just 45 days from offer to completion – less than half the time of London!

Outside London, the North West (93 days) and East of England are the slowest regions to secure a mortgage

While data reveals it takes on average just over 2 weeks (18 days) to go from mortgage submission to an offer being accepted, the wait the average UK homebuyer faces following this is staggering.

Our data reveals UK homebuyers face an average wait of 87 days (nearly 3 months!) from receiving a mortgage offer from their lender to completion on their mortgage. This significant period is often consumed by essential conveyancing, legal checks, and administrative processes.

"Securing an offer is a huge milestone, but our data shows that the finish line for UK homebuyers is often much further away than they anticipate due to the intricate conveyancing and legal checks required. This lengthy process can be a significant source of stress and uncertainty for aspiring homeowners. Whilst mortgage brokers can help speed up the conveyancing process by proactively managing paperwork and communication, buyers need to be prepared for this timeline."

John Fraser-Tucker, Head of Mortgages

So just how long will it take you to get from mortgage offer to completion in the UK? Our data reveals this can vary widely depending on where you are based in the UK, so we have broken it down by region to give people a better estimated timeframe when planning their home purchase journey.

Average Days from Offer to Completion Across the UK

There's plenty of discrepancy between different regions in the UK when it comes to the home purchase timeline. Our data reveals that, in London, the average number of days it takes homebuyers to complete from the offer stage on a mortgage is 94 days, followed by the residents in the North West at an average of 93 days (cities such as Liverpool and Manchester) and East of England at 91 days on average (cities such as Cambridge and Norwich).

The table below shows the regions with the fastest to slowest average mortgage offer-completion times:

Rank | Region | Offer-completion average overall (days) | Submission - completion average overall (days) |

|---|---|---|---|

1 | Scotland | 45 | 62 |

2 | Northern Ireland | 82 | 103 |

3 | South West | 86 | 106 |

4 | East Midlands | 87 | 103 |

5 | Wales | 89 | 105 |

6 | North East | 89 | 107 |

7 | South East | 90 | 108 |

8 | West Midlands | 90 | 108 |

9 | East of England | 91 | 109 |

10 | North West | 93 | 110 |

11 | Greater London | 94 | 114 |

A variety of factors impact how long the home buying process takes - each has its own unique set of circumstances from the buyers, sellers and the property itself. Varied conveyancing times across the UK can, however, have a big impact depending on how long the wait list is for a local council to complete the necessary local land search. Regularly updated information on your specific area's turnaround times can be found online on your local council’s website or on SearchFlow.

The average local land search time is around 10 days, according to SearchFlow data*, but right now (October 2025) in 14 areas of the UK there are wait times of over 30 days in some areas, which would hugely impact the timeline of an individual's home buying process.

“The dramatic difference in completion times, particularly with Scotland's impressive speed, isn't a new revelation. As highlighted by The Times recently, Scotland's unique legal and conveyancing systems play a crucial role. Their ‘offer to completion’ process is often more streamlined, with detailed legal work occurring earlier, leading to faster completion once an offer is accepted.

With this in mind, the government's newly proposed homebuying overhaul aims to significantly cut down these waiting times. The recent proposals include measures designed to speed up the drawn-out and costly process of buying a home by up to four weeks. A key aspect requires sellers and estate agents to provide buyers with vital information about a property upfront. This includes critical details like the home's condition, any associated leasehold costs, and information about chains of people waiting to move.

It is hoped that these changes will reduce delays caused by information gathering during the conveyancing stage, ultimately allowing new homebuyers to complete their mortgages and step into their new homes more quickly. This research aims to shine a light on these crucial timelines, empowering both homebuyers with realistic expectations and industry professionals with data to drive improvements.”

John Fraser-Tucker, Head of Mortgages

Whilst it may take some time for a mortgage to go through the entire process, at the beginning of your home hunting journey you can get a Mortgage in Principle to indicate to sellers and estate agents that you are ready to get the ball rolling.

Mortgage brokers can help you navigate the process and ensure it doesn’t become overwhelming. Mojo Mortgages offers a free residential mortgage broker service, comparing thousands of mortgage deals from across a wide range of lenders to find the right option for you.

This study has taken internal data from across Mojo Mortgages clients who have completed on their mortgages across the UK to find out the average number of days it takes to go from offer to completion stage on a mortgage application. This was then broken down per region to find out which regions face, on average, the longest and shortest mortgage application timelines.