Negative equity explained

Being in negative equity can make it difficult to remortgage and move house, but there are ways to get out of it. We’ll look at everything you need to know about negative equity, how to avoid it and how to recover.

What is negative equity?

Equity is the amount of your property that you own, compared to its full value. So, for example: Your current property value is £200,000 and your deposit and repayments so far add up to £100,000. You therefore have 50% equity in your home, you own half.

Negative equity is when you owe more than your home is currently worth. This can happen for a number of reasons, but there are certainly risk factors that you can avoid to reduce the chances of finding yourself in negative equity.

How do you end up with negative equity in your home?

Negative equity happens when the value of your home falls below the amount you owe on your mortgage.This could be because the value of your property, or of properties in general, has fallen since you bought your home. It can also happen if you fail to keep up with your mortgage payments - or a combination of both.

It’s probably easiest to show this with an example:

You buy a property worth £300,000 with a deposit of £30,000 - so borrow £270,000

The following year the housing market crashes so your home is now worth £250,000

You’ve paid off £5000

However, you still owe £265,000

This means you have negative equity of £15,000

Because the property market fluctuates, being in negative equity is unlikely to last forever, and is not necessarily an immediate problem. However, it can make remortgaging or moving home very difficult.

Who’s most at risk of negative equity?

Using a small deposit is a big risk factor, and especially opting for a deposit-free mortgage. This would mean only a slight dip in your property value would leave you in negative equity.

Particularly for first time buyers, much of the repayments of the first few years will be made up of interest, given the large balance, which means the dent you make in repaying the loan is fairly small.

Using an interest-only mortgage can also increase the risk of negative equity. This is because you don’t repay any of the loan back over the course of your mortgage - until the end, where you pay it back in a final lump sum.

This means that even 24 years into a 25 year mortgage, you would essentially still owe the full amount that you borrowed. As your borrowing remains high throughout the mortgage term, it’s easier for property value to fall down in line with that as you won’t be building equity.

This is why interest-only mortgages typically need a higher deposit, it provides more of an equity buffer.

How do I reduce the risk of falling into negative equity?

There is no steadfast way to completely avoid negative equity, because to some degree, you’re at the mercy of the property market. That said, over a typical mortgage duration of 25-35 years, it’s unlikely the value of your home wouldn’t have risen quite dramatically.

There are a few ways you can reduce the risk of falling into negative equity, however, such as:

Providing as large of a deposit as possible when you buy your home

Making overpayments will reduce your balance more quickly - which could be particularly helpful if you have an interest-only mortgage. Look out for ERCs (early repayment charges) though, as most lenders put a limit on how much you can overpay per year

Improve the value of your home, perhaps by extending, or even simply obtaining planning permission, in some cases

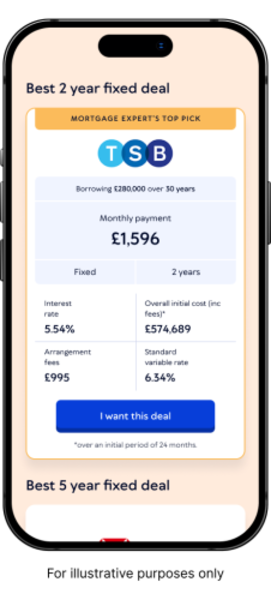

Remortgage to a lower interest-rate but keep paying the same amount, so that more of your repayments go towards reducing the balance

Can you remortgage if you’re in negative equity?

It’s possible, but it does depend on the extent of your negative equity, and will narrow down your pool of lenders dramatically.

Most high street lenders, in particular, will refuse a remortgage to anyone who’s in negative equity. This is considered too risky for them to take on, as if you failed to repay your loan, the repossession and onward sale of your home wouldn’t cover their losses.

If you only have a small amount of negative equity, it might be possible to overpay your mortgage to increase your LTV to a level the lender accepts. The LTV, or loan to value, is the ratio of equity you hold compared to the property value.

There are also specialist lenders who consider remortgages for those in negative equity.

What is a negative equity mortgage?

A negative equity mortgage permits you to transfer your negative equity to a new home with you. This is quite a rare product and only a handful of specialist lenders offer this option, and you’ll likely need to access them through a whole of market broker.

It’s likely you would need to pay both ERCs on your existing mortgage and a higher interest rate on your new one, but in emergency circumstances, such as where you have no choice to move, it can be a worthwhile option.

How do I get out of negative equity?

You have a few options when it comes to getting out of negative equity. Unless you’re planning to move or remortgage soon, it’s possible to do nothing. You could simply wait for your property value to rise above the amount you owe - and continuing to make mortgage repayments will aid in this.

If you are hoping to move house or remortgage soon, you’ll need to make a more concerted effort to get out of negative equity, however. The same things that help prevent negative equity also apply here.

Essentially the goal is to owe less than your home is worth - so whether you choose to reduce the value of your loan or increase the value of your property, or especially both, negative equity will eventually balance out.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.

Negative equity FAQS

No, sadly there is no help for these circumstances, and arguably, those who use some of the government homeownership schemes have an increased risk of falling into negative equity.

This is because borrowing a large sum of money with a small deposit, which is what many government schemes enable, is one of the major risk factors for falling into negative equity. Always ensure you ask advice from an experienced broker before making a decision on your mortgage borrowing.

Not directly, no. However, if being in negative equity is due to missing mortgage payments, or causes you to miss them, then that certainly will impact your credit score.

It’s possible, but you may have to repay the difference to the lender before you do. However, there are other ways, for example, you could look at a negative equity mortgage.

It may even be possible to move in with relatives and get a consent to let from your mortgage lender, so that you can rent out your home to help repay the mortgage more quickly.