Mortgages and credit scores

When you apply for a mortgage, one of the things a lender looks at is how you've handled credit in the past. After all, they are about to loan you a large amount of money.

But what exactly is a credit score? And what should you do if yours is bad? Our guide below covers everything you need to know about your credit rating and applying for a mortgage.

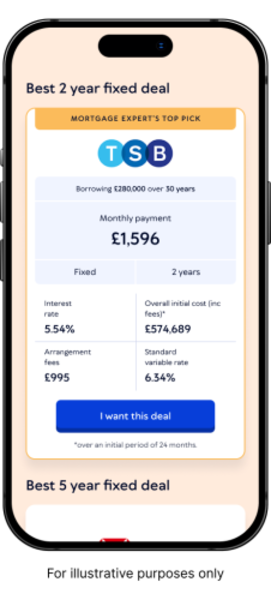

Looking for a mortgage? Let us help:

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 70 lenders & online mortgage broker exclusive products

We've helped 1,000s of people find their best deal

Author - Emily Smith Editor - Stuart Bowman

Last reviewed on 17th October 2023

Going above and beyond to save you time and money on your mortgage

Paperwork help ✅ Online mortgage broker exclusives ✅ Works alongside 70+ lenders ✅

1. Add your details online

No 2-hr phone calls or branch visits. It takes a few minutes to tell us what you need from your next mortgage online

2. Choose how & when to speak to your broker

ASAP? Or choose the perfect time - 6 days a week and evenings

3. Get your mortgage with Mojo

We’ll check and chase to help avoid delays. Get regular updates from your broker and case manager

What is a credit score?

A credit score (or rating) is a numerical representation of your reliability using credit, so borrowing money. A credit score is awarded to each credit file, and there are 3 major agencies that hold credit files, known as credit reference agencies - but each one scores differently. This means that nobody in the UK has a truly universal credit score.

Credit reference agencies record all of the details about any credit agreements you enter into, and how you manage them. This includes whether you repay them on time, or miss any payments, as well as how much you’ve borrowed compared to what you can afford to pay back.

Missing deadlines, or straying into an overdraft too often, harms your score, while your rating will climb if you pay what you’re meant to, when you’re meant to.

Why do mortgage lenders care about your credit score?

Put simply, because they’re extending a huge amount of credit to you, so want to know if you’ve been responsible when using it in the past.

Especially if you use a small deposit, banks are taking a significant risk in loaning you three quarters of the cost of a property, or more. They need to be as confident as possible that they’ll get that money back - so signing on the dotted line isn’t really enough.

What is considered a good credit score?

A good credit score could be a different number with each agency, as they all have different scoring systems.

Good scores for the main three agencies are:

Experian: 881-960

TransUnion: 604-627

Equifax: 420-465

As you can see, there is a significant variance in the numbers applied to a good score. Some lenders focus on one of these, using their preferred agency. Others may combine the agency scores and then apply further internal scoring.

How do mortgage lenders check my credit report?

It depends on the lender, but usually they do a soft check at the mortgage in principle stage, and a full credit search on application.

Not all lenders use the same credit reference agency, so it’s also possible that some lenders will find records that others don’t. Credit scores vary between agencies because they use different scoring systems, but you can also find that the information held about you differs from one agency to another.

Should I check my credit score before applying for a mortgage?

It's a really good idea to use a site like checkmyfile.com before you make a mortgage application. This allows you to see what information all of the credit reference agencies hold about you.

It also gives you an idea of what lenders will find out, and whether there is anything on there that needs to be corrected. This can help you to see if you’re ready for an application, but also prevent you from further damaging your score.

What credit score is needed to buy a house?

There isn’t one specific score. There is just so much variation between how the different credit referencing agencies work, and how lenders interpret credit files, that there is no magic score that will guarantee you a mortgage.

Of course, those with a strong credit score and better credit history overall will be more likely to get a mortgage than someone with poor credit.

Can I get a mortgage with a fair credit score?

Again, it’s possible, but it depends on the lender. With most lenders, you’ve got more chance of getting a mortgage if your score falls into a ‘good’ or ‘excellent’ category. However, having a fair score does not mean you will necessarily be rejected.

What about a bad score?

There are bad credit mortgage lenders, also known as subprime lenders. This means that it’s not always impossible to find a mortgage with bad credit, but you’ll pay for it with a higher interest rate.

How to boost your credit score in preparation for your mortgage application

There are usually a number of things you can do to easily improve your credit score before you apply for a mortgage. Few people find that their score is optimised as much as it could be unless they have made a concerted effort to raise it.

Here are some simple improvements you can make to enhance your credit file:

Have a proper look at your credit file in detail, using checkmyfile.com or a similar site. If there is anything showing that you think is incorrect, reach out to the credit referencing agency to get it changed - or break financial links with ex’s or other people you are no longer linked to

Make sure all bills that can possibly be paid by direct debit are set up to do so, to avoid any late payments

Make sure you appeal on the electoral roll at your current address

If you have a low credit score due to not having used much credit in the past, a credit builder card can help you show you’re a responsible borrower. Just keep the limit low and repay your debts straight away

What else do lenders look at as well as my credit score?

Checking your credit file is an important part of the mortgage application process, but lenders also consider many other factors about you. These include:

Your income level

Income vs expenditure - so how much you have left once you’ve paid your commitments. They also look at your DTI ratio (debt to income) ratio to see if you’re someone who overextends themselves financially. Most lenders have a DTI limit of around 40-50%

Your mortgage deposit amount and whether or not you can prove where it came from. You’ll need to be confident that savings are documented accumulating, for example

Mortgage credit score FAQs

If you want to get a better interest rate, there are a few ways you could potentially LTV enough to do so:

Save a larger deposit or wait until you’ve got more equity if you already own your home - you can speed this up by making overpayments

Try to get a lower offer accepted if you're buying a new home - a detailed survey can be helpful here if it picks out any issues that may warrant a discount

If you’re trying to remortgage, adding value to your current home by expanding or improving it

Look for a cheaper property if you’ve not yet bought, although this might not be the most appealing option for many people

It can certainly help restore some of the lender’s faith in your financial stability, and ability to fix your credit issues. However, it won’t guarantee you a mortgage, no matter how much you earn.

With credit issues, the more time has passed since they happened, the greater your chances of securing a mortgage.

It really depends on how poor your score is, and why. Some people can make a few basic improvements, such as getting on the electoral roll, and it will move them into a good score.

If you’ve got CCJs (county court judgements) or defaults, for example, it can take longer to fix.

That said, some lenders are willing to re-look at your credit file a year or so after a bad credit event, such as a CCJ, to see how you’re managing your finances now.

The vast majority do. There are specialist lenders who are willing to take a more holistic view of your circumstances, and don’t base their decision on a credit score. However, these tend to be on the specialist side, can usually only be accessed through a broker and have higher rates.

If you’re concerned about your credit score, speak to us, here at Mojo mortgage. We can give you honest feedback on your chances of being accepted in your current circumstances, but also recommend ways to become more mortgage-worthy in the future, if now isn’t the right time.

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning online mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.