Remortgage

Searching for the right remortgage can be tiresome. At Mojo mortgages, we're here to help.

Let us do the hard part. For free.

Speak to an expert today about your needs and the current market

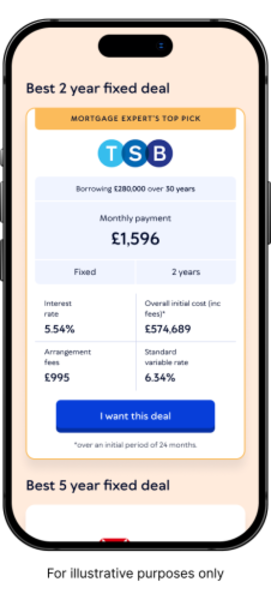

Clear mortgage recommendations with access to 70+ lenders & broker exclusive products

We've helped 1000s of people find and get their best deal

How to get the best remortgage rates with Mojo

Paperwork help ✅ Broker exclusives ✅ Works alongside nearly every lender ✅

1. Add your details online

No 2-hr phone calls or branch visits. It takes a few minutes to tell us what you need from your next mortgage online

2. Choose how & when to speak to your broker

ASAP? Or choose the perfect time - 6 days a week and evenings

3. Get your mortgage with Mojo

We’ll check and chase to help avoid delays. Get regular updates from your broker and case manager

What is a remortgage?

A remortgage is when you switch to a new mortgage but keep the same home. There are a number of reasons you might do so, and you can switch to a new lender, or a remortgage to a new deal with the same lender - a product transfer.

A remortgage counts as a new application, so you have to go through the full application process and qualify with a new lender. You then use the money to repay your existing mortgage. A product transfer can be quicker and easier, as you don’t change lenders. But you won’t always save the most money.

When is the right time to remortgage my property?

The majority of people remortgage when their existing deal is coming to an end, to avoid the SVR (standard variable rate). This is what you’re transferred onto when your current deal ends, and the rate is usually higher.

That said, your circumstances play a huge role in remortgaging. Falling onto the SVR won’t necessarily mean you’re able to remortgage. It’s also not the only reason you might want to. We’ll look at other reasons to remortgage later.

What is a loan-to-value (LTV) ratio, and why is it important for remortgaging?

LTV stands for loan-to-value. This is the percentage of the current property value that you’re borrowing.

So, for example: on a £200,000 property you borrow £150,000 and put down a deposit of £50,000 - so 75% LTV as the deposit is 25% of the property value.

When you come to remortgage, your property value is likely to have changed, and you’ll have repaid some of what you originally borrowed. Any gain is known as ‘equity’ and this changes the LTV.

Let’s say the same home is now worth £220,000, but you’ve repaid £10,000. This means you’re now only borrowing £140,000 against a £220,000 home. You therefore have equity of £80,000 - or 36% equity

When you remortgage, equity is typically used as your deposit - so the more you have, the better the remortgage rates available to you.

LTV bands and how they impact the rates you’ll get

Lenders tend to offer their interest rates based on LTV bands, which are spaced at intervals of 5%. So those with a 5% deposit (borrowing at 95% LTV) will pay a lot more in interest than those with a 40% deposit (borrowing 60% LTV) - as there’s more risk to the lender.

It’s therefore beneficial for you to have a bigger deposit (or more equity in the case of remortgaging) so you can lower your LTV into a lower band.

Why might I remortgage?

-

To avoid the SVR - If you’re on a set length deal (fixed or variable) that’s about to expire, you’ll end up on the lenders standard variable rate, which is almost always more expensive

-

To change deal types - Perhaps you’re on a tracker and the base rate is set to rise, or you want a product with more flexibility towards overpayments. Your mortgage should always be the right fit for your current needs

-

To release equity - if you have enough equity in your home, this sometimes allows you to borrow additional money against it instead of taking out a loan. You might remortgage for home improvements, debt consolidation, holidays etc - but it’s not always the cheapest way to borrow, so remember to compare with personal loans

-

Your property value has risen - As an increase in property value reduces your LTV, this could be a good time to get a more competitive ratel

Remortgaging in a high interest rate environment

Historically people remortgaged to save money, but in a lot of cases the rates available now are considerably higher than when people bought their homes.

Even the best rates may be higher than what you’ve been used to paying, and you won’t always qualify for those without a big chunk of equity.

That said, in most cases you’ll still want to avoid the SVR (which is generally higher), so if you’re approaching the end of a deal - especially in the last six months - remortgaging is likely to be the lesser of two evils.

There is still competition in the market, however, with thousands of deals available, some of which disappear quickly.

Choosing a broker, like ourselves, can help you lock in the best deals while they’re available. We can sometimes even use our experience and history with lenders to convince them to accept borderline applications.

It’s also worth keeping in mind that certain lenders only deal with brokers, especially on more niche products.

So, it’s always worth having a free consultation with us to see what we can to to help you secure the best remortgage rates

How to do this:

-

Reduce your borrowing - This could be by overpaying a certain amount each month, but beware of ERCs (early repayment charges). Some lenders will also allow you to add a cash deposit onto your equity to reduce the LTV

-

Increase the value of your home - whether you simply try to get a higher valuation, or put work into increasing the value by adding an extension or upgrading your windows - a more valuable property reduces the LTV of your borrowing

-

Wait - Probably the least appealing option, but assuming you have a repayment mortgage, eventually your LTV will reduce as you repay your loan. This is unless house prices fall dramatically, but most will increase over the full duration of a mortgage term

Can you remortgage early?

You can remortgage before the end of your current deal, but in most cases it will cost you to do that. Most mortgages charge ERCs (early repayment charges) if you remortgage before the end of the introductory period.

If you’re near the end of your deal period, this might not be too much of a problem, but it tends to get costlier the longer you have left on your existing deal.

The best time to remortgage is in the six month window before your deal ends, as you can lock in a new deal without paying ERCs. You’re not strictly leaving early, even though you’ve pre-arranged your new rate.

This can be really helpful if rates look like they could be going up over the next six months. However, you even have a safety net, as you’re not tied into that rate until your existing deal ends. That means if you see a better rate in the meantime, you can switch, usually free of charge.

Are there times when I shouldn’t remortgage?

Timing is a really important factor in remortgaging, because your personal circumstances will impact the rates available to you and whether or not you want to tie yourself to another introductory period.

High ERCs - If your lender wants to charge you more in early repayment charges than you would save from remortgaging to a new rate, it’s probably not worth switching until your deal ends, or you’re at least closer to the end of it

You don’t qualify - As rates are so much higher than they have been in recent years, some people have found it difficult to re-qualify to borrow the same amount of money. Especially if their property value, affordability or credit score have deteriorated. A product transfer might still be possible in these circumstances, so reach out to us for advice

Your mortgage balance is small - £50,000 is usually the cut off point at which you’ll benefit from remortgaging. This is because the fees are likely to outweigh any savings you could make from a lower rate at this point in your mortgage. Some lenders even have lower level limits for remortgaging, usually £25,000, meaning you couldn’t if you wanted to in certain cases

Remortgage FAQs

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.