First-time buyer mortgages

Nervous about applying for your first mortgage?

Mojo is here to help find the right deal for you

Speak to an expert today about your needs and the current market

Clear mortgage recommendations with access to 70+ lenders & broker exclusive products

We've helped 1000s of people find and get their best deal

How to get the best first-time buyer mortgage with Mojo

Paperwork help ✅ Broker exclusives ✅ Works alongside nearly every lender ✅

1. Add your details online

No 2-hr phone calls or branch visits. It takes a few minutes to tell us what you need from your next mortgage online

2. Choose how & when to speak to your broker

ASAP? Or choose the perfect time - 6 days a week and evenings

3. Get your mortgage with Mojo

We’ll check and chase to help avoid delays. Get regular updates from your broker and case manager

Buying your first home is a huge accomplishment, but not a task to be taken lightly. There are lots of important decisions to be made - and they go way beyond location, location, location.

Your mortgage is almost as important as your home, as you’ll be paying it off for a good chunk of your life. Especially nowadays, with rates high and property value considerably outweighing income for the majority of buyers.

How to get a first time buyer mortgage

At Mojo we’ll help you answer all the tough questions when it comes to choosing the right mortgage. We’ll get to know you and recommend the lender we think best suits your long-term goals. We’ll even complete the application for you.

Read on to find out more about getting a mortgage as a first-time buyer, and how a helping hand from one of our friendly brokers can steer you clear of any obstacles.

What is a first time buyer?

To be considered a first-time buyer for UK mortgage purposes, none of the applicants can have owned a home anywhere in the world before, even if they didn’t buy it themselves.

This means that if you’ve been bought a home, or left one in a will, you don’t qualify as a first-time buyer.

Oddly enough, it doesn’t make too much difference to the mortgage you’ll get, as most products are available to all buyers. Where it will count, especially in England and Northern Ireland, is with your stamp duty charges. More on that later.

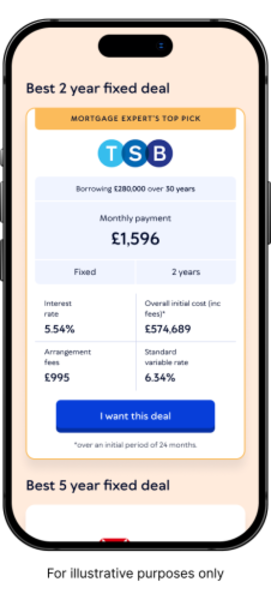

First time buyer mortgage rates and charges

How much do I need for a deposit?

Usually at least 5% of the property value, but it’s better to provide more if you can.

The amount of deposit you provide determines the loan to value (or LTV) of your loan. The LTV is the percentage of a property’s value that you borrow - and this is important as the LTV impacts the interest rates a lender can offer.

You'll usually need at least 5% as most lenders offer mortgage loans at a maximum of 95% LTV, although there are a few no-deposit mortgage options available in certain circumstances.

Interest rates are generally higher, the higher the LTV of your loan, as higher LTV loans are more risky for the lender. This means that you’ll see rates advertised, but those at 60% LTV are likely to be the cheapest. Unfortunately, very few first-time buyers can scrape together a 40% deposit.

The best thing to do is save as much as you can, and speak to us about how to stretch your deposit further. Sometimes an increase of just 1% can take you into a new LTV bracket and get you a better deal.

Other costs involved with taking out a mortgage

Some of the other costs that can apply to buying a home are:

Arrangement fees are not charged on all mortgages, but range from around £500 to £2,000+, depending on the property and mortgage value. You can sometimes add this cost to the loan, but keep in mind you’ll pay interest this way

Valuation fees start from around £150, depending on the value of the property you’re buying. It’s what the lender charges to ensure the home you’re buying is worth what’s being asked for it

Legal fees for conveyancing services carried out be a solicitor to formalise the property deeds and check contract accuracy - these also vary due to property and mortgage value

However, not all lenders charge all of these - in fact, legal and valuation fees are often waived in certain deals as an incentive for first-time buyers. A good broker will take all fees into account when they recommend a mortgage, to ensure you get the best deal overall.

How much could I borrow as a first time buyer?

Most mortgage providers will lend you between four and five times your annual income, but it's important to understand that income and affordability are not the same thing. Lenders will deduct your regular outgoings from your income before calculating the multiple you can borrow.

That said, all lenders have different criteria, which means some will include additional payments, such as overtime, whereas others won’t. All lenders also look at your credit score, but again, each has their own version of a creditworthy buyer, so it’s important to find a lender with criteria that matches your circumstances.

We can help you to find one to suit your needs, whether that’s to borrow as much as possible, or to get the most competitive rate.

How to use a mortgage calculator effectively as a first-time buyer

Mortgage calculators can give you a reasonable starting point when you’re looking at what sort of property you’re able to afford. You can use ours to find out what lenders might be able to offer based on your income and deposit.

However, if you want a more accurate idea of the size of mortgage you’re likely to get, a mortgage agreement in principle is the way to go.

How do mortgage repayments work?

Most first-time buyer mortgages are capital repayment, which means you make a monthly payment that covers some of the loan and some of the interest charged on it.

There are also interest-only mortgages, where you don’t pay any of the capital until the end of the mortgage - usually 25-35 years later. However, these are typically only offered to higher income earners with a large deposit.

Generally the more you borrow, the higher your repayments will be, but your interest rate will also impact this. Most lenders allow a certain value in overpayments per year, which can help you repay your mortgage more quickly, saving you money on interest, no matter what rate you’re entitled to.

Is there any help available for first time buyers?

Yes - there are specialist options from mortgage lenders and government first time buyer mortgage schemes, both intended to help those struggling to get onto the property ladder.

Lender options aimed at first time buyers

Borrowers lucky enough to have relatives willing and able to help them onto the property ladder have a few options available:

-

Gifted deposit - not all lenders allow this, but most will, so long as whoever is giving you the gift confirms its gift-status in writing

-

Guarantor mortgages - where a parent or family member agrees to cover the loan costs if you’re not able to - this is usually when you’re unable to meet affordability for repayments on the loan size you need

-

Family assisted mortgage - a more up-to-date version of guarantor mortgages, this lets relatives (often parents) to use their savings in lieu of a deposit - it’s then repaid to them when you’ve paid off enough to satisfy the lender’s deposit criteria

How do I choose the best first time buyer mortgage?

It’s perfectly possible to check through all the lenders yourself to see which deals are suitable - but it can take a while - especially as they all have different criteria.

The easiest way to find the best mortgage deal available to you is to enlist the help of mortgage brokers, like ourselves. Mojo mortgages is an award-winning mortgage broker and we can help you to find the perfect mortgage for your needs by:

-

Searching the whole market on your behalf, including exclusive rates that aren’t available to the public, to find a good match

-

Advising you about the crucial details of mortgage terms that many people overlook or struggle to understand

-

Providing help with your application if needed, from completing it for you, through to suggesting improvements to your circumstances and supporting documentation

-

Help you weigh up difficult to calculate decisions, like whether a fee-free mortgage is worth paying a slightly higher interest rate for or not

And unlike a lot of brokers, we do all this for free!

Ready to be clear about your mortgage options?

Mojo Mortgages is an award-winning mortgage broker. Let's get you the best rate you can... for free, all from the comfort of your sofa.